Pitney Bowes 2012 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2012 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

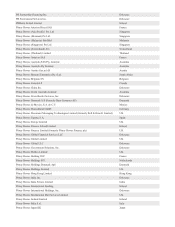

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

80

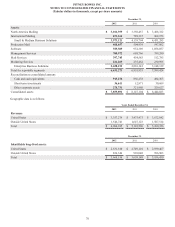

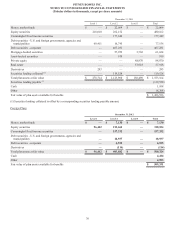

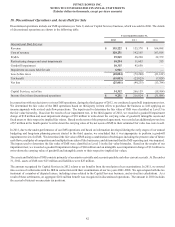

Pretax amounts recognized in AOCI consist of:

2012 2011

Net actuarial loss $ 106,654 $ 115,713

Prior service cost (credit) 8,872 (5,696)

Total $ 115,526 $ 110,017

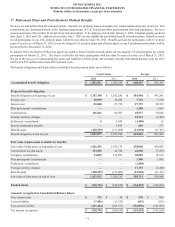

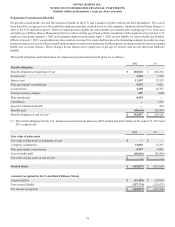

The components of net periodic benefit cost for nonpension postretirement benefit plans were as follows:

2012 2011 2010

Service cost $ 3,563 $ 3,328 $ 3,724

Interest cost 11,187 13,528 13,828

Amortization of prior service benefit (1,724)(2,504) (2,511)

Recognized net actuarial loss 8,214 7,666 6,793

Curtailment —2,839 6,954

Special termination benefits —300 191

Net periodic benefit cost $ 21,240 $ 25,157 $ 28,979

Other changes in plan assets and benefit obligation for nonpension postretirement benefit plans recognized in other comprehensive income

were as follows:

2012 2011

Net actuarial (gain) loss $(195)$ 22,201

Amortization of net actuarial gain (loss) 4,631 (9,980)

Amortization of prior service credit 1,724 2,504

Adjustment for actual Medicare Part D Premium (651)(2,040)

Curtailment —308

Total recognized in other comprehensive income $ 5,509 $ 12,993

The estimated amounts that will be amortized from AOCI into net periodic benefit cost in 2013 are as follows:

Net actuarial loss $ 8,961

Prior service 661

Total $ 9,622

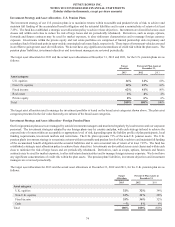

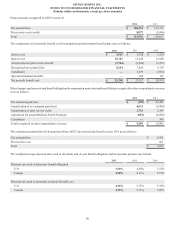

The weighted-average discount rates used to determine end of year benefit obligation and net periodic pension cost include:

2012 2011 2010

Discount rate used to determine benefit obligation

U.S. 3.50% 4.50% 5.15%

Canada 3.90% 4.15% 5.15%

Discount rate used to determine net period benefit cost

U.S. 4.50% 5.15% 5.35%

Canada 4.15% 5.15% 5.85%

cost