Pottery Barn 2010 Annual Report Download - page 146

Download and view the complete annual report

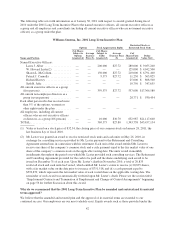

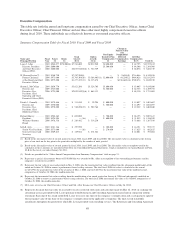

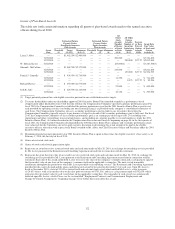

Please find page 146 of the 2010 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.provided for the cash to be paid and the shares underlying such award to be issued on December 31 of each year. Upon Mr. Lester’s

death in November 2010, a total of 20,835 restricted stock and cash units had vested, which entitled Mr. Lester’s estate to receive

(i) 20,835 shares, with a fair market value on the date prior to issuance of $751,518, and (ii) a cash payment equal to $592,839, which

represents the fair market value of each vested share on the applicable vesting date. The remainder of such award was automatically

forfeited upon Mr. Lester’s death. Please see the section titled “Employment Contracts and Termination of Employment and

Change-of-Control Arrangements” beginning on page 56 for further discussion about this award.

(9) An aggregate loss of $3,638 was incurred during fiscal 2010 under the Executive Deferral Plan described in footnote (1) to the

“Nonqualified Deferred Compensation” table on page 55.

(10) Represents the sum of (i) $5,000,000, the grant date fair value of an award made on January 25, 2010 with respect to fiscal 2009

performance, and (ii) $705,308, the total incremental fair value of an award granted on May 2, 2008, subsequently modified on

October 28, 2008 to remove the performance criteria associated with this award (see footnote (12) below), and subsequently modified on

January 25, 2010 to provide for the acceleration of vesting in connection with Mr. Lester’s retirement. The incremental fair value of the

modified award in fiscal 2009 is computed as of January 25, 2010, the modification date. Please see the section titled “Employment

Contracts and Termination of Employment and Change-of-Control Arrangements” beginning on page 56 for further discussion

about awards and modifications of awards made in connection with Mr. Lester’s retirement.

(11) Represents the sum of the incremental fair values of two unvested awards modified on January 25, 2010 to provide for the acceleration of

vesting in connection with Mr. Lester’s retirement: (i) $251 represents the incremental fair value of an option award granted on May 27,

2005 and subsequently modified on January 25, 2010, and (ii) $3,584,152 represents the incremental fair value of a SSAR award granted

on November 7, 2008 and subsequently modified on January 25, 2010. The incremental fair value of each of the modified awards is

computed as of January 25, 2010, the modification date. Please see the section titled “Employment Contracts and Termination of

Employment and Change-of-Control Arrangements” beginning on page 56 for further discussion about modifications of awards made in

connection with Mr. Lester’s retirement.

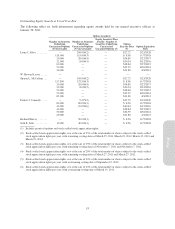

(12) Represents aggregate earrings of $84,256 during fiscal 2009 under the Executive Deferral Plan described in footnote (1) to the

“Nonqualified Deferred Compensation” table on page 55.

(13) Represents the fair value of an award granted on May 2, 2008, plus the incremental fair value resulting from the subsequent modification

of the award on October 28, 2008 to remove a performance-based vesting criterion. The total fiscal 2008 fair value is calculated

as the sum of (i) $944,986, the grant date fair value of the award as of May 2, 2008, and (ii) $332,241, the incremental fair value of the

modified award, computed as of October 28, 2008, the modification date.

(14) An aggregate loss of $238,669 was incurred during fiscal 2008 under the Executive Deferral Plan described in footnote (1) to the

“Nonqualified Deferred Compensation” table on page 55.

(15) Represents the fair value of an award granted on May 2, 2008, plus the incremental fair value resulting from the subsequent modification

of the award on October 28, 2008 to remove a performance-based vesting criterion. The total fiscal 2008 fair value is calculated

as the sum of (i) $377,994, the grant date fair value of the award as of May 2, 2008, and (ii) $132,896, the incremental fair value of the

modified award, computed as of October 28, 2008, the modification date.

(16) Restricted stock units were granted as part of the Williams-Sonoma, Inc. Equity Award Exchange, which was approved by shareholders

at the 2008 Annual Meeting and was completed during fiscal 2009. Mr. Harvey and Mr. Jaffe were not named executive officers at the

time that the exchange program began and, accordingly, they were eligible to participate in the exchange program. The restricted stock

units granted pursuant to the exchange had a fair value equal to or less than the fair value of the exchanged eligible awards they replaced.

As a result, no incremental compensation cost was recognized in fiscal 2009 with respect to the grant of such restricted stock units, and

no incremental fair value is reportable in this table. Please see the “Grants of Plan-Based Awards” table on page 52 for further discussion

about these restricted stock unit grants.

50