Pottery Barn 2010 Annual Report Download - page 106

Download and view the complete annual report

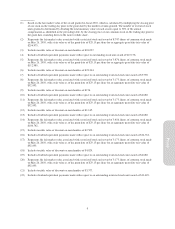

Please find page 106 of the 2010 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.What is our Board leadership structure?

We currently separate the positions of Chief Executive Officer and Chairman of the Board. Since May 2010,

Adrian D.P. Bellamy, one of our independent directors who previously served as our Lead Independent Director,

has served as our Chairman of the Board. Our Corporate Governance Guidelines also provide that in the event

that the Chairman of the Board is not an independent director, the Board shall elect a Lead Independent Director.

Separating the positions of Chief Executive Officer and Chairman of the Board maximizes the Board’s

independence and aligns our leadership structure with current trends in corporate governance best practices. Our

Chief Executive Officer is responsible for day-to-day leadership and for setting the strategic direction of the

company, while the Chairman of the Board provides independent oversight and advice to our management team,

as well as presides over Board meetings.

Do we have a Lead Independent Director?

No. On May 26, 2010 the Board appointed Adrian D.P. Bellamy, an independent director, as Chairman of the

Board.

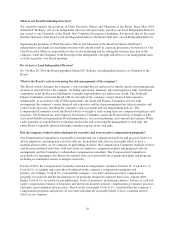

What is the Board’s role in overseeing the risk management of the company?

The Board actively manages the company’s risk oversight process and receives regular reports from management

on areas of material risk to the company, including operational, financial, legal and regulatory risks. Our Board

committees assist the Board in fulfilling its oversight responsibilities in certain areas of risk. The Audit and

Finance Committee assists the Board with its oversight of the company’s major financial risk exposures.

Additionally, in accordance with NYSE requirements, the Audit and Finance Committee reviews with

management the company’s major financial risk exposures and the steps management has taken to monitor and

control such exposures, including the company’s risk assessment and risk management policies. The

Compensation Committee assists the Board with its oversight of risks arising from our compensation policies and

programs. The Nominations and Corporate Governance Committee assists the Board with its oversight of risks

associated with Board organization, Board independence, succession planning, and corporate governance. While

each committee is responsible for evaluating certain risks and overseeing the management of such risks, the

entire Board is regularly informed through committee reports about such risks.

Did the company evaluate risks relating to its executive and non-executive compensation programs?

Our Compensation Committee is responsible for monitoring our compensation policies and practices relative to

all our employees, including non-executive officers, for potential risks that are reasonably likely to have a

material adverse effect on our company. In performing its duties, the Compensation Committee regularly reviews

and discusses potential risks that could arise from our employee compensation plans and programs with our

management and the Committee’s independent compensation consultant. The Compensation Committee is

responsible for reporting to the Board any material risks associated with our compensation plans and programs,

including recommended actions to mitigate such risks.

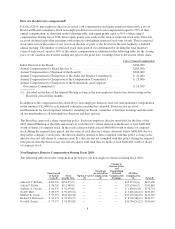

For fiscal 2010, the Compensation Committee retained its independent consultant, Frederic W. Cook & Co. or

Cook & Co., to identify and assess the risk inherent in the company’s compensation programs and

policies. Accordingly, Cook & Co. evaluated the company’s executive and non-executive compensation

programs for such risk and the mechanisms in our programs designed to mitigate these risks. Among other

things, Cook & Co. reviewed our pay philosophy, forms of incentives, performance metrics, balance of cash and

equity compensation, balance of long-term and short-term incentive periods, compensation governance practices,

and equity grant administration practices. Based on the assessment, Cook & Co. concluded that the company’s

compensation programs and policies do not create risks that are reasonably likely to have a material adverse

effect on our company.

10