Pottery Barn 2010 Annual Report Download - page 152

Download and view the complete annual report

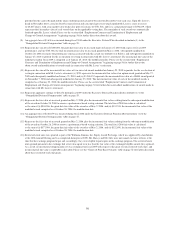

Please find page 152 of the 2010 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.quarterly installments over 5, 10 or 15 years, or a single lump sum, is available for terminations due to

retirement or disability, as defined in the plan, if the account is over $25,000. All other distributions are paid

as a single lump sum. The commencement of payments can be postponed, subject to advance election and

minimum deferral requirements. At death, the plan may provide a death benefit funded by a life insurance

policy, in addition to payment of the participant’s account.

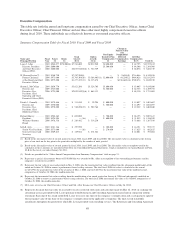

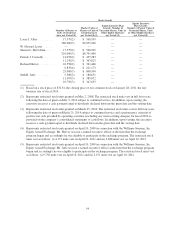

(2) Represents the value realized on each vesting date of the following: (i) 249,501 shares that vested upon

Mr. Lester’s retirement on May 26, 2010 (the “Retirement Shares”), with a value realized on such vesting of

$7,272,954, and (ii) an aggregate of 20,835 shares, of which 4,167 shares vested on each of June 30,

2010, July 31, 2010, August 31, 3010, September 30, 2010 and October 31, 2010 (collectively, the

“Consulting Shares”), with an aggregate value realized on such vesting dates of $592,839. The Retirement

Shares were deferred pursuant to the terms of the equity award. The Consulting Shares were deferred

pursuant to the terms of the Retirement and Consulting Agreement.

(3) Represents the following: (i) the aggregate loss of $3,638 incurred during fiscal 2010 under the Executive

Deferral Plan, (ii) $1,726,547, which represents the difference between the value realized on the vesting of

the Retirement Shares and the value realized on December 31, 2010, when such shares were delivered, and

(ii) $158,679, which represents the difference between the aggregate value realized on the vesting of the

Consulting Shares and the aggregate value realized on December 31, 2010, when such shares were

delivered.

(4) Following Mr. Lester’s retirement, he received a distribution under the Executive Deferral Plan of $294,572

and elected to receive the remaining balance in quarterly installments over 15 years. A quarterly payment of

$1,259 was made on October 20, 2010, and upon Mr. Lester’s death, the remaining balance of $89,660 was

distributed to his estate.

Employment Contracts and Termination of Employment and Change-of-Control Arrangements

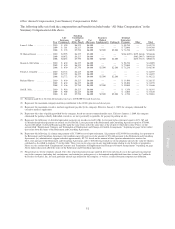

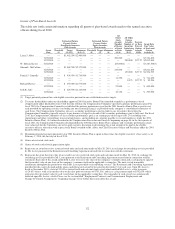

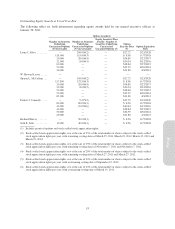

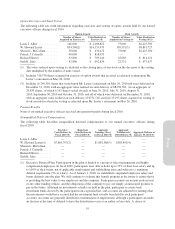

We have entered into a management retention agreement with each of Ms. Alber, Ms. McCollam, Mr. Connolly,

Mr. Harvey and Mr. Jaffe. Each retention agreement has an initial two-year term and will be automatically

extended for one-year following the initial term unless either party provides notice of non-extension. If we enter

into a definitive agreement with a third party providing for a “change of control,” each retention agreement will

be automatically extended for 18 months following the change of control. If within 18 months following a

change of control, an executive’s employment is terminated by us without “cause,” or by the executive for “good

reason,” (i) 100% of such executive’s outstanding equity awards, including full value awards, with performance-

based vesting where the payout is a set number or zero depending on whether the performance metric is obtained,

will immediately become fully vested, except that if a full value award has performance-based vesting and the

performance period has not been completed and the number of shares that can be earned is variable based on the

performance level, a pro-rata portion of such executive’s outstanding equity awards will immediately become

fully vested at the target performance level, and (ii) in lieu of continued employment benefits (other than as

required by law), such executive will be entitled to receive payments of $3,000 per month for 12 months.

In addition, if, within 18 months following a change of control, Ms. Alber’s, Ms. McCollam’s, Mr. Connolly’s or

Mr. Harvey’s employment is terminated by us without “cause,” or by the executive for “good reason,” such

executive will be entitled to receive (i) severance equal to 200% of such executive’s base salary as in effect

immediately prior to the change of control or such executive’s termination, whichever is greater, with such

severance to be paid over 24 months, and (ii) if such termination occurs in 2010, an amount equal to 200% of the

annual bonus received in the last 12 months, if such termination occurs in 2011, an amount equal to 200% of the

average annual bonus received in the last 24 months, or if such termination occurs in 2012 or later, an amount

equal to 200% of the average annual bonus received in the last 36 months, with such severance to be paid over 24

months. If, within 18 months following a change of control, Mr. Jaffe’s employment is terminated by us without

“cause,” or by Mr. Jaffe for “good reason,” he will be entitled to receive (i) severance equal to 100% of his base

salary as in effect immediately prior to the change of control or his termination, whichever is greater, with such

56