Pottery Barn 2010 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2010 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

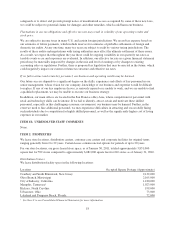

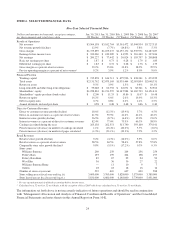

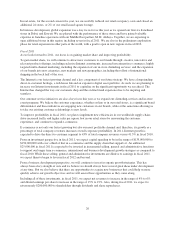

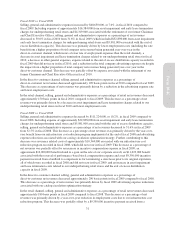

ITEM 6. SELECTED FINANCIAL DATA

Five-Year Selected Financial Data

Dollars and amounts in thousands, except percentages,

per share amounts and retail stores data

Jan. 30, 2011

(52 Weeks)

Jan. 31, 2010

(52 Weeks)

Feb. 1, 2009

(52 Weeks)

Feb. 3, 2008

(53 Weeks)

Jan. 28, 2007

(52 Weeks)

Results of Operations

Net revenues $3,504,158 $3,102,704 $3,361,472 $3,944,934 $3,727,513

Net revenue growth (decline) 12.9% (7.7%) (14.8%) 5.8% 5.3%

Gross margin $1,373,859 $1,103,237 $1,135,172 $1,535,971 $1,487,287

Earnings before income taxes $ 323,060 $ 120,289 $ 41,953 $ 316,340 $ 337,186

Net earnings $ 200,227 $ 77,442 $ 30,024 $ 195,757 $ 208,868

Basic net earnings per share $ 1.87 $ 0.73 $ 0.28 $ 1.79 $ 1.83

Diluted net earnings per share $ 1.83 $ 0.72 $ 0.28 $ 1.76 $ 1.79

Gross margin as a percent of net revenues 39.2% 35.6% 33.8% 38.9% 39.9%

Pre-tax operating margin as a percent of net revenues19.2% 3.9% 1.2% 8.0% 9.0%

Financial Position

Working capital $ 735,878 $ 616,711 $ 479,936 $ 438,241 $ 473,229

Total assets $2,131,762 $2,079,169 $1,935,464 $2,093,854 $2,048,331

Return on assets 9.5% 3.9% 1.5% 9.4% 10.1%

Long-term debt and other long-term obligations $ 59,048 $ 62,792 $ 62,071 $ 68,761 $ 32,562

Shareholders’ equity $1,258,863 $1,211,595 $1,147,984 $1,165,723 $1,151,431

Shareholders’ equity per share (book value) $ 12.00 $ 11.33 $ 10.86 $ 11.07 $ 10.48

Return on equity 16.2% 6.6% 2.6% 16.9% 18.3%

Debt-to-equity ratio 0.7% 0.8% 2.2% 2.2% 2.5%

Annual dividends declared per share $ 0.58 $ 0.48 $ 0.48 $ 0.46 $ 0.40

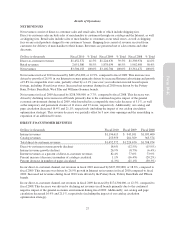

Direct-to-Customer Revenues

Direct-to-customer revenue growth (decline) 18.6% (12.5%) (15.9%) 5.7% 4.5%

Direct-to-customer revenues as a percent of net revenues 41.5% 39.5% 41.6% 42.2% 42.2%

Internet revenue growth (decline) 26.9% (8.7%) (6.4%) 19.0% 21.0%

Internet revenues as a percent of direct-to-customer revenues 82.4% 77.0% 73.9% 66.3% 58.9%

Catalogs circulated during the year 265,138 262,351 313,740 393,160 379,011

Percent increase (decrease) in number of catalogs circulated 1.1% (16.4%) (20.2%) 3.7% (1.6%)

Percent increase (decrease) in number of pages circulated (1.3%) (21.1%) (30.3%) 7.9% 3.2%

Retail Revenues

Retail revenue growth (decline) 9.2% (4.3%) (14.0%) 5.9% 6.0%

Retail revenues as a percent of net revenues 58.5% 60.5% 58.4% 57.8% 57.8%

Comparable store sales growth (decline)29.8% (5.1%) (17.2%) 0.3% 0.3%

Store count

Williams-Sonoma 260 259 264 256 254

Pottery Barn 193 199 204 198 197

Pottery Barn Kids 85 87 95 94 92

West Elm 36 36 36 27 22

Williams-Sonoma Home — 11 10 9 7

Outlets 18 18 18 16 16

Number of stores at year-end 592 610 627 600 588

Store selling area at fiscal year-end (sq. ft.) 3,609,000 3,763,000 3,828,000 3,575,000 3,389,000

Store leased area at fiscal year-end (sq. ft.) 5,831,000 6,081,000 6,148,000 5,739,000 5,451,000

1Pre-tax operating margin is defined as earnings before income taxes.

2Calculated on a 52-week to 52-week basis, with the exception of fiscal 2007 which was calculated on a 53-week to 53-week basis.

The information set forth above is not necessarily indicative of future operations and should be read in conjunction

with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the Consolidated

Financial Statements and notes thereto in this Annual Report on Form 10-K.

24