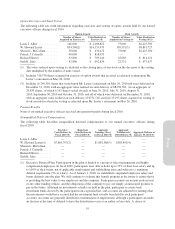

Pottery Barn 2010 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2010 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

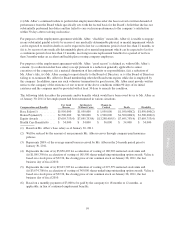

severance to be paid over 12 months, and (ii) if such termination occurs in 2010, an amount equal to 100% of the

annual bonus received in the last 12 months, if such termination occurs in 2011, an amount equal to 100% of the

average annual bonus received in the last 24 months, or if such termination occurs in 2012 or later, an amount

equal to 100% of the average annual bonus received in the last 36 months, with such severance to be paid over

12 months. If the executive’s employment is terminated for any reason, either prior to a change of control or

more than 18 months following the change of control, then the executive will be entitled to receive severance

benefits only as provided under the company’s then existing severance and benefits plans or pursuant to other

written agreements with the company.

Each executive’s receipt of the severance benefits discussed above is contingent on such executive signing and

not revoking a release of claims against us, such executive’s continued compliance with our Corporate Code of

Conduct (including its provisions relating to confidential information and non-solicitation), such executive not

accepting employment with one of our competitors, and such executive’s continued non-disparagement of us. In

the event that the severance payments and other benefits payable to an executive under a retention agreement

constitute a “parachute payment” under Section 280G of the U.S. tax code and would be subject to the applicable

excise tax, then the executive’s severance payments and other benefits will be either (i) delivered in full or

(ii) delivered to a lesser extent such that no portion of the benefits are subject to the excise tax, whichever results

in the receipt by such executive on an after-tax basis of the greatest amount of benefits.

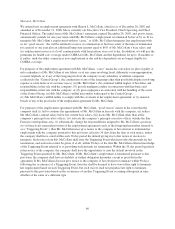

For purposes of the management retention agreement, cause means: (i) an act of dishonesty made by the

executive in connection with his or her responsibilities as an employee; (ii) the executive’s conviction of or plea

of nolo contendere to, a felony or any crime involving fraud, embezzlement or any other act of moral turpitude;

(iii) the executive’s gross misconduct; (iv) the executive’s unauthorized use or disclosure of any proprietary

information or trade secrets of the company or any other party to whom the executive owes an obligation of

nondisclosure as a result of the executive’s relationship with the company; (v) the executive’s willful breach of

any obligations under any written agreement or covenant with the company or breach of the company’s

Corporate Code of Conduct; or (vi) the executive’s continued failure to perform his or her employment duties

after he or she has received a written demand of performance which specifically sets forth the factual basis for

the belief that the executive has not substantially performed his or her duties and has failed to cure such

non-performance within 30 days after receiving such notice.

For purposes of the management retention agreement, change of control means the occurrence of any of the

following events: (i) a change in the ownership of the company which occurs on the date that any one person, or

more than one person acting as a group, (“Person”) acquires ownership of the stock of the company that, together

with the stock held by such Person, constitutes more than 50% of the total voting power of the stock of the

company; provided, however, that for purposes of this subsection (i), the acquisition of additional stock by any

one Person, who is considered to own more than 50% of the total voting power of the stock of the company will

not be considered a change of control; or (ii) a change in the effective control of the company which occurs on

the date that a majority of members of the Board of Directors is replaced during any 12-month period by

directors whose appointment or election is not endorsed by a majority of the members of the Board of Directors

prior to the date of the appointment or election; provided, however, that for purposes of this clause (ii), if any

Person is considered to effectively control the company, the acquisition of additional control of the company by

the same Person will not be considered a change of control; or (iii) a change in the ownership of a substantial

portion of the company’s assets which occurs on the date that any Person acquires (or has acquired during the

12-month period ending on the date of the most recent acquisition by such person or persons) assets from the

company that have a total gross fair market value equal to or more than 50% of the total gross fair market value

of all of the assets of the company immediately prior to such acquisition or acquisitions; provided, however, that

for purposes of this subsection (iii), the following will not constitute a change in the ownership of a substantial

portion of the company’s assets: (A) a transfer to an entity that is controlled by the company’s shareholders

immediately after the transfer, or (B) a transfer of assets by the company to: (1) a shareholder of the company

(immediately before the asset transfer) in exchange for or with respect to the company’s stock, (2) an entity, 50%

or more of the total value or voting power of which is owned, directly or indirectly, by the company, (3) a

57

Proxy