Pottery Barn 2010 Annual Report Download - page 130

Download and view the complete annual report

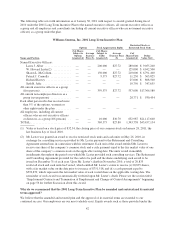

Please find page 130 of the 2010 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.reserved shares were subject to outstanding awards and 3,905,007 of these reserved shares remained available for

future grant. The 1993 Stock Option Plan and the 2000 Nonqualified Stock Option Plan are no longer used to

grant awards. On March 28, 2011, the closing price of a share of our common stock on the New York Stock

Exchange was $39.03.

Has our Board approved the amended and restated plan?

Yes. On March 8, 2011, our Board approved the amended and restated plan, subject to approval from our

shareholders at the 2011 Annual Meeting. Our named executive officers and directors have an interest in this

proposal because they are eligible to receive plan awards.

SUMMARY OF THE AMENDED AND RESTATED PLAN

The following questions and answers provide a summary of the principal features of the amended and restated

plan and its operation. This summary is qualified in its entirety by the Amended and Restated 2001 Long-Term

Incentive Plan attached as Exhibit D.

What types of awards are available under the plan?

We may grant the following types of incentive awards under the plan: (i) stock options; (ii) restricted stock;

(iii) restricted stock units; (iv) stock appreciation rights that are settled in shares; (v) dividend equivalents; and

(vi) deferred stock awards.

Who administers the plan?

A committee of at least two non-employee members of our Board administers the plan (the “committee”). To the

extent the company wishes to qualify grants as exempt from Rule 16b-3 of the Securities Exchange Act, as

amended, the members of the committee must qualify as “non-employee directors” under Rule 16b-3 of the

Securities Exchange Act of 1934, as amended. Further, to make grants to our officers or directors, the members

of the committee must qualify as “independent directors” under the applicable requirements and criteria of the

New York Stock Exchange. Members of the committee must also qualify as “outside directors” under

Section 162(m) to the extent the company wishes to receive a federal tax deduction for certain compensation paid

under the plan to our Chief Executive Officer and the next three highest paid employees. The committee has

delegated its authority under the plan to two members of the Board, but only with respect to grants to certain of

our employees who are not “officers” for purposes of Section 16 of the Securities Exchange Act of 1934, as

amended.

What are the powers of the committee?

Subject to the terms of the plan, the committee has the sole discretion to: (i) select the employees and

non-employee directors who will receive awards; (ii) determine the terms and conditions of awards such as the

exercise price and vesting schedule (see below for certain limitations); and (iii) interpret the provisions of the

plan and outstanding awards. The committee may not reduce the exercise price of stock options or stock

appreciation rights, nor may it allow employees to cancel an existing stock option or stock appreciation right in

exchange for a new award, cash, or a combination of the two, without prior consent from our shareholders.

Who is eligible to receive awards?

The committee selects the employees and non-employee directors who will be granted awards under the plan

(our non-employee directors receive awards under the plan as compensation for Board service). The actual

number of employees and non-employee directors who will receive an award under the plan cannot be

determined in advance because the committee has the discretion to select the participants. As of March 28, 2011,

approximately 21,000 employees and seven non-employee directors were eligible to participate in the plan.

However, of our employees, our current policy is to grant equity awards generally to employees at the level of

director or above, as well as certain other company buyers; as of March 28, 2011, there were 462 such

employees.

34