Pottery Barn 2010 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2010 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

The following discussion and analysis of our financial condition, results of operations, and liquidity and capital

resources for the 52 weeks ended January 30, 2011 (“fiscal 2010”), the 52 weeks ended January 31, 2010 (“fiscal

2009”), and the 52 weeks ended February 1, 2009 (“fiscal 2008”) should be read in conjunction with our

consolidated financial statements and notes thereto. All explanations of changes in operational results are

discussed in order of magnitude.

OVERVIEW

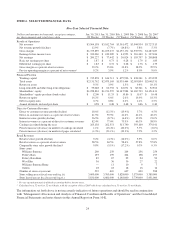

Fiscal 2010 Financial Results

Fiscal 2010 was a year of record performance for our company. Each of our brands ended the year stronger than

it began, and aggressive and proactive initiatives across the organization led to new milestones in profitability.

We are pleased with the progress we made in merchandising, marketing, customer acquisition and customer

service, as it was these initiatives that we believe have allowed us to attract new customers to our brands and gain

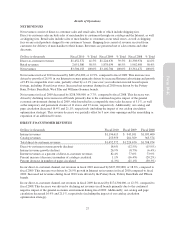

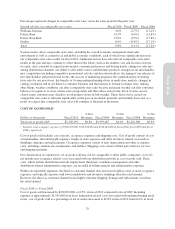

profitable market share all year. In fiscal 2010, our net revenues increased 12.9% to $3,504,158,000 compared to

$3,102,704,000 in fiscal 2009 and we increased our fiscal 2010 diluted earnings per share to $1.83 versus $0.72

in fiscal 2009. We also ended the year with $628,403,000 in cash after returning nearly $185,000,000 to our

shareholders through stock repurchases and dividends.

In our direct-to-customer channel, net revenues in fiscal 2010 increased by $227,902,000, or 18.6%, compared to

fiscal 2009. This increase was driven by 26.9% growth in Internet net revenues in fiscal 2010 compared to fiscal

2009. Increased net revenues during fiscal 2010 were driven by the Pottery Barn, Pottery Barn Kids and PBteen

brands.

Retail net revenues in fiscal 2010 increased by $173,552,000, or 9.2%, compared to fiscal 2009. This increase

was driven by growth of 9.8% in comparable store sales, partially offset by a 4.1% year-over-year reduction in

retail leased square footage, including 18 net fewer stores. Increased net revenues during fiscal 2010 were driven

by the Pottery Barn, West Elm and Williams-Sonoma brands.

In our core brands, net revenues increased 12.3% compared to fiscal 2009 led by growth in the Pottery Barn

brand. Sales trends improved in every concept and we saw significant growth in new customer acquisition.

In our emerging brands, net revenues increased 17.1% led by West Elm and PBteen, which continued to see net

revenue and operating margin increases. In Williams-Sonoma Home, we completed the retail restructuring of the

brand by closing all stand-alone retail stores.

Fiscal 2010 Operational Results

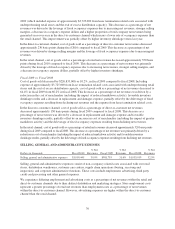

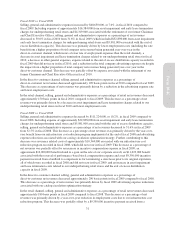

In our supply chain, we continued to see ongoing customer service and cost reduction benefits from our

distribution, transportation, packaging, and quality returns initiatives. These initiatives included: implementing

the first phase of our multi-year east coast distribution center consolidation; optimizing our inbound and

outbound packaging; improving efficiency in our personalization operations; and consolidating shipments of

customers’ furniture and non-furniture orders into one delivery.

Another significant supply chain initiative was Asian sourcing where we expanded our in-country operations.

This initiative has allowed us to establish factory specific expertise, improve vendor performance and reduce

returns, replacements and damages. We are gaining similar efficiencies from the expansion of our North Carolina

upholstered furniture operation, which is now a major supplier of our upholstered furniture.

In information technology, we made significant progress in e-commerce, particularly in the areas of on-site

search, customer engagement, mobile and social media. All of these investments drove increased traffic, higher

conversion and a superior on-site experience for our customers. We also launched new e-gift card functionality in

all brands and a new member-based shipping program in the Williams-Sonoma brand. In direct marketing, we

implemented new functionality that allowed us to make significant advancements in the relevance of our

e-marketing programs.

25

Form 10-K