Pottery Barn 2010 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2010 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

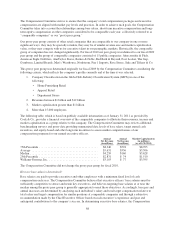

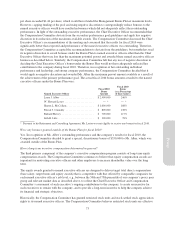

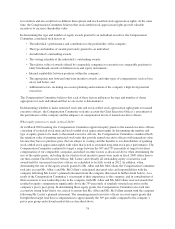

The equity grants approved at the March 2010 meeting are as follows:

Named Executive Officer

Number of

Restricted

Stock

Units

Number of Stock-

Settled Stock

Appreciation

Rights

Laura J. Alber ...................... 280,000 200,000

Sharon L. McCollam ................ 210,000 150,000

Patrick J. Connolly .................. 11,250 9,375

Richard Harvey .................... 25,000 0

Seth R. Jaffe ....................... 10,750 0

The restricted stock units granted to the named executive officers vest on the fourth anniversary of the award’s

grant date, subject to the company achieving positive net cash provided by operating activities in fiscal 2010

(excluding any non-recurring charges) as provided on our consolidated statements of cash flow, with adjustments

to any evaluation of performance to exclude (i) any extraordinary non-recurring items, or (ii) the effect of any

changes in accounting principles affecting the company’s or a business unit’s reported results and subject to the

named executive officer’s continued service to the company through such date. The stock-settled stock

appreciation rights granted to the named executive officers (including those granted to Ms. Alber and

Ms. McCollam) vest in equal annual installments over the four-year period from the date of grant, subject to the

named executive officer’s continued service with the company.

As described in our proxy for fiscal 2009, Mr. Lester had received a grant of restricted stock units at the end of

fiscal 2009, in January 2010, when he entered into his Retirement and Consulting Agreement. In addition, please

see below for a summary of the compensation Mr. Lester received as compensation for his consulting services to

the company.

Grants of stock-settled stock appreciation rights and restricted stock units made in fiscal 2010 to company

associates, including its named executive officers (other than Mr. Lester’s May 2010 grant), include an

acceleration feature which provides for the full acceleration of vesting of such awards in the event of a qualifying

retirement, which is defined as leaving the company’s employment at age 70 or later, with at least fifteen years of

service, because management and the Compensation Committee believe it is important to provide a mechanism

for vesting for its long-service associates who are reaching an age upon which they might want to retire from

their employment from the company as a reward for their long and valued service.

When are equity awards made to named executive officers?

In general, equity awards to named executive officers are only approved at scheduled Compensation Committee

meetings. Executives do not have any role in selecting the grant date of equity awards. The grant date of equity

awards may be a date set in advance by the Compensation Committee or the date of the Compensation

Committee’s approval. The exercise price of stock options or stock-settled stock appreciation rights is always the

closing price of the company’s common stock on the trading day prior to the grant date.

In general, equity awards to named executive officers are made during the Compensation Committee’s March

meeting in which the Compensation Committee reviews company performance over the past fiscal year and

determines base salaries and bonuses for named executive officers. The Compensation Committee also makes

equity awards at other times during the year in connection with promotions, assumptions of additional

responsibilities and other considerations, such as special retention or incentive concerns. The restricted stock unit

and cash award granted to Mr. Lester was made by the Compensation Committee effective in May 2010

immediately prior to his retirement date, in accordance with the terms of his Retirement and Consulting

Agreement described below. Grants made by the Incentive Award Committee are made in the first week of each

open trading window on an as-needed basis. The Compensation Committee does not time equity grants to take

advantage of anticipated or actual changes in the price of our common stock prior to or following the release of

material information regarding the company.

75

Proxy