Pottery Barn 2010 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2010 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252

|

|

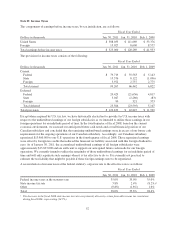

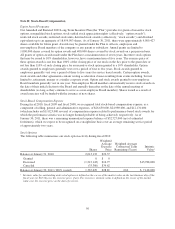

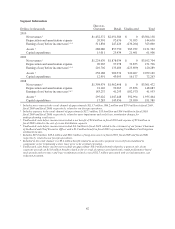

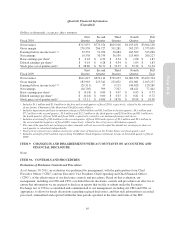

Segment Information

Dollars in thousands

Direct-to-

Customer Retail Unallocated Total

2010

Net revenues1$1,452,572 $2,051,586 $ 0 $3,504,158

Depreciation and amortization expense 20,901 92,676 31,053 144,630

Earnings (loss) before income taxes2,3,4 311,838 247,426 (236,204) 323,060

Assets 5288,080 857,750 985,932 2,131,762

Capital expenditures 15,011 25,434 21,461 61,906

2009

Net revenues1$1,224,670 $1,878,034 $ 0 $3,102,704

Depreciation and amortization expense 20,965 97,978 32,853 151,796

Earnings (loss) before income taxes2,3,4 210,702 133,486 (223,899) 120,289

Assets 5258,188 900,574 920,407 2,079,169

Capital expenditures 12,991 43,095 16,177 72,263

2008

Net revenues1$1,398,974 $1,962,498 $ 0 $3,361,472

Depreciation and amortization expense 21,142 99,065 27,876 148,083

Earnings (loss) before income taxes2,6,7 183,237 41,293 (182,577) 41,953

Assets 5295,022 1,047,448 592,994 1,935,464

Capital expenditures 17,283 145,456 29,050 191,789

1Includes net revenues in the retail channel of approximately $113.7 million, $84.2 million and $79.9 million in fiscal 2010,

fiscal 2009 and fiscal 2008, respectively, related to our foreign operations.

2Includes expenses in the retail channel of approximately $17.5 million, $35.0 million and $34.0 million in fiscal 2010,

fiscal 2009 and fiscal 2008, respectively, related to asset impairment and early lease termination charges for

underperforming retail stores.

3Unallocated costs before income taxes include a net benefit of $0.4 million in fiscal 2010 and expense of $7.6 million in

fiscal 2009 related to the exit of excess distribution capacity.

4Unallocated costs before income taxes include $4.3 million in fiscal 2010 related to the retirement of our former Chairman

of the Board and Chief Executive Officer and a $1.9 million benefit in fiscal 2009 representing Visa/MasterCard litigation

settlement income.

5Includes $27.0 million, $29.6 million and $28.3 million of long-term assets in fiscal 2010, fiscal 2009 and fiscal 2008,

respectively, related to our foreign operations.

6Included in the retail channel is a $9.4 million benefit related to an incentive payment received from a landlord to

compensate us for terminating a store lease prior to its original expiration.

7Unallocated costs before income taxes include an approximate $16.0 million benefit related to a gain on sale of our

corporate aircraft, an $11.0 million benefit related to the reversal of expense associated with certain performance-based

stock awards and severance and lease termination related costs of $12.7 million associated with our infrastructure cost

reduction program.

62