Pottery Barn 2010 Annual Report Download - page 170

Download and view the complete annual report

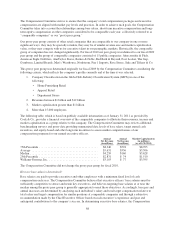

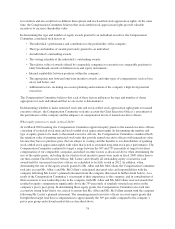

Please find page 170 of the 2010 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.for retention and also result in less dilution than options and stock-settled stock appreciation rights. At the same

time, the Compensation Committee believes that stock-settled stock appreciation rights provide valuable

incentives to increase shareholder value.

In determining the type and number of equity awards granted to an individual executive, the Compensation

Committee considered such factors as:

• The individual’s performance and contribution to the profitability of the company;

• The type and number of awards previously granted to an individual;

• An individual’s outstanding awards;

• The vesting schedule of the individual’s outstanding awards;

• The relative value of awards offered by comparable companies to executives in comparable positions to

fairly benchmark awards of different sizes and equity instruments;

• Internal equitability between positions within the company;

• The appropriate mix between long-term incentive awards, and other types of compensation, such as base

salary and bonus; and

• Additional factors, including succession planning and retention of the company’s high-level potential

executives.

The Compensation Committee believes that each of these factors influences the type and number of shares

appropriate for each individual and that no one factor is determinative.

In determining whether to make restricted stock unit and stock-settled stock appreciation right grants for named

executive officers, the Compensation Committee took into account the Chief Executive Officer’s assessment of

the performance of the company and the adequacy of compensation levels of named executive officers.

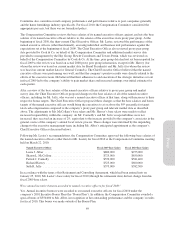

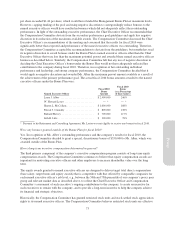

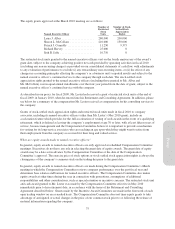

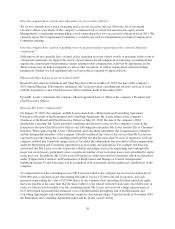

What equity grants were made in fiscal 2010?

At its March 2010 meeting, the Compensation Committee approved equity grants to the named executive officers

consisting of restricted stock units and stock-settled stock appreciation rights. In determining the number and

type of equity grants to be made to the named executive officers, the Compensation Committee considered both

the retention value of granting restricted stock units that provide named executive officers with immediate value

because they have no purchase price (but are subject to vesting) and the benefits to our shareholders of granting

stock-settled stock appreciation rights with value that is tied to sustained long-term stock price performance. The

Compensation Committee continued to target a range between the 50th and 75th percentile of target total direct

compensation of our comparable companies and relied on other factors as discussed above when determining the

size of the equity grants, including the fact that no focal incentive grants were made in fiscal 2009 (other than to

our then-current Chief Executive Officer, Mr. Lester) and virtually all outstanding equity or incentive cash

awards held by our named executive officers are scheduled to be fully vested in 2012. In addition, when

determining the size of the equity awards granted to Ms. Alber and Ms. McCollam, the Compensation Committee

took into account Ms. Alber’s and Ms. McCollam’s anticipated increased roles and responsibilities with the

company following Mr. Lester’s planned retirement from the company (discussed in further detail below). As a

result of the Compensation Committee’s assessment of their importance to the company, and in consideration of

their ascension to new leadership roles in the company, both Ms. Alber and Ms. McCollam received awards that

resulted in equity compensation significantly above the 75th percentile of similarly situated executives in the

company’s proxy peer group. In determining these equity grants, the Compensation Committee also took into

account its strong belief that it was critical to ensure that Ms. Alber and Ms. McCollam remain with the company

following Mr. Lester’s planned retirement. The remaining named executive officers received equity grants that

brought their target total direct compensation to approximately the 50th percentile compared to the company’s

proxy peer group and relevant market data as described above.

74