Pottery Barn 2010 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2010 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252

|

|

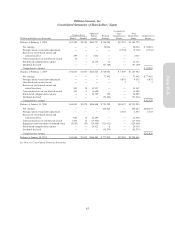

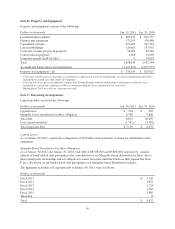

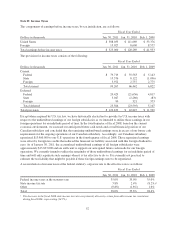

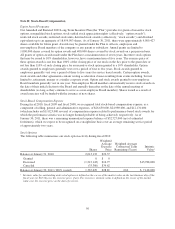

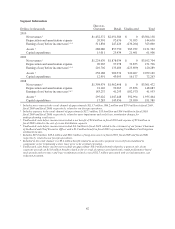

Significant components of our deferred tax accounts are as follows:

Dollars in thousands Jan. 30, 2011 Jan. 31, 2010

Current:

Compensation $ 8,086 $ 8,659

Merchandise inventories 20,424 21,715

Accrued liabilities 16,182 17,451

Customer deposits 50,452 53,229

Prepaid catalog expenses (14,614) (13,014)

Other 5,082 4,155

Total current 85,612 92,195

Non-current:

Depreciation 16,064 37,586

Deferred rent 15,067 16,007

Deferred lease incentives (26,990) (36,556)

Stock-based compensation 17,370 23,956

Executive deferral plan 5,253 5,307

Uncertainties 5,407 7,252

Other 475 257

Total non-current 32,646 53,809

Total deferred tax assets, net $118,258 $146,004

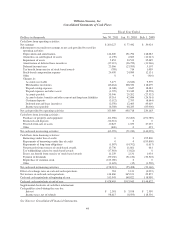

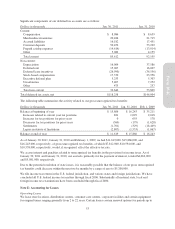

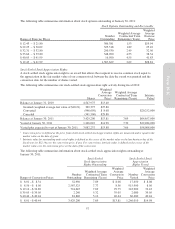

The following table summarizes the activity related to our gross unrecognized tax benefits:

Dollars in thousands Jan. 30, 2011 Jan. 31, 2010 Feb. 1, 2009

Balance at beginning of year $ 15,866 $ 16,243 $ 35,211

Increases related to current year tax positions 821 1,029 2,018

Increases for tax positions for prior years 0 655 178

Decreases for tax positions for prior years (560) (179) (1,628)

Settlements (1,701) (329) (18,469)

Lapses in statute of limitations (2,807) (1,553) (1,067)

Balance at end of year $ 11,619 $ 15,866 $ 16,243

As of January 30, 2011, January 31, 2010 and February 1, 2009, we had $11,619,000, $15,866,000, and

$16,243,000, respectively, of gross unrecognized tax benefits, of which $7,812,000, $10,594,000, and

$10,558,000, respectively, would, if recognized, affect the effective tax rate.

We accrue interest and penalties related to unrecognized tax benefits in the provision for income taxes. As of

January 30, 2011 and January 31, 2010, our accruals, primarily for the payment of interest, totaled $4,062,000

and $5,081,000, respectively.

Due to the potential resolution of state issues, it is reasonably possible that the balance of our gross unrecognized

tax benefits could decrease within the next twelve months by a range of zero to $5,200,000.

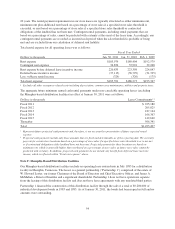

We file income tax returns in the U.S. federal jurisdiction, and various states and foreign jurisdictions. We have

concluded all U.S. federal income tax matters through fiscal 2006. Substantially all material state, local and

foreign income tax examinations have been concluded through fiscal 2000.

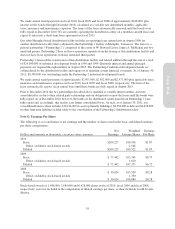

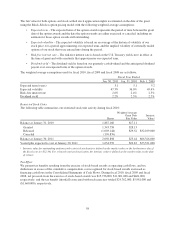

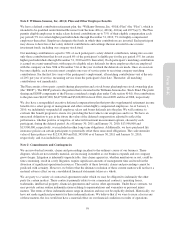

Note E: Accounting for Leases

Operating Leases

We lease store locations, distribution centers, customer care centers, corporate facilities and certain equipment

for original terms ranging generally from 2 to 22 years. Certain leases contain renewal options for periods up to

53

Form 10-K