Pottery Barn 2010 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2010 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

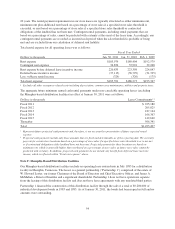

Credit Facility

On September 23, 2010, we entered into the Fifth Amended and Restated Credit Agreement that amended and

replaced our existing credit facility and provided for a $300,000,000 unsecured revolving line of credit that may

be used for loans or letters of credit. Prior to March 23, 2015, we may, upon notice to the lenders, request an

increase in the credit facility of up to $200,000,000, to provide for a total of $500,000,000 of unsecured revolving

credit. The credit facility contains certain financial covenants, including a maximum leverage ratio (funded debt

adjusted for lease and rent expense to earnings before interest, income tax, depreciation, amortization and rent

expense “EBITDAR”), and covenants limiting our ability to dispose of assets, make acquisitions, be acquired (if

a default would result from the acquisition), incur indebtedness, grant liens and make investments. The credit

facility contains events of default that include, among others, non-payment of principal, interest or fees, violation

of covenants, inaccuracy of representations and warranties, bankruptcy and insolvency events, material

judgments, cross-defaults to material indebtedness and events constituting a change of control. The occurrence of

an event of default will increase the applicable rate of interest by 2.0% and could result in the acceleration of our

obligations under the credit facility and an obligation of any or all of our U.S. subsidiaries that have guaranteed

the credit facility to pay the full amount of our obligations under the credit facility. As of January 30, 2011, we

were in compliance with our financial covenants under the credit facility and, based on current projections,

expect to be in compliance throughout fiscal 2011. The credit facility matures on September 23, 2015, at which

time all outstanding borrowings must be repaid and all outstanding letters of credit must be cash collateralized.

We may elect interest rates calculated at (i) Bank of America’s prime rate (or, if greater, the average rate on

overnight federal funds plus one-half of one percent, or a rate based on LIBOR plus one percent) plus a margin

based on our leverage ratio or (ii) LIBOR plus a margin based on our leverage ratio. During fiscal 2010 and fiscal

2009, we had no borrowings under the credit facility, and no amounts were outstanding as of January 30, 2011 or

January 31, 2010. Additionally, as of January 30, 2011, $9,420,000 in issued but undrawn standby letters of

credit was outstanding under the credit facility. The standby letters of credit were issued to secure the liabilities

associated with workers’ compensation and other insurance programs.

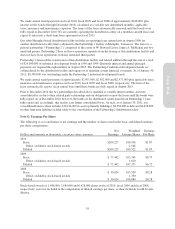

Letter of Credit Facilities

We have three unsecured commercial letter of credit reimbursement facilities, each of which matures on

September 2, 2011. The aggregate credit available under all letter of credit facilities is $90,000,000. The letter of

credit facilities contain covenants and provide for events of default that are consistent with our unsecured

revolving line of credit. Interest on unreimbursed amounts under the letter of credit facilities accrues at the

lender’s prime rate (or if greater, the average rate on overnight federal funds plus one-half of one percent) plus

2.0%. As of January 30, 2011, an aggregate of $27,584,000 was outstanding under the letter of credit facilities,

which represents only a future commitment to fund inventory purchases to which we had not taken legal title.

The latest expiration possible for any future letters of credit issued under the facilities is January 30, 2012.

Restricted Cash

On April 16, 2010, we entered into a Collateral Trust Agreement (the “Agreement”) to replace a portion of our

standby letters of credit, which secure the liabilities associated with our workers’ compensation and other

insurance programs. Under the Agreement, we funded the trust with an initial deposit of $12,500,000 and are

required to reinvest interest income up to a maximum of 110% of the initial deposit thereby guaranteeing our

obligation for any losses below our insurance deductibles. The Agreement is renewable annually and is

cancellable upon 90 days written notice with the insurance provider’s and our mutual consent. As of January 30,

2011, restricted cash related to the Agreement was $12,512,000.

51

Form 10-K