Samsung 2006 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2006 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

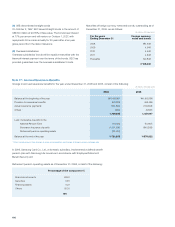

97

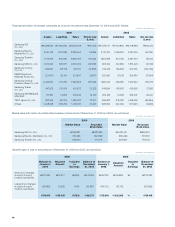

2006

Land Buildings and

Structures

Machinery

and

Equipment

Construction-

In-Progress/

Machinery- In-

Transit

Tools and

Vehicles

Total

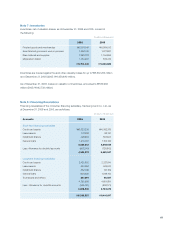

Balance at January 1, 2006 \2,768,774 \5,570,436 \15,850,980 \4,033,198 \1,052,773 \29,276,161

Acquisition 3,306 59,430 376,891 11,089,236 209,428 11,738,291

Transfer 276,892 1,375,293 8,924,265 (10,941,017) 364,567 -

Disposal (64,372) (98,285) (91,858) - (37,082) (291,597)

Depreciation - (422,703) (5,837,939) - (435,520) (6,696,162)

Others ¹(7,781) (30,129) (80,802) (135,298) 11,932 (242,078)

Balance at December 31, 2006 \2,976,819 \6,454,042 \19,141,537 \4,046,119 \1,166,098 \33,784,615

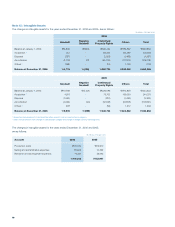

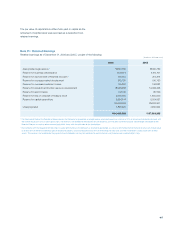

2005

Land Buildings and

Structures

Machinery

and

Equipment

Construction-

In-Progress/

Machinery- In-

Transit

Tools and

Vehicles

Total

Balance at January 1, 2005 \2,273,296 \4,851,477 \12,188,848 \3,692,511 \956,264 \23,962,396

Acquisition 10,066 87,386 600,586 10,547,037 295,150 11,540,225

Transfer 517,979 1,058,292 8,293,915 (10,135,959) 265,773 -

Disposal (15,138) (35,780) (121,264) - (20,203) (192,385)

Depreciation - (346,148) (5,088,871) - (430,733) (5,865,752)

Others ¹(17,429) (44,791) (22,234) (70,391) (13,478) (168,323)

Balance at December 31, 2005 \2,768,774 \5,570,436 \15,850,980 \4,033,198 \1,052,773 \29,276,161

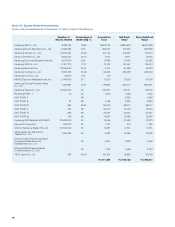

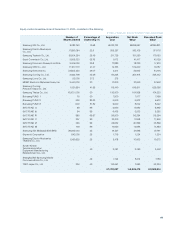

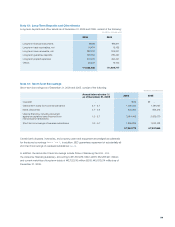

Note 11 : Property, Plant and Equipment

Movements property, plant and equipment for the years ended December 31, 2006 and 2005, consist of the following:

(In millions of Korean won)

¹ Others include amounts from changes in consolidation category and changes in foreign currency exchanges rates.

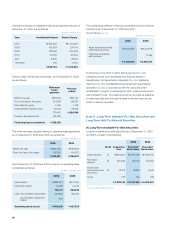

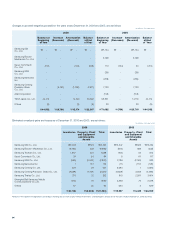

In accordance with the Asset Revaluation Law, on January 1,

1980, 1982, 1998 and April 1, 1999, SEC revalued a substantial

portion of its property, plant, equipment and investments in

equity securities by \3,051,612 million. The remaining revaluation

increments amounting to \1,209,161 million, net of revaluation

tax, credits to deferred foreign currency translation losses

and others, were credited to capital surplus, a component of

shareholders’ equity.

In addition, on October 1, 2000, Samsung Kwangju Electronics

Co., Ltd. revalued a substantial portion of its property, plant

and equipment by \63,326 million. The revaluation increment

of \62,145 million, net of revaluation tax of \1,181 million, was

credited to capital surplus.

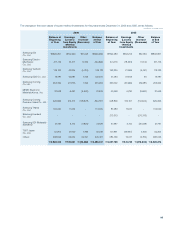

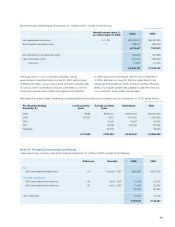

As of December 31, 2006, certain portion of overseas subsidiaries’

property, plant and equipment, \4,633 million (equivalent to US$

4,984 thousand) (2005: \5,620 million (equivalent to US$ 5,547

thousand)) is pledged as collaterals for various loans from financial

institutions.

As of December 31, 2006, property, plant, equipment are insured

against fire and other casualty losses, and business interruption

losses of up to \56,492,021 million (2005: \55,261,920

million) and \21,456,224 million (2005: \21,298,026 million),

respectively.

As of December 31, 2006, Samsung Card Co., Ltd., an SEC

subsidiary, recorded \505,319 million (2005: \432,958 million)

of operating lease assets, cancellation lease assets and prepaid

finance lease assets acquired through the lease financing

business (Note 8).