Pottery Barn 2010 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2010 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Note K: Related Party Transactions

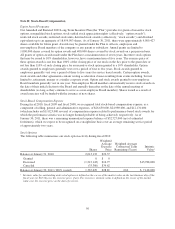

Retirement and Consulting Agreement

On January 25, 2010, the independent members of our Board of Directors (the “Board”) approved our entry into

a Retirement and Consulting Agreement (the “Agreement”) with W. Howard Lester (“Mr. Lester”), our former

Chairman of the Board and Chief Executive Officer. Pursuant to the terms of the Agreement, Mr. Lester retired

as Chairman of the Board and Chief Executive Officer on May 26, 2010. Upon his retirement and in recognition

of his contributions to the Company, Mr. Lester received, among other things, accelerated vesting of his

outstanding stock options, stock-settled stock appreciation rights and restricted stock units. The total expense

recorded in fiscal 2010 associated with Mr. Lester’s retirement, consisting primarily of stock-based

compensation expense, was approximately $4,319,000. The total expense recorded in fiscal 2010 associated with

Mr. Lester’s consulting services, consisting primarily of stock based compensation expense and cash

compensation, among other things, was approximately $1,616,000. As a result of Mr. Lester’s death in

November 2010, the Agreement terminated and all unvested stock units and cash payments granted under the

Agreement were forfeited.

Airplane Lease Agreement

On May 16, 2008, we completed two transactions relating to our corporate aircraft. First, we sold our Bombardier

Global Express airplane for approximately $46,787,000 in cash (a net after-tax cash benefit of approximately

$29,000,000) to an unrelated third party. This resulted in a gain on sale of asset of approximately $16,000,000 in

the second quarter of fiscal 2008. Second, we entered into an Aircraft Lease Agreement (the “Lease Agreement”)

with a limited liability company (the “LLC”) owned by Mr. Lester for use of a Bombardier Global 5000 owned

by the LLC. These transactions were approved by our Board of Directors.

Under the terms of the Lease Agreement, in exchange for use of the aircraft, we are required to pay the LLC

$375,000 for each of the 36 months of the lease term through May 15, 2011. We are also responsible for all

use-related costs associated with the aircraft, including fixed costs such as crew salaries and benefits, insurance

and hangar costs, and all direct operating costs. Closing costs associated with the Lease Agreement were divided

evenly between us and the LLC, and each party paid its own attorney and advisor fees. During fiscal 2010, fiscal

2009 and fiscal 2008, we paid a total of $4,500,000, $4,500,000 and $3,185,000 to the LLC, respectively.

In conjunction with the Retirement and Consulting Agreement entered into between us and Mr. Lester, the Lease

Agreement will continue pursuant to its terms through May 2011. Additionally, Mr. Lester, under the agreement

agreed to give us an option to purchase this aircraft at the end of the lease term for its then estimated fair value of

$32,000,000. On January 3, 2011, we provided the LLC with notice under the agreement of our intent to exercise

the option to purchase the aircraft at the end of the lease term. However, on or prior to the end of the lease term,

we expect to instead enter into an agreement to lease the aircraft from a third party on terms no less favorable

than those in the current lease.

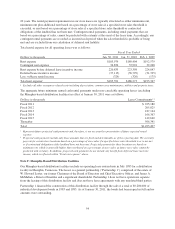

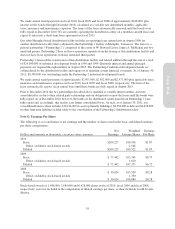

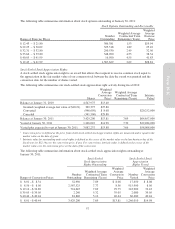

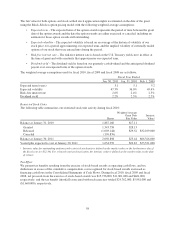

Note L: Stock Repurchase Program

In May 2010, our Board of Directors authorized a stock repurchase program to purchase up to $60,000,000 of our

common stock, and in September 2010, our Board of Directors authorized another stock repurchase program to

purchase up to $65,000,000 of our common stock. We completed the $60,000,000 stock repurchase program by

repurchasing 2,317,962 shares of our common stock at a weighted average cost of $25.88 per share in fiscal

2010. We completed the $65,000,000 stock repurchase program by repurchasing 1,945,501 shares of our

common stock at a weighted average cost of $33.41 per share in fiscal 2010.

In January 2011, our Board of Directors authorized a new stock repurchase program to purchase up to

$125,000,000 of our common stock through open market and privately negotiated transactions, at times and in

such amounts as management deems appropriate. The timing and actual number of shares repurchased will

depend on a variety of factors including price, corporate and regulatory requirements, capital availability and

other market conditions. This stock repurchase programs does not have an expiration date and may be limited or

terminated at any time without prior notice.

60