Samsung 2006 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2006 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101

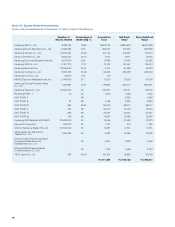

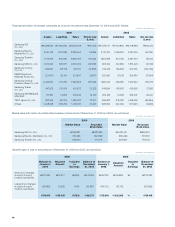

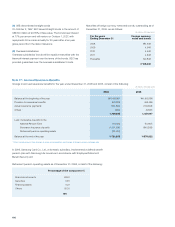

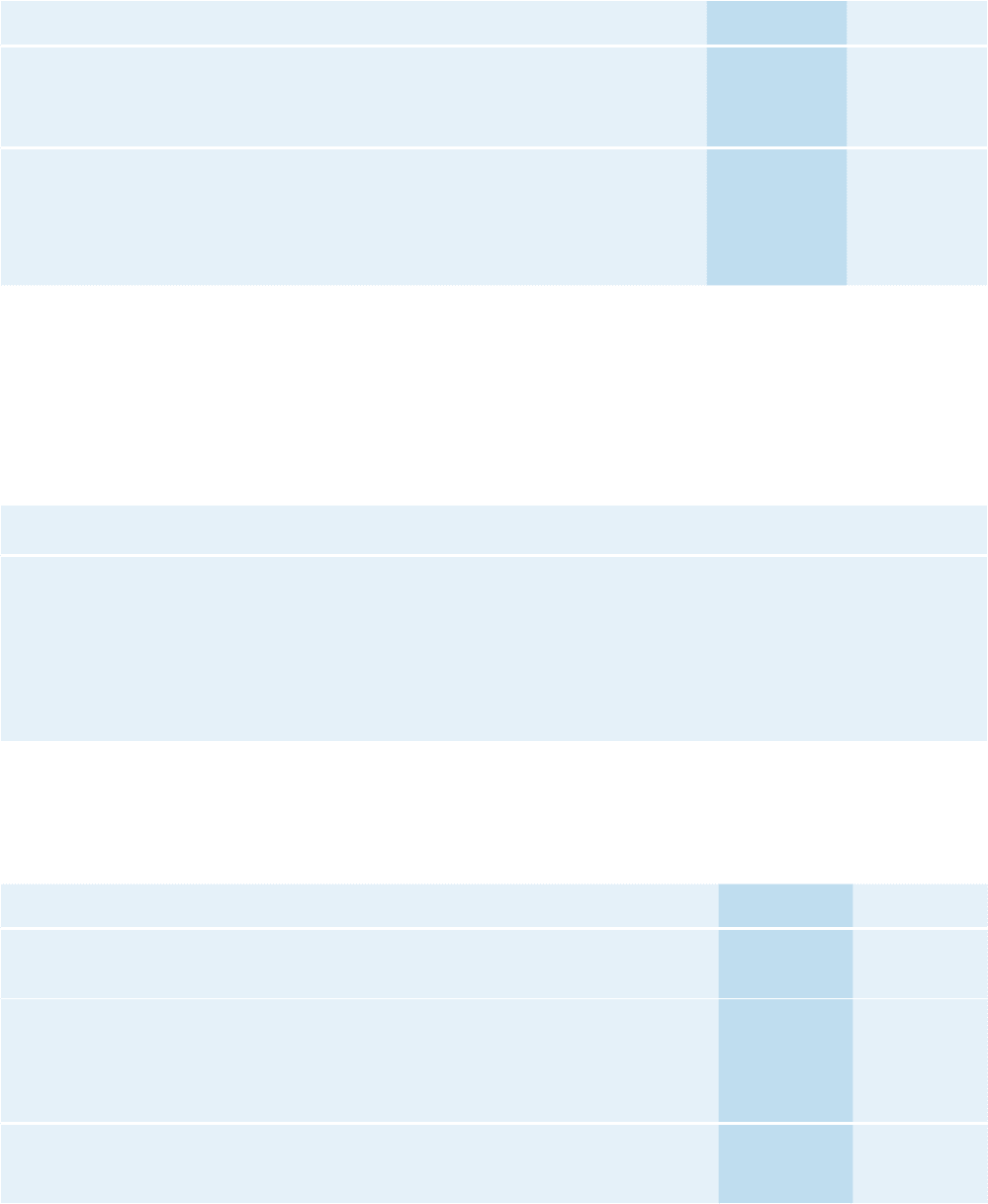

(C) Debentures outstanding as of December 31, 2006 and 2005, consist of the following:

