Samsung 2006 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2006 Samsung annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

the purpose of cash-flow hedges, which is recorded as an

adjustment to shareholders’ equity.

All derivative instruments are accounted for at fair value with

the resulting valuation gain or loss recorded as an asset or

liability. If the derivative instrument is not designated as a hedging

instrument, the gain or loss is recognized in earnings in the period

of change. Fair value hedge accounting is applied to a derivative

instrument with the purpose of hedging the exposure to changes

in the fair value of an asset or a liability or a firm commitment

(hedged item) that is attributable to a particular risk.

The gain or loss, both on the hedging derivative instrument and

on the hedged item attributable to the hedged risk, is reflected in

current operations. Cash flow hedge accounting is applied to

a derivative instrument with the purpose of hedging the exposure

to variability in expected future cash flows of an asset or a liability

or a forecasted transaction that is attributable to a particular risk.

The effective portion of the gain or loss on a derivative instrument

designated as a cash flow hedge is recorded as a capital

adjustment and the ineffective portion is recorded in current

operations. The effective portion of the gain or loss recorded as

a capital adjustment is reclassified to current operations in

the same period during which the hedged forecasted transaction

affects earnings. If the hedged transaction results in

the acquisition of an asset or the incurrence of a liability,

the gain or loss recognized as a capital adjustment is added to or

deducted from the asset or the liability.

Asset Impairment

When the book value of an asset is significant greater than its

recoverable value due to obsolescence, physical damage or

the abrupt decline in the market value of the asset, the decline in

value is deducted from the book value and recognized as an asset

impairment loss in the current year.

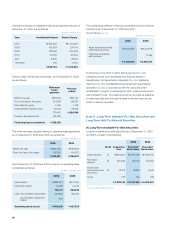

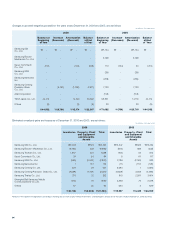

Note 3 United States Dollar Amounts

SEC and its Korean subsidiaries operate primarily in Korean

won and its official accounting records are maintained in Korean

won. The U.S. dollar amounts, provided herein, represent

supplementary information solely for the convenience of

the reader. All won amounts are expressed in U.S. dollars

at the rate of \929 to US$1, the exchange rate in effect on

December 31, 2006. Such presentation is not in accordance with

generally accepted accounting principles in either the Republic

of Korea or the United States, and should not be construed as

a representation that the won amounts shown could be readily

converted, realized or settled in U.S. dollars at this or at any

other rate.

The 2005 U.S. dollar amounts, which were previously expressed

at \1,013 to US$1, the rate in effect on December 31, 2005, have

been restated to reflect the exchange rate in effect on December

31, 2006.

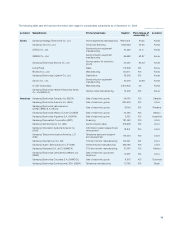

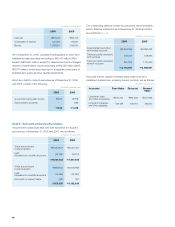

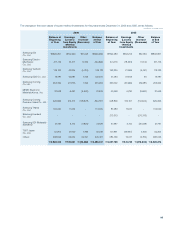

Note 4 Cash Subject to Withdrawal Restrictions

Cash in banks subject to withdrawal restrictions as of December

31, 2006 and 2005, consist of the following:

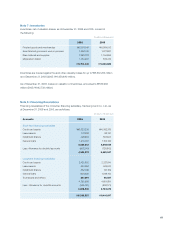

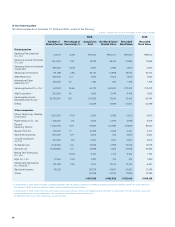

Note 5 : Short-Term Available-For-Sale Securities and

Short-Term Held-To-Maturity Securities

Short-term available-for-sale securities as of December 31, 2006

and 2005, consist of the following:

(In millions of Korean won)

2006 2005

Short-term

financial

intruments

Government-sponsored

R&D projects \31,425 \33,525

Other activities 26,493 15,732

\57,918 \49,257

Long-term

financial

instruments

Government-sponsored

R&D projects - \8,826

Special deposits 77 133

Other activities 330 -

\407 \8,959

\58,325 \58,216

2006 2005

Financial institution bonds ¹\589,697 \585,225

Fair-value investments - 166,199

Beneficiary certificates ²1,469,084 1,114,543

ABS subordinated securities - 13,680

Others - 51,155

\2,058,781 \1,930,802

(In millions of Korean won)

¹ Includes accrued interest income amounting to \5,022 million (2005: \3,551 million).

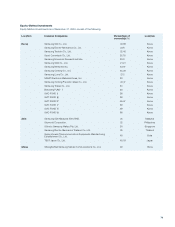

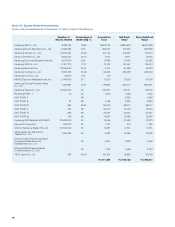

² Beneficiary certificates as of December 31, 2006 and 2005, consist of the following: