Pottery Barn 2010 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2010 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

This summary is for general information only and does not address all aspects of U.S. federal income taxation

that may be important to a particular holder in light of its investment or tax circumstances or to holders subject to

special tax rules, such as partnerships, subchapter S corporations or other pass-through entities, banks, financial

institutions, tax-exempt entities, insurance companies, regulated investment companies, real estate investment

trusts, trusts and estates, dealers in stocks, securities or currencies, traders in securities that have elected to use

the mark-to-market method of accounting for their securities, persons holding our common stock as part of an

integrated transaction, including a “straddle,” “hedge,” “constructive sale,” or “conversion transaction,” persons

whose functional currency for tax purposes is not the U.S. dollar and persons subject to the alternative minimum

tax provisions of the Code. This summary does not include any description of the tax laws of any state or local

governments, or of any foreign government, that may be applicable to a particular holder.

This summary is directed solely to holders that hold our common stock as capital assets within the meaning of

Section 1221 of the Code, which generally means as property held for investment. In addition, the following

discussion only addresses “U.S. persons” for U.S. federal income tax purposes, generally defined as beneficial

owners of our common stock who are:

• individuals who are citizens or residents of the United States;

• corporations (including an entity treated as a corporation for U.S. federal income tax purposes) created or

organized in or under the laws of the United States or of any state of the United States or the District of

Columbia;

• estates the income of which is subject to U.S. federal income taxation regardless of its source;

• trusts if a court within the United States is able to exercise primary supervision over the administration of

any such trust and one or more U.S. persons have the authority to control all substantial decisions of such

trust; or

• trusts in existence on August 20, 1996 that have valid elections in effect under applicable Treasury

regulations to be treated as U.S. persons.

If an entity or arrangement treated as a partnership for U.S. federal income tax purposes holds our common

stock, the U.S. federal income tax treatment of a partner generally will depend on the status of the partner and the

activities of the partnership. A partner of a partnership holding our common stock should consult its own tax

advisor regarding the U.S. federal income tax consequences to the partner of the Reincorporation.

This summary is not a comprehensive description of all of the U.S. federal tax consequences that may be

relevant to holders. We urge you to consult your own tax advisor regarding your particular circumstances

and the U.S. federal income and estate tax consequences to you of the Reincorporation, as well as any tax

consequences arising under the laws of any state, local, foreign or other tax jurisdiction and the possible

effects of changes in U.S. federal or other tax laws.

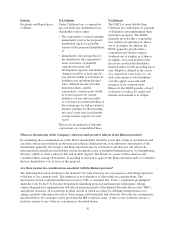

We have not requested a ruling from the IRS or an opinion of counsel regarding the U.S. federal income tax

consequences of the Reincorporation. However, we believe:

• the Reincorporation will constitute a tax-free reorganization under Section 368(a) of the Code;

• no gain or loss will be recognized by holders of W-S California common stock on receipt of W-S

Delaware common stock pursuant to the Reincorporation;

• the aggregate tax basis of the W-S Delaware common stock received by each holder will equal the

aggregate tax basis of the W-S California common stock surrendered by such holder in exchange therefor;

and

• the holding period of the W-S Delaware common stock received by each holder will include the period

during which such holder held the W-S California common stock surrendered in exchange therefor.

31

Proxy