Samsung 2006 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2006 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

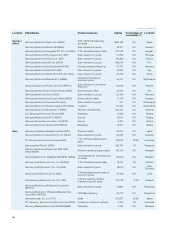

86

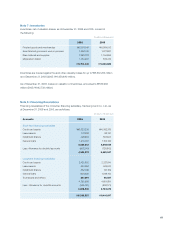

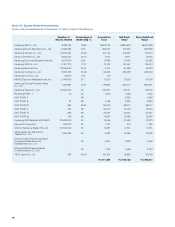

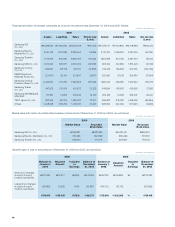

2006 2005

Call loan \13,937 \26,170

Certificates of deposit 400,824 179,851

Bonds 1,033,091 913,842

As of December 31, 2006, unrealized holding gains on short-term

available-for-sale securities amounting to \6,167 million (2005:

losses of \19,961 million), except for deferred income tax charged

directly to shareholders’ equity amounting to \2,338 million (2005:

\7,571 million), which were recorded in a separate component of

shareholders’ equity as other capital adjustments.

Short-term held-to-maturity securities as of December 31, 2006

and 2005, consist of the following:

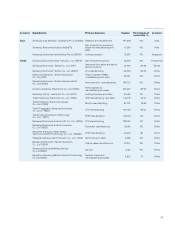

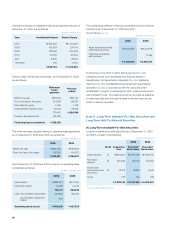

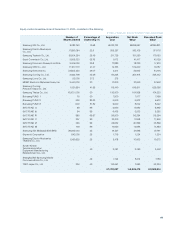

Note 6 : Accounts and Notes Receivable

Accounts and notes receivable, and their allowance for doubtful

accounts as of December 31, 2006 and 2005, are as follows:

(In millions of Korean won)

2006 2005

Government and public bonds \248 \178

Subordinated securities - 898

\248 \1,076

2006 2005

Trade accounts and

notes receivable \9,133,647 \7,451,467

Less:

Allowance for doubtful accounts (44,195) (54,114)

\9,089,452 \7,397,353

Other accounts and

notes receivable \987,634 \1,118,869

Less:

Allowance for doubtful accounts (15,156) (16,222)

Discounts on present value (52) (27)

\972,426 \1,102,620

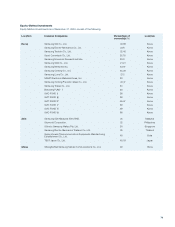

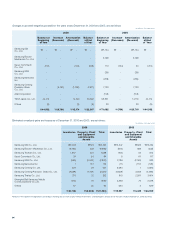

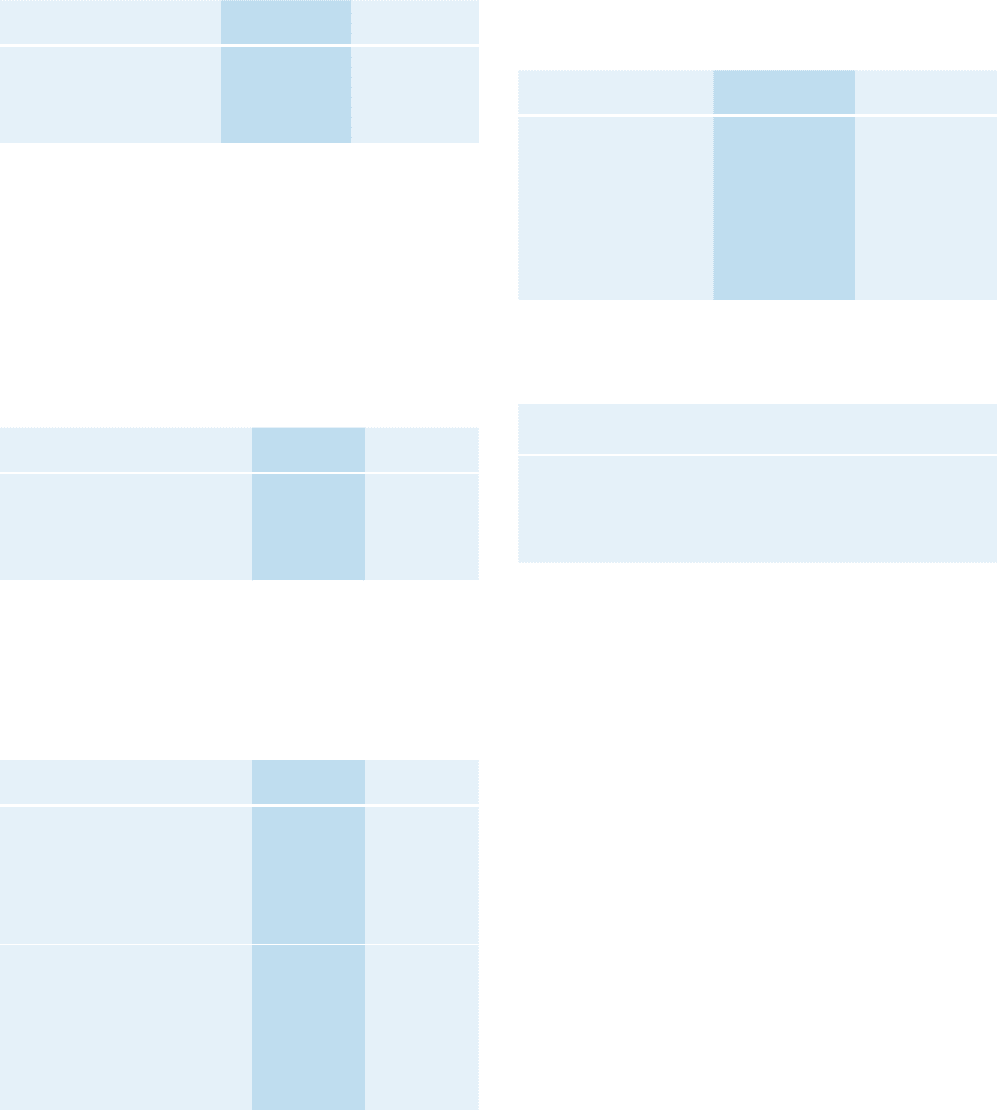

The outstanding balance of trade accounts and notes receivable

sold to financial institutions as of December 31, 2006 and 2005,

are as follows (Note 19):

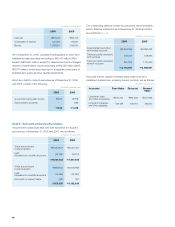

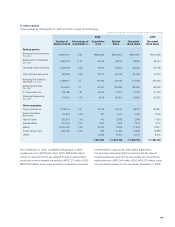

Accounts that are valued at present value under long-term

installment transactions, including current portions, are as follows:

2006 2005

Asset-backed securities

with limited recourse \1,254,030 \1,280,432

Trade accounts receivable

with recourse 556,432 548,035

Trade accounts receivable

without recourse 905,375 1,170,480

\2,715,837 \2,998,947

Accounts Face Value Discount Present

Value

Long-term loans

and other receivables \244,724 \33,228 \211,496

Long-term payables

and other payables 607,138 109,191 497,947

(In millions of Korean won)

(In millions of Korean won)

(In millions of Korean won)

(In millions of Korean won)