Annual interest rates (%)

as of December 31, 2006 2006 2005

Non-guaranteed debentures 0.0 - 8.5 \5,318,500 \6,367,200

Subordinated convertible bonds 2 799,947 800,000

6,118,447 7,167,200

Add: Premium for non-executed rights 334,676 334,698

Less: Conversion rights (116,153) (186,024)

Discounts (7,269) (11,142)

\6,329,701 \7,304,732

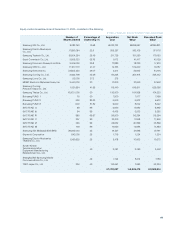

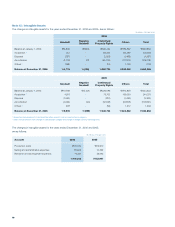

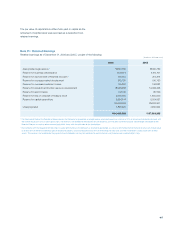

Maturities of long-term debts outstanding, excluding premiums and discounts on debentures, as of December 31, 2006, are as follows:

For the years Ending

December 31

Local currency

loans

Foreign currency

loans

Debentures Total

2008 \282 \148,007 \2,191,947 \2,340,236

2009 172,320 3,373 1,110,000 1,285,693

2010 - 3,505 40,000 43,505

2011 - 23,199 250,000 273,199

Thereafter - 56,325 - 56,325

\172,602 \234,409 \3,591,947 \3,998,958

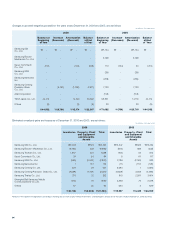

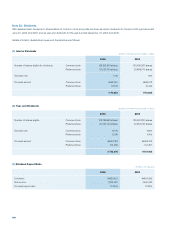

Samsung Card Co., Ltd., a domestic subsidiary, issued

subordinated convertible bonds on June 23, 2003 with principal

of \800,000 million, coupon rate of 2.0% and with a maturity date

of June 23, 2008. Convertible bonds are convertible to common

stock at the exercise price of \43,040 adjusted from \8,608

to reflect issuance of new shares of five to one on November

2, 2006, effective from June 23, 2006 (or when listed on the

exchange) through May 23, 2008. Premium of 9% (or 5% when

listed) on principal is additionally payable in case the bonds are

not converted to equity before the due date.

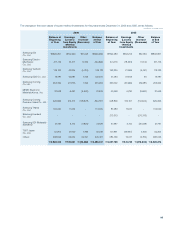

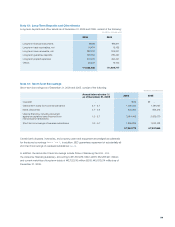

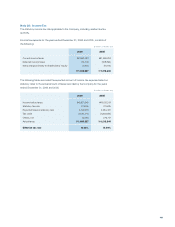

Reference Due date 2006 2005

SEC

USD denominated straight bonds ( A ) October 1, 2027 \92,960 \101,300

Overseas subsidiaries

USD denominated fixed rate notes ( B ) April 1, 2027 23,240 25,325

USD denominated fixed rate notes ( B ) April 1, 2030 23,240 25,325

139,440 151,950

Less : Discounts (5,643) (5,743)

\133,797 \146,207

Note 16 : Foreign Currency Notes and Bonds

Unsecured foreign currency notes and bonds as of December 31, 2006 and 2005, consist of the following:

(In millions of Korean won)

(In millions of Korean won)

(In millions of Korean won)