Pottery Barn 2010 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2010 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252

|

|

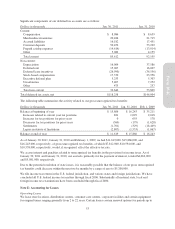

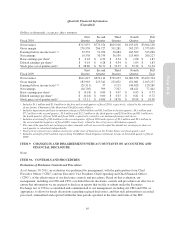

The fair value for both options and stock-settled stock appreciation rights is estimated on the date of the grant

using the Black-Scholes option pricing model with the following weighted-average assumptions:

•Expected term – The expected term of the option awards represents the period of time between the grant

date of the option awards and the date the option awards are either exercised or canceled, including an

estimate for those option awards still outstanding.

•Expected volatility – The expected volatility is based on an average of the historical volatility of our

stock price, for a period approximating our expected term, and the implied volatility of externally traded

options of our stock that were entered into during the period.

•Risk-free interest rate – The risk-free interest rate is based on the U.S. Treasury yield curve in effect at

the time of grant and with a maturity that approximates our expected term.

•Dividend yield – The dividend yield is based on our quarterly cash dividend and the anticipated dividend

payout over our expected term of the option awards.

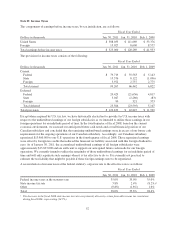

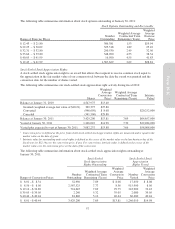

The weighted average assumptions used for fiscal 2010, fiscal 2009 and fiscal 2008 are as follows:

Fiscal Year Ended

Jan. 30, 2011 Jan. 31, 2010 Feb. 1, 2009

Expected term (years) 5.1 5.1 5.2

Expected volatility 47.3% 56.0% 49.4%

Risk-free interest rate 2.6% 2.4% 2.5%

Dividend yield 2.2% 2.3% 2.7%

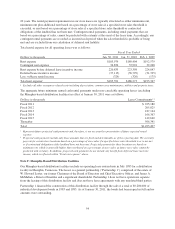

Restricted Stock Units

The following table summarizes our restricted stock unit activity during fiscal 2010:

Shares

Weighted Average

Grant Date

Fair Value

Intrinsic

Value1

Balance at January 31, 2010 1,887,160 $17.11

Granted 1,343,758 $28.13

Released (1,003,144) $29.52 $32,109,000

Canceled (176,876)

Balance at January 30, 2011 2,050,898 $23.44 $66,326,000

Vested plus expected to vest at January 30, 2011 1,654,959 $22.83 $53,521,000

1Intrinsic value for outstanding and unvested restricted stock units is defined as the market value on the last business day of

the fiscal year (or $32.34). For released restricted stock units, the intrinsic value is defined as the market value on the date

of release.

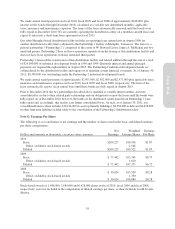

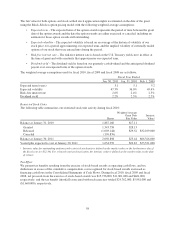

Tax Effect

We present tax benefits resulting from the exercise of stock-based awards as operating cash flows, and tax

deductions in excess of the cumulative compensation cost recognized for stock-based awards exercised as

financing cash flows in the Consolidated Statements of Cash Flows. During fiscal 2010, fiscal 2009 and fiscal

2008, net proceeds from the exercise of stock-based awards was $15,736,000, $11,861,000 and $461,000,

respectively, and the tax benefit (shortfall) associated with such exercises totaled $24,762,000, $5,981,000 and

($1,660,000), respectively.

58