Samsung 2006 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2006 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106

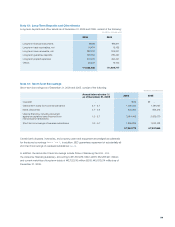

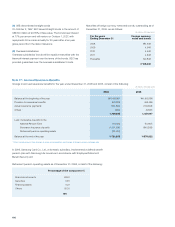

financing agreement with 21 banks including Shinhan Bank for

up to US$8,624 million; a credit sales facility agreement with five

Korean banks, including Woori Bank; and an accounts receivable

factoring agreement with Korea Exchange Bank for up to

\150,000 million. In relation to the credit sales facility agreement

with Woori Bank (up to v70,000 million) and Kookmin Bank (up

to \200,000 million), the Company has recourse obligations

on the receivables where the extensions have been granted on

the due dates. In addition, the Company also has loan facilities

with accounts receivables pledged as collateral with four banks,

including Woori Bank for up to \736,000 million.

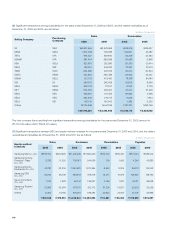

(N) As of December 31, 2006, Samsung Card Co., Ltd. has credit

loan facilities of up to \1,500 billion and collateral loan facilities

of up to \2,000 billion with Samsung Life Insurance Co., Ltd.

In addition, S-LCD and two other domestic subsidiaries have

general term loan facilities up to \3,320 billion with Korean banks,

including Kookmin Bank.

(P) Samsung Card Co., Ltd. has agreements with various financial

institutions to sell certain eligible financing receivables, subject

to recourse. Remittances of the sold accounts receivables are

collected by the consumer financing subsidiaries and transferred

to the buyers of the receivables on predetermined due dates.

As of December 31, 2006, these transferred financing receivables

which have been accounted for as sales of receivables are nil

(2005: \17,395 million).

In addition, Samsung Card Co., Ltd. has entered into agreements

(“Receivables Sale Agreements”) with several financial institutions,

whereby they will sell certain eligible financing receivables in

accordance with the Act on Asset Backed Securitization of

the Republic of Korea (the “ABS Act”). Pursuant to the

Receivables Sale Agreements, Samsung Card Co., Ltd. formed

Special Purpose Entities (“SPEs”) for the sole purpose of buying

receivables generated by the consumer financing subsidiary.

Under the Receivables Sale Agreements, Samsung Card Co., Ltd.,

irrevocably and with limited recourse, transfer eligible financing

receivables to the SPEs.

These transactions are accounted for as a sale of receivables

and as a result, the related receivables amounting to \4,002,923

million (2005: \4,017,978 million) have been excluded from

the accompanying consolidated balance sheet as of

December 31, 2006.

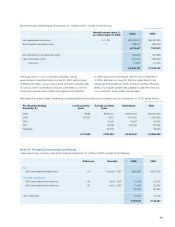

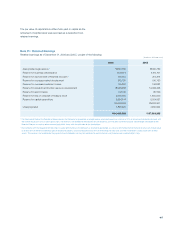

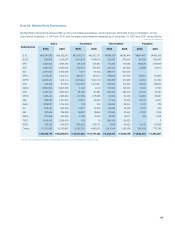

Note 20 : Capital Stock

Under its Articles of Incorporation, SEC is authorized to issue

500 million shares of capital stock with a par value of \5,000 per

share, of which 100 million shares are cumulative, participating

preferred stock that are non-voting and entitled to a minimum

cash dividend at 9% of par value. In addition, SEC is authorized

to issue to investors, other than current shareholders, convertible

debentures and debentures with warrants with face values up to

\4,000 billion and \2,000 billion, respectively. The convertible

debentures amounting to \3,000 billion and \1,000 billion are

assigned to common stock and preferred stock, respectively.

While debentures with warrants amounting to \1,500 billion and

\500 billion are assigned to common stock and preferred stock,

respectively.

SEC is also authorized, subject to the Board of Directors’ approval,

to issue shares of common or preferred stock to investors other

than current shareholders for issuance of depository receipts,

general public subscription, urgent financing with financial

institutions, and strategic alliance.

SEC is authorized, subject to the Board of Directors’ approval,

to retire treasury stock in accordance with applicable laws up to

the maximum amount of certain undistributed earnings. As of

December 31, 2005, the 8,310,000 shares of common stock and

1,060,000 shares of non-voting preferred stock had been retired

over three trenches, with the Board of Directors’ approval.

SEC has issued global depositary receipts (“GDR”), representing

certain shares of non-voting preferred stock and common stock,

at overseas stock markets, are as follows:

In addition to the above issuances, there have been several

conversions of foreign currency convertible bonds into GDRs and

conversions of the issued GDRs into original shares of common

stock or non-voting preferred stock.

As of December 31, 2006, outstanding global depositary receipts

consist of 24,282,064 shares for common stock (common stock

equivalent: 12,141,032 shares) and 7,760,842 shares for non-voting

preferred stock (preferred stock equivalent: 3,880,421 shares).

As of December 31, 2006, exclusive of retired stocks, 147,299,337

shares of common stock and 22,833,427 shares of preferred

stock have been issued. The preferred shares, which are non-

cumulative and non-voting, were all issued on or before February

28, 1997, and are entitled to an additional cash dividend of 1% of

par value over common stock.

Number of

Shares of Stock

Number of

Shares of GDR

Non-voting preferred stock 7,695,272 15,390,544

Common stock 4,251,338 8,502,678