Pottery Barn 2010 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2010 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

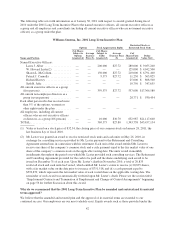

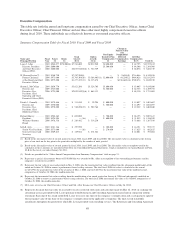

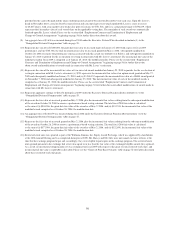

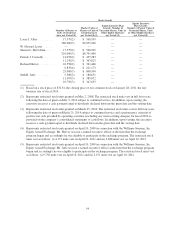

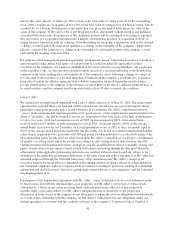

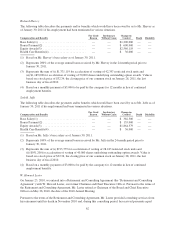

Grants of Plan-Based Awards

This table sets forth certain information regarding all grants of plan-based awards made to the named executive

officers during fiscal 2010.

Grant

Date

Estimated Future

Payouts Under

Non-Equity Incentive

Plan Awards

Estimated Future

Payouts Under

Equity Incentive

Plan Awards

All

Other

Stock

Awards;

Number

of Shares

of Stock

or Units

(#)(4)

All Other

Option

Awards;

Number of

Securities

Underlying

Options

(#)(5)

Exercise

or Base

Price of

Option

Awards

($/Sh)

Grant Date

Fair Value

of Stock and

Option

Awards ($)

Threshold

($)

Target

($)(1)(2)

Maximum

($)(2)(3)

Threshold

($)

Target

($)

Maximum

($)

Laura J. Alber ....... — — $1,462,500 $2,400,000 — — — — — — —

3/25/2010 — — — — — — 280,000 — — $7,761,600

3/25/2010 — — — — — — — 200,000 $27.72 $2,032,940

W. Howard Lester .... 5/26/2010 — — — — — — 125,000(6) — — $7,287,500(7)

Sharon L. McCollam . . — — $1,062,500 $2,175,000 — — — — — — —

3/25/2010 — — — — — — 210,000 — — $5,821,200

3/25/2010 — — — — — — — 150,000 $27.72 $1,524,705

Patrick J. Connolly . . . — — $ 436,050 $1,710,000 — — — — — — —

3/25/2010 — — — — — — 11,250 — — $ 311,850

3/25/2010 — — — — — — — 9,375 $27.72 $ 95,294

Richard Harvey ...... — — $ 450,000 $1,575,000 — — — — — — —

3/25/2010 — — — — — — 25,000 — — $ 693,000

Seth R. Jaffe ........ — — $ 229,500 $1,125,000 — — — — — — —

3/25/2010 — — — — — — 10,750 — — $ 297,990

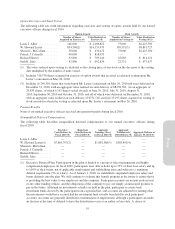

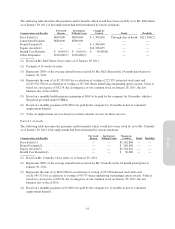

(1) Target potential payment for each eligible executive pursuant to our established incentive targets.

(2) To ensure deductibility under our shareholder-approved 2001 Incentive Bonus Plan (intended to qualify as performance-based

compensation under Internal Revenue Code Section 162(m)), the Compensation Committee specified a primary performance goal. For

fiscal 2010, the Compensation Committee established the primary performance goal for the 2001 Incentive Bonus Plan as positive net

cash provided by operating activities (excluding any non-recurring charges) as provided on the company’s consolidated statements of

cash flows. The Compensation Committee also set a secondary performance goal to guide its use of negative discretion; the

Compensation Committee typically expects to pay bonuses at target levels only if the secondary performance goal is fully met. For fiscal

2010, the Compensation Committee set the secondary performance goal as an earnings per share target of $1.24 (excluding store

impairments and other extraordinary non-recurring charges, and including any amounts payable to covered employees under the 2001

Incentive Bonus Plan). As further described in the Compensation Discussion and Analysis beginning on page 64, in the first quarter of

fiscal 2011, the Compensation Committee determined that the 2001 Incentive Bonus Plan’s primary and secondary performance goals

were achieved, but the Committee elected to apply negative discretion in determining the actual amount to be paid to the eligible

executive officers, other than with respect to the bonus awarded to Ms. Alber, our Chief Executive Officer and President, under the 2001

Incentive Bonus Plan.

(3) Maximum potential payment pursuant to our 2001 Incentive Bonus Plan is equal to three times the eligible executive’s base salary as of

February 1, 2010, the first day of fiscal 2010.

(4) Grants of restricted stock units.

(5) Grants of stock-settled stock appreciation rights.

(6) Represents an award to receive restricted stock units and cash units made on May 26, 2010, in exchange for consulting services provided

by Mr. Lester pursuant to the Retirement and Consulting Agreement entered into in connection with his retirement.

(7) Represents the grant date fair value of an award to receive restricted stock units and cash units made on May 26, 2010, in exchange for

consulting services provided by Mr. Lester pursuant to the Retirement and Consulting Agreement entered into in connection with his

retirement. Each unit of the award entitled Mr. Lester to receive one share of the company’s common stock and a cash payment equal to

the fair market value of one share of the company’s common stock on the applicable vesting date. The units vested in monthly

installments throughout the period over which Mr. Lester provided such consulting services. The Retirement and Consulting Agreement

provided for the cash to be paid and the shares underlying such award to be issued on December 31 of each year. Upon Mr. Lester’s

death in November 2010, a total of 20,835 restricted stock and cash units had vested, which entitled Mr. Lester’s estate to receive

(i) 20,835 shares, with a fair market value on the date prior to issuance of $751,518, and (ii) a cash payment equal to $592,839, which

represents the fair market value of each vested share on the applicable vesting date. The remainder of such award was automatically

forfeited upon Mr. Lester’s death. Please see the section titled “Employment Contracts and Termination of Employment and

Change-of-Control Arrangements” beginning on page 56 for further discussion about this award.

52