Pottery Barn 2010 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2010 Pottery Barn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

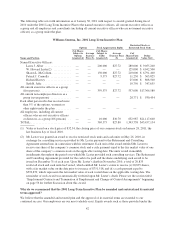

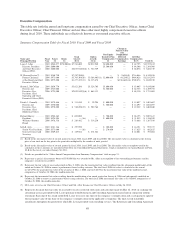

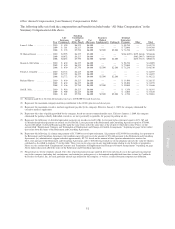

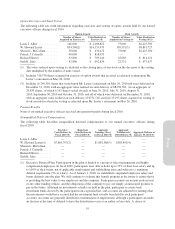

Executive Compensation

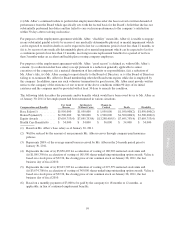

This table sets forth the annual and long-term compensation earned by our Chief Executive Officer, former Chief

Executive Officer, Chief Financial Officer and our three other most highly compensated executive officers

during fiscal 2010. These individuals are collectively known as our named executive officers.

Summary Compensation Table for Fiscal 2010, Fiscal 2009 and Fiscal 2008

Name and

Principal Position

Fiscal

Year

Salary

($)

Bonus

($)

Stock

Awards

($)(1)

Option

Awards

($)(2)

Non-Equity

Incentive Plan

Compensation

($)

Change in

Pension Value

and

Nonqualified

Deferred

Compensation

Earnings

All Other

Compensation

($)(3) Total ($)

Laura J. Alber .......... 2010 $948,077 $350,000(4) $7,761,600 $2,032,940 $2,400,000 — $ 62,795 $13,555,412

Director, President

and Chief Executive

Officer (PEO)

2009 $800,000 — — — $1,500,000 — $ 84,506 $ 2,384,506

2008 $800,000 — $2,053,942(5)(6) $ 722,729 — — $ 88,078 $ 3,664,749

W. Howard Lester(7) .... 2010 $348,750 — $7,287,500(8) — — $ (3,638)(9) $716,846 $ 8,349,458

Former Chairman

of the Board and Chief

Executive Officer

2009 $975,000 — $5,705,308(10) $3,584,403(11) $2,000,000 $ 84,256(12) $484,026 $12,832,993

2008 $975,000 — $1,277,227(13) $1,335,478 — $(238,669)(14) $700,874 $ 4,049,910

Sharon L. McCollam .... 2010 $830,770 — $5,821,200 $1,524,705 $1,600,000 — $ 63,005 $ 9,839,680

Director and

Executive Vice

President, Chief

Operating and Chief

Financial Officer (PFO)

2009 $725,000 — — — $1,500,000 — $ 84,755 $ 2,309,755

2008 $725,000 — $2,053,942(5)(6) $ 864,133 — — $ 88,330 $ 3,731,405

Patrick J. Connolly ...... 2010 $579,646 — $ 311,850 $ 95,294 $ 800,000 — $ 14,897 $ 1,801,687

Director and

Executive Vice

President, Chief

Marketing Officer

2009 $570,000 — — — $ 500,000 — $ 14,897 $ 1,084,897

2008 $570,000 — $ 510,890(15) $ 502,768 — — $ 19,222 $ 1,602,880

Richard Harvey ........ 2010 $588,462 — $ 693,000 — $ 700,000 — $ 26,155 $ 2,007,617

President,

Williams-Sonoma

Brand

2009 $524,994 — — (16) — $ 600,000 — $ 31,955 $ 1,156,949

2008 $476,538 — $ 283,482 $ 314,230 — — $ 33,686 $ 1,107,936

Seth R. Jaffe ........... 2010 $381,346 — $ 297,990 — $ 300,000 — $ 16,391 $ 995,727

Senior Vice President,

General Counsel and

Secretary

2009 $375,000 — — (16) — $ 270,000 — $ 17,825 $ 662,825

2008 $369,615 — $ 149,984 $ 251,384 — — $ 22,081 $ 793,064

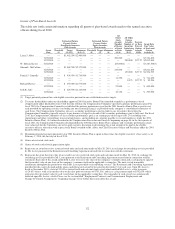

(1) Based on the fair market value of awards granted in fiscal 2010, fiscal 2009, and fiscal 2008. The fair market value is calculated as the closing

price of our stock on the day prior to the grant date multiplied by the number of units granted.

(2) Based on the fair market value of awards granted in fiscal 2010, fiscal 2009, and fiscal 2008. The fair market value assumptions used in the

calculation of these amounts are included in Note H to our Consolidated Financial Statements, which is included in our Annual Report on Form

10-K for the fiscal year ended January 30, 2011.

(3) Details are provided in the “Other Annual Compensation from Summary Compensation” table on page 51.

(4) Represents a special, discretionary bonus of $350,000 that was awarded to Ms. Alber in recognition of her outstanding performance and the

company’s results for fiscal 2010.

(5) Represents the fair value of an award granted on May 2, 2008, plus the incremental fair value resulting from the subsequent modification of the

award on October 28, 2008 to remove a performance-based vesting criterion. The total fiscal 2008 fair value is calculated as the sum of

(i) $471,996, the grant date fair value of the award as of May 2, 2008, and (ii) $165,946, the incremental fair value of the modified award,

computed as of October 28, 2008, the modification date.

(6) Represents the incremental fair value resulting from the modification of an award granted on January 6, 2006 and subsequently modified on

October 28, 2008 to remove a performance-based vesting criterion. The total fiscal 2008 incremental fair value is $1,416,000, computed as of

October 28, 2008, the modification date.

(7) Mr. Lester served as our Chief Executive Officer until Ms. Alber became our Chief Executive Officer on May 26, 2010.

(8) Represents the grant date fair value of an award to receive restricted stock units and cash units made on May 26, 2010, in exchange for

consulting services provided by Mr. Lester pursuant to the Retirement and Consulting Agreement entered into in connection with his

retirement. Each unit of the award entitled Mr. Lester to receive one share of the company’s common stock and a cash payment equal to

the fair market value of one share of the company’s common stock on the applicable vesting date. The units vested in monthly

installments throughout the period over which Mr. Lester provided such consulting services. The Retirement and Consulting Agreement

49

Proxy