Pottery Barn 2010 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2010 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

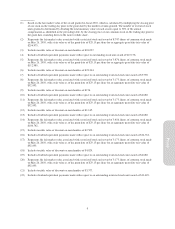

Highly Developed and Predictable Corporate Law. Delaware has adopted comprehensive and flexible corporate

laws that are revised regularly to meet changing business circumstances. The Delaware legislature is particularly

sensitive to issues regarding corporate law and is especially responsive to developments in modern corporate law.

In addition, Delaware offers a system of specialized Chancery Courts to deal with corporate law questions, which

have streamlined procedures and processes that help provide relatively quick decisions. These courts have

developed considerable expertise in dealing with corporate issues, as well as a substantial and influential body of

case law construing Delaware’s corporate law. In contrast, California does not have a similar specialized court

established to hear only corporate law cases. Instead, disputes involving questions of California corporate law are

either heard by the California Superior Court, the general trial court in California that hears all manner of cases,

or, if federal jurisdiction exists, a federal district court. This lack of specialized courts in California has been

known to result in lengthy delays in resolving cases and to produce outcomes that are inconsistent from court to

court. In addition, the Delaware Secretary of State is particularly flexible, highly experienced and responsive in

its administration of the filings required for mergers, acquisitions and other corporate transactions.

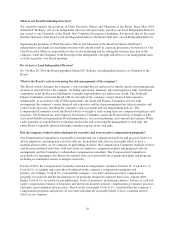

Delaware has become the preferred domicile for most major American corporations, and Delaware law and

administrative practices have become comparatively well-known and widely understood. As a result of these

factors, it is anticipated that Delaware law will provide greater efficiency, predictability and flexibility in our

legal affairs than is presently available under California law. In addition, in general, Delaware case law provides

a well-developed body of law defining the proper duties and decision making process expected of a board of

directors in evaluating potential and proposed corporate takeover offers and business combinations. The Board

believes that the Delaware law will help the Board to protect W-S Delaware’s strategic objectives, consider fully

any proposed takeover and alternatives, and, if appropriate, negotiate terms that maximize the benefit to all of our

shareholders.

Enhanced Ability of the Majority of Shareholders to Exercise Control. The majority of shareholders of a

Delaware corporation would have greater ability to exercise control, because Delaware law does not require

cumulative voting. Cumulative voting is often used when a minority shareholder (or shareholder group) is

otherwise unable to persuade the majority to elect one or more nominees for the election of directors. Under

cumulative voting, a shareholder may cast as many votes as shall equal the number of votes that such holder

would be entitled to cast for the election of directors multiplied by the number of directors to be elected. The

holder may cast all such votes for a single director or distribute the votes among two or more directors. Thus,

minority shareholders are often able to use cumulative voting to elect one or more directors to the corporation’s

board of directors. The Board believes that directors so elected by a minority shareholder who was unable or

unwilling to persuade the majority of shareholders would then act to advance courses of action with respect to

which the majority of shareholders was not persuaded. Oftentimes, such situations lead to impediment and

frustration of the intentions of the majority of shareholders. The Board believes that each director should be

elected by a majority vote of the shareholders, rather than a minority, and has included a majority vote provision

in the Delaware Bylaws.

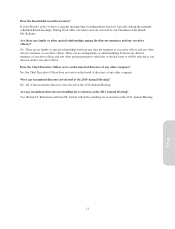

Enhanced Ability to Attract and Retain Directors and Officers. The Board believes that the Reincorporation will

enhance our ability to attract and retain qualified directors and officers, as well as encourage directors and

officers to continue to make independent decisions in good faith on behalf of the company. We are in a

competitive industry and compete for talented individuals to serve on our management team and on our Board.

The vast majority of public companies are incorporated in Delaware, including the majority of the companies

included in the peer group used by the company to benchmark executive compensation. Not only is Delaware

law more familiar to directors, it also offers greater certainty and stability from the perspective of those who

serve as corporate officers and directors. The parameters of director and officer liability are more extensively

addressed in Delaware court decisions and are therefore better defined and better understood than under

California law. The Board believes that the Reincorporation will provide appropriate protection for shareholders

from possible abuses by directors and officers, while enhancing our ability to recruit and retain directors and

officers. In this regard, it should be noted that directors’ personal liability is not, and cannot be, eliminated under

Delaware law for intentional misconduct, bad faith conduct or any transaction from which the director derives an

19

Proxy