Pottery Barn 2010 Annual Report Download - page 50

Download and view the complete annual report

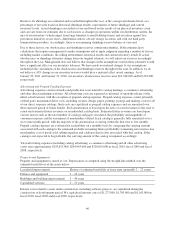

Please find page 50 of the 2010 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2.0%. As of January 30, 2011, an aggregate of $27,584,000 was outstanding under the letter of credit facilities,

which represents only a future commitment to fund inventory purchases to which we had not taken legal title.

The latest expiration possible for any future letters of credit issued under the facilities is January 30, 2012.

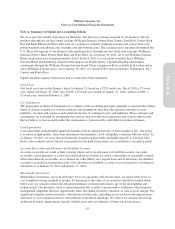

Restricted Cash

On April 16, 2010, we entered into a Collateral Trust Agreement (the “Agreement”) to replace a portion of our

standby letters of credit, which secure the liabilities associated with our workers’ compensation and other

insurance programs. Under the Agreement, we funded the trust with an initial deposit of $12,500,000 and are

required to reinvest interest income up to a maximum of 110% of the initial deposit thereby guaranteeing our

obligation for any losses below our insurance deductibles. The Agreement is renewable annually and is

cancellable upon 90 days written notice with the insurance provider’s and our mutual consent. As of January 30,

2011, restricted cash related to the Agreement was $12,512,000.

MEMPHIS-BASED DISTRIBUTION FACILITIES

Our Memphis-based distribution facilities include an operating lease entered into in July 1983 for a distribution

facility in Memphis, Tennessee. The lessor is a general partnership (“Partnership 1”) comprised of the estate of

W. Howard Lester, our former Chairman of the Board of Directors and Chief Executive Officer, and James A.

McMahan, a Director Emeritus and a significant shareholder. Partnership 1 does not have operations separate

from the leasing of this distribution facility and does not have lease agreements with any unrelated third parties.

Partnership 1 financed the construction of this distribution facility through the sale of a total of $9,200,000 of

industrial development bonds in 1983 and 1985. As of January 30, 2011, the bonds had been repaid in full and no

amounts were outstanding.

We made annual rental payments in fiscal 2010, fiscal 2009 and fiscal 2008 of approximately $618,000, plus

interest on the bonds (through December 2010) calculated at a variable rate determined monthly, applicable

taxes, insurance and maintenance expenses. The terms of the lease automatically renewed until the bonds were

fully repaid in December 2010. We are currently operating the distribution center on a month-to-month lease and

expect to enter into a short-term lease agreement in fiscal 2011.

Our other Memphis-based distribution facility includes an operating lease entered into in August 1990 for

another distribution facility that is adjoined to the Partnership 1 facility in Memphis, Tennessee. The lessor is a

general partnership (“Partnership 2”) comprised of the estate of W. Howard Lester, James A. McMahan and two

unrelated parties. Partnership 2 does not have operations separate from the leasing of this distribution facility and

does not have lease agreements with any unrelated third parties.

Partnership 2 financed the construction of this distribution facility and related addition through the sale of a total

of $24,000,000 of industrial development bonds in 1990 and 1994. Quarterly interest and annual principal

payments are required through maturity in August 2015. The Partnership 2 industrial development bonds are

collateralized by the distribution facility and require us to maintain certain financial covenants. As of January 30,

2011, $8,338,000 was outstanding under the Partnership 2 industrial development bonds.

We made annual rental payments of approximately $2,567,000, $2,582,000 and $2,577,000 plus applicable taxes,

insurance and maintenance expenses in fiscal 2010, fiscal 2009 and fiscal 2008, respectively. The term of the

lease automatically renews on an annual basis until these bonds are fully repaid in August 2015.

Prior to December 2010, the two partnerships described above qualified as variable interest entities and were

consolidated by us due to their related party relationship and our obligation to renew the leases until the bonds

were fully repaid. As of December 2010, however, the bonds on the distribution center leased from Partnership 1

were fully repaid and, accordingly, this facility is no longer consolidated by us. As such, as of January 30, 2011,

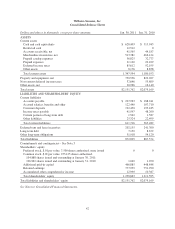

our consolidated balance sheet includes $12,414,000 in assets (primarily buildings), $8,338,000 in debt and

$4,076,000 in other long-term liabilities related solely to the consolidation of the Partnership 2 distribution

facility.

36