Pottery Barn 2010 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2010 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Dividend Equivalents

A participant generally will recognize ordinary income each time a dividend is paid pursuant to the dividend

equivalent in an amount equal to the fair market value of the dividend received. If the dividends are deferred,

additional requirements must be met to ensure that the dividend is taxable upon actual delivery of the shares,

instead of the grant of the dividend.

Deferred Stock Awards

A participant generally will not have taxable income upon the grant of a deferred stock award. Instead, a

participant generally will recognize ordinary income at the time of the receipt of the shares subject to the award

equal to the difference between the fair market value of the shares at the time of receipt and the amount, if any,

paid for the shares. However, an employee participant will be subject to employment taxes (FICA and, where

applicable, state disability insurance taxes) at the time a deferred stock award vests, even if the participant has

not yet received the shares subject to the award. We do not guarantee the federal or state income tax treatment of

the deferred amounts. If the Internal Revenue Service successfully asserts that the deferral was ineffective, the

recipient could be liable for taxes, interest and penalties. In addition, the recipient could be liable for additional

taxes, penalties and interest as a result of Section 409A and/or comparable state laws.

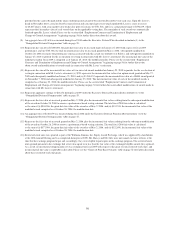

What are the tax effects to us as a result of grants of awards under the plan?

We generally will be entitled to a tax deduction in connection with an award under the plan in an amount equal to

the ordinary income realized by a participant at the time the participant recognizes such income, such as when a

participant exercises a nonqualified stock option. Special rules limit the deductibility of compensation paid to our

Chief Executive Officer and to each of our next three most highly compensated executive officers. Under

Section 162(m), the annual compensation paid to any of these specified executives will be deductible only to the

extent that it does not exceed $1,000,000. However, we can preserve the deductibility of certain compensation in

excess of $1,000,000 if the conditions of Section 162(m) are met. These conditions include: (i) shareholder

approval of the material terms of the plan; (ii) setting limits on the number of awards that any individual may

receive; and (iii) for awards other than certain stock options and stock appreciation rights, establishing

performance criteria that must be met before the award actually will vest or be paid. The plan has been designed

to permit the committee to grant awards that qualify as performance-based for purposes of satisfying the

conditions of Section 162(m), thereby permitting us to continue to receive a federal income tax deduction in

connection with such awards.

How can we amend or terminate the plan?

The Board generally may amend or terminate the plan at any time and for any reason. Amendments will be

contingent on shareholder approval if required by applicable law, stock exchange listing requirements or if so

determined by the Board. By its terms, the amended and restated plan will automatically terminate on March 8,

2021, unless its term is extended or it is earlier terminated by the Board. In addition, as mentioned above, the

committee may not reduce the exercise price of stock options or stock appreciation rights, nor may it allow

employees to cancel an existing award in exchange for a new award, cash, or a combination of the two, without

prior consent from our shareholders.

What specific benefits will be granted under the amended and restated plan?

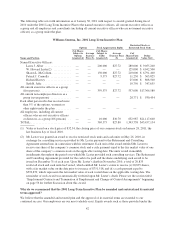

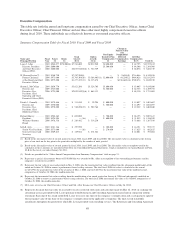

The amount and timing of awards granted under the plan are determined in the sole discretion of the committee

and therefore cannot be determined in advance. Except for the automatic grants to non-employee directors,

described above, the future awards that would be received under the plan by executive officers and other

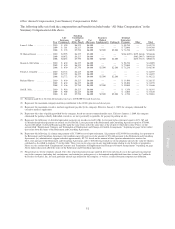

employees are discretionary and are therefore not determinable at this time. If the proposed amendment of the

plan had been in effect for our fiscal year ended January 30, 2011, we do not expect that the number of shares

granted to participants under the plan during that year would have been materially different than the number of

shares granted set forth in the table below. The only changes to the amended and restated plan that will be made

pursuant to this proposal include an increase to the shares issuable under the plan by 7,300,000 shares and to

extend the term of the plan to 2021. We also are asking shareholders to approve the material terms of the plan.

Specific benefits granted under the amended and restated plan will not change as a result of this proposal.

41

Proxy