Pottery Barn 2010 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2010 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

We have in place policies in our Corporate Code of Conduct that provide that associates must not engage in any

transaction when an associate may face a real or perceived conflict of interest with the company. Our Corporate

Code of Conduct is distributed to all employees on an annual basis and made available throughout the year in our

internal document database. It is also available on our website and in print to any shareholder who requests it. In

addition, we have in place policies and procedures with respect to related person transactions that provide that

our executive officers, directors, director nominees and principal shareholders, as well as their immediate family

members and affiliates, are not permitted to enter into a related party transaction with us unless (i) the transaction

is approved or ratified by our Audit and Finance Committee or the disinterested members of our Board or (ii) the

transaction involves the service of one of our executive officers or directors or any related compensation, is

reportable under Item 402 of Regulation S-K and is approved by our Compensation Committee.

For the purposes of our related party transaction policy, “related party transaction” means any transaction in

which the amount involved exceeds $120,000 in any calendar year and in which any of our executive officers,

directors, director nominees and principal shareholders, as well as their immediate family members and affiliates,

had, has or will have a direct or indirect material interest, other than transactions available to all of our

employees.

It is our policy to approve related party transactions only when it has been determined that such transaction is in,

or is not inconsistent with, our best interests and those of our shareholders, including situations where we may

obtain products or services of a nature, quantity or quality, or on other terms, that are not readily available from

alternative sources or when the transaction is on terms comparable to those that could be obtained in arm’s length

dealings with an unrelated third party.

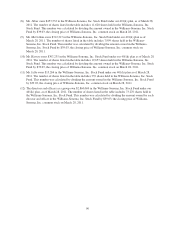

Memphis-Based Distribution Facilities

Our Memphis-based distribution facilities include an operating lease entered into in July 1983 for a distribution

facility in Memphis, Tennessee. The lessor is a general partnership (“Partnership 1”) comprised of the estate of

W. Howard Lester, our former Chairman of the Board of Directors and Chief Executive Officer, and James A.

McMahan, a Director Emeritus and a significant shareholder. Partnership 1 does not have operations separate

from the leasing of this distribution facility and does not have lease agreements with any unrelated third parties.

Partnership 1 financed the construction of this distribution facility through the sale of a total of $9,200,000 of

industrial development bonds in 1983 and 1985. As of January 30, 2011, the bonds had been repaid in full and no

amounts were outstanding.

We made annual rental payments in fiscal 2010, fiscal 2009 and fiscal 2008 of approximately $618,000, plus

interest on the bonds (through December 2010) calculated at a variable rate determined monthly, applicable

taxes, insurance and maintenance expenses. The terms of the lease automatically renewed until the bonds were

fully repaid in December 2010. We are currently operating the distribution center on a month-to-month lease and

expect to enter into a short term lease agreement on the distribution center in fiscal 2011.

Our other Memphis-based distribution facility includes an operating lease entered into in August 1990 for

another distribution facility that is adjoined to the Partnership 1 facility in Memphis, Tennessee. The lessor is a

general partnership (“Partnership 2”) comprised of the estate of W. Howard Lester, James A. McMahan and two

unrelated parties. Partnership 2 does not have operations separate from the leasing of this distribution facility and

does not have lease agreements with any unrelated third parties.

Partnership 2 financed the construction of this distribution facility and related addition through the sale of a total

of $24,000,000 of industrial development bonds in 1990 and 1994. Quarterly interest and annual principal

payments are required through maturity in August 2015. The Partnership 2 industrial development bonds are

86