Pottery Barn 2010 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2010 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In real estate, for the second consecutive year, we successfully reduced our retail occupancy costs and closed an

additional 24 stores, or 2% of our retail leased square footage.

In business development, global expansion was a key focus for us this year as we opened our first six franchised

stores in Dubai and Kuwait. We are pleased with the performance of these stores and have gained valuable

expertise in franchise operations with our Middle-East partner, M. H. Alshaya. Together, we are expecting to

open additional stores in this region, including seven in fiscal 2011. We are also in the preliminary exploration

phase for retail expansion in other parts of the world, with a goal to open in new regions in fiscal 2012.

Fiscal 2011

As we look forward to 2011, our focus is on gaining market share and improving profitability.

To gain market share, we will continue to attract new customers to our brands through: creative, innovative and

relevant product offerings, including exclusive Internet assortments; increased investment in e-commerce; highly

targeted multi-channel marketing, including the expansion of our in-store clienteling services; and the expansion

of our brands into new categories, new markets and new geographies, including the rollout of international

shipping in the back half of the year.

The Internet is our fastest growing channel and a key component of our future strategy. We have a longstanding

direct-to-customer heritage, a rich house file and an expansive digital asset portfolio. As such, we are planning to

increase our Internet investments in fiscal 2011 to capitalize on the significant opportunity we see ahead. The

Internet has changed the way our customers shop and the on-line brand experience has to be inspiring and

seamless.

Our customer service initiatives are also a key focus this year as we expand our clienteling-services and in-store

event programs. We believe the customer experience, whether on-line or in our retail stores, is a significant brand

differentiator and these initiatives are engaging new customers in our brands, while at the same time allowing us

to take our existing customer relationships to new levels.

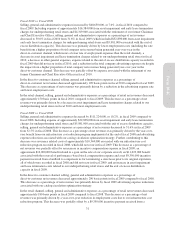

To improve profitability in fiscal 2011, we plan to implement new efficiencies in our worldwide supply chain;

drive increased traffic and higher sales per square foot in our retail stores by reinventing the customer

experience; and continue to expand e-commerce.

E-commerce is not only our fastest growing but also our most profitable channel and, therefore, its growth as a

percentage of total company revenues increases overall corporate profitability. In 2011, Internet growth is

expected to drive the direct-to-customer segment to 43% of total company revenues versus 41.5% in fiscal 2010.

From an investment perspective in fiscal 2011, we expect capital spending to be in the range of $135,000,000 to

$150,000,000 with over a third of that in e-commerce and the supply chain that supports it. An additional

$25,000,000 in fiscal 2011 is expected to be invested in incremental selling, general and administrative functions

to support our longer term e-commerce, international and business development growth strategies as compared to

fiscal 2010. While these selling, general and administrative investments are dilutive to earnings in fiscal 2011,

we expect them to begin to lever in fiscal 2012 and beyond.

From a business development perspective, we will continue to invest in organic growth strategies. This has

always been a key strength of ours and we believe we should always have several great ideas under development

at any time. But we also believe that there are opportunities to acquire new businesses that could help us more

quickly achieve our growth objectives and we will assess these opportunities as they come along.

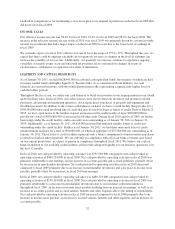

Including all of these investments, in fiscal 2011, we expect net revenues to increase in the range of 4% to 6%

and diluted earnings per share to increase in the range of 15% to 19%. Also, during fiscal 2011, we expect to

return nearly $200,000,000 to shareholders through dividends and share repurchases.

26