Pottery Barn 2010 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2010 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

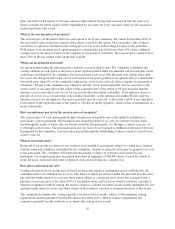

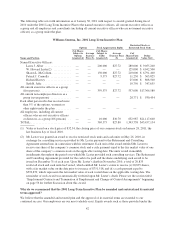

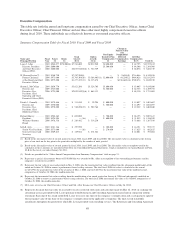

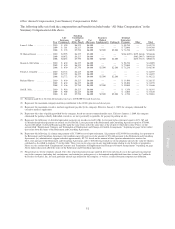

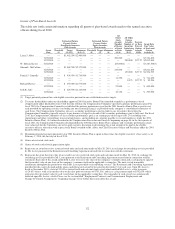

The following table sets forth information as of January 30, 2011 with respect to awards granted during fiscal

2010 under the 2001 Long-Term Incentive Plan to the named executive officers, all current executive officers as

a group and all employees and consultants (including all current executive officers who are not named executive

officers) as a group under the plan.

Williams-Sonoma, Inc. 2001 Long-Term Incentive Plan

Options Stock Appreciation Rights

Restricted Stock or

Restricted Stock Units

Name and Position

# of Shares

Subject to

Options

Granted (#)

Average

Exercise

Price ($)

# of Shares

Subject to

SARs

Granted (#)

Average

Exercise Price

($)

#of

Shares/Units

Granted (#)

Dollar

Value ($)(1)

Named Executive Officers:

Laura J. Alber .................. — — 200,000 $27.72 280,000 $ 9,055,200

W. Howard Lester(2) ............ — — — — 125,000 $ 4,042,500

Sharon L. McCollam ............. — — 150,000 $27.72 210,000 $ 6,791,400

Patrick J. Connolly .............. — — 9,375 $27.72 11,250 $ 363,825

Richard Harvey ................. — — — — 25,000 $ 808,500

Seth R. Jaffe ................... — — — — 10,750 $ 347,655

All current executive officers as a group

(five persons) ..................... — — 359,375 $27.72 537,000 $17,366,580

All current non-employee directors as a

group (seven persons) .............. — — — — 28,771 $ 930,454

Each other person who has received more

than 5% of the options, warrants or

other rights under the plan .......... — — — — — —

All employees, including all current

officers who are not executive officers

or directors, as a group 106 persons) . . — — 10,000 $30.70 652,987 $21,117,600

TOTAL:........................... — — 369,375 $27.80 1,343,758 $43,457,134

(1) Value is based on a stock price of $32.34, the closing price of our common stock on January 28, 2011, the

last business day of fiscal 2010.

(2) Mr. Lester was granted an award to receive restricted stock units and cash units on May 26, 2010, in

exchange for consulting services provided by Mr. Lester pursuant to the Retirement and Consulting

Agreement entered into in connection with his retirement. Each unit of the award entitled Mr. Lester to

receive one share of the company’s common stock and a cash payment equal to the fair market value of one

share of the company’s common stock on the applicable vesting date. The units vested in monthly

installments throughout the period over which Mr. Lester provided such consulting services. The Retirement

and Consulting Agreement provided for the cash to be paid and the shares underlying such award to be

issued on December 31 of each year. Upon Mr. Lester’s death in November 2010, a total of 20,835

restricted stock and cash units had vested, which entitled Mr. Lester’s estate to receive (i) 20,835 shares,

with a fair market value on the date prior to issuance of $751,518, and (ii) a cash payment equal to

$592,839, which represents the fair market value of each vested share on the applicable vesting date. The

remainder of such award was automatically forfeited upon Mr. Lester’s death. Please see the section titled

“Employment Contracts and Termination of Employment and Change-of-Control Arrangements” beginning

on page 56 for further discussion about this award.

Why do we recommend that the 2001 Long-Term Incentive Plan be amended and restated and its material

terms approved?

We believe that the amended and restated plan and the approval of its material terms are essential to our

continued success. Our employees are our most valuable asset. Equity awards such as those provided under the

42