Pottery Barn 2010 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2010 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

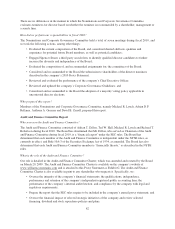

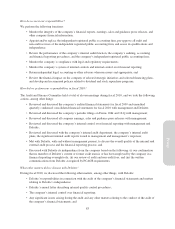

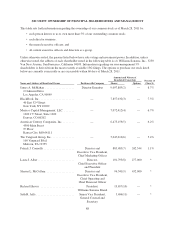

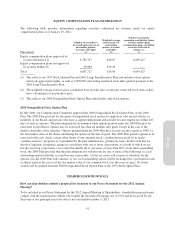

Name and Address of Beneficial Owner Position with Company

Amount and Nature of

Beneficial Ownership Percent of

Class(1)Shares Options

Adrian D.P. Bellamy ......................... Director 98,512 78,750 *

Adrian T. Dillon ............................. Director 35,733 36,750 *

Anthony A. Greener .......................... Director 24,917 6,750 *

Ted W. Hall ................................ Director 10,005 6,750 *

Michael R. Lynch ........................... Director 10,808 103,750 *

Richard T. Robertson ......................... Director — 66,591 *

David B. Zenoff ............................. Director 11,000 32,250 *

All current executive officers and directors as a

group (12 persons) ......................... — 1,297,857(12) 1,282,935 2.4%

* Less than 1%.

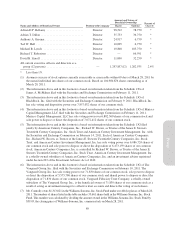

(1) Assumes exercise of stock options currently exercisable or exercisable within 60 days of March 28, 2011 by

the named individual into shares of our common stock. Based on 104,980,876 shares outstanding as of

March 28, 2011.

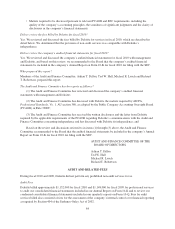

(2) The information above and in this footnote is based on information taken from the Schedule 13G of

James A. McMahan filed with the Securities and Exchange Commission on February 11, 2011.

(3) The information above and in this footnote is based on information taken from the Schedule 13G of

BlackRock, Inc. filed with the Securities and Exchange Commission on February 9, 2011. BlackRock, Inc.

has sole voting and dispositive power over 7,857,032 shares of our common stock.

(4) The information above and in this footnote is based on information taken from the Schedule 13G of Marisco

Capital Management, LLC filed with the Securities and Exchange Commission on February 11, 2011.

Marisco Capital Management, LLC has sole voting power over 6,882,360 shares of our common stock and

sole power to dispose or direct the disposition of 7,072,412 shares of our common stock.

(5) The information above and in this footnote is based on information taken from the Schedule 13G filed

jointly by American Century Companies, Inc., Richard W. Brown, as Trustee of the James E. Stowers

Twentieth Century Companies, Inc. Stock Trust and American Century Investment Management, Inc. with

the Securities and Exchange Commission on February 14, 2011. Each of American Century Companies,

Inc., Richard W. Brown, as Trustee of the James E. Stowers Twentieth Century Companies, Inc. Stock

Trust, and American Century Investment Management, Inc. has sole voting power over 6,086,724 shares of

our common stock and sole power to dispose or direct the disposition of 6,473,159 shares of our common

stock. American Century Companies, Inc. is controlled by Richard W. Brown, as Trustee of the James E.

Stowers Twentieth Century Companies, Inc. Stock Trust. American Century Investment Management, Inc.

is a wholly-owned subsidiary of American Century Companies, Inc. and an investment advisor registered

under Section 203 of the Investment Advisors Act of 1940.

(6) The information above and in this footnote is based on information taken from the Schedule 13G of The

Vanguard Group, Inc. filed with the Securities and Exchange Commission on February 10, 2011. The

Vanguard Group, Inc. has sole voting power over 71,830 shares of our common stock, sole power to dispose

or direct the disposition of 5,575,786 shares of our common stock and shared power to dispose or direct the

disposition of 71,830 shares of our common stock. Vanguard Fiduciary Trust Company, a wholly-owned

subsidiary of The Vanguard Group, Inc., is the beneficial owner of 71,830 shares of our common stock as a

result of acting as investment manager to collective trust accounts and directs the voting of such shares.

(7) Mr. Connolly owns $1,313,821 in the Williams-Sonoma, Inc. Stock Fund under our 401(k) plan as of March 28,

2011. The number of shares listed in the table includes 33,661 shares held in the Williams-Sonoma, Inc. Stock

Fund. This number was calculated by dividing the amount owned in the Williams-Sonoma, Inc. Stock Fund by

$39.03, the closing price of Williams-Sonoma, Inc. common stock on March 28, 2011.

89

Proxy