Pitney Bowes 2012 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2012 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

53

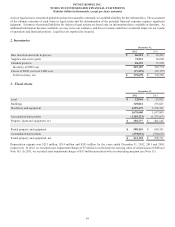

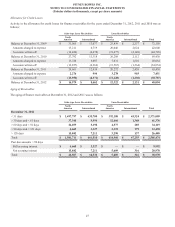

Annual maturities of outstanding debt at December 31, 2012 are as follows:

2013 $ 375,000

2014 450,000

2015 450,000

2016 680,000

2017 500,000

Thereafter 1,510,000

Total $ 3,965,000

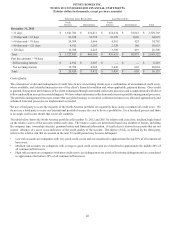

8. Income Taxes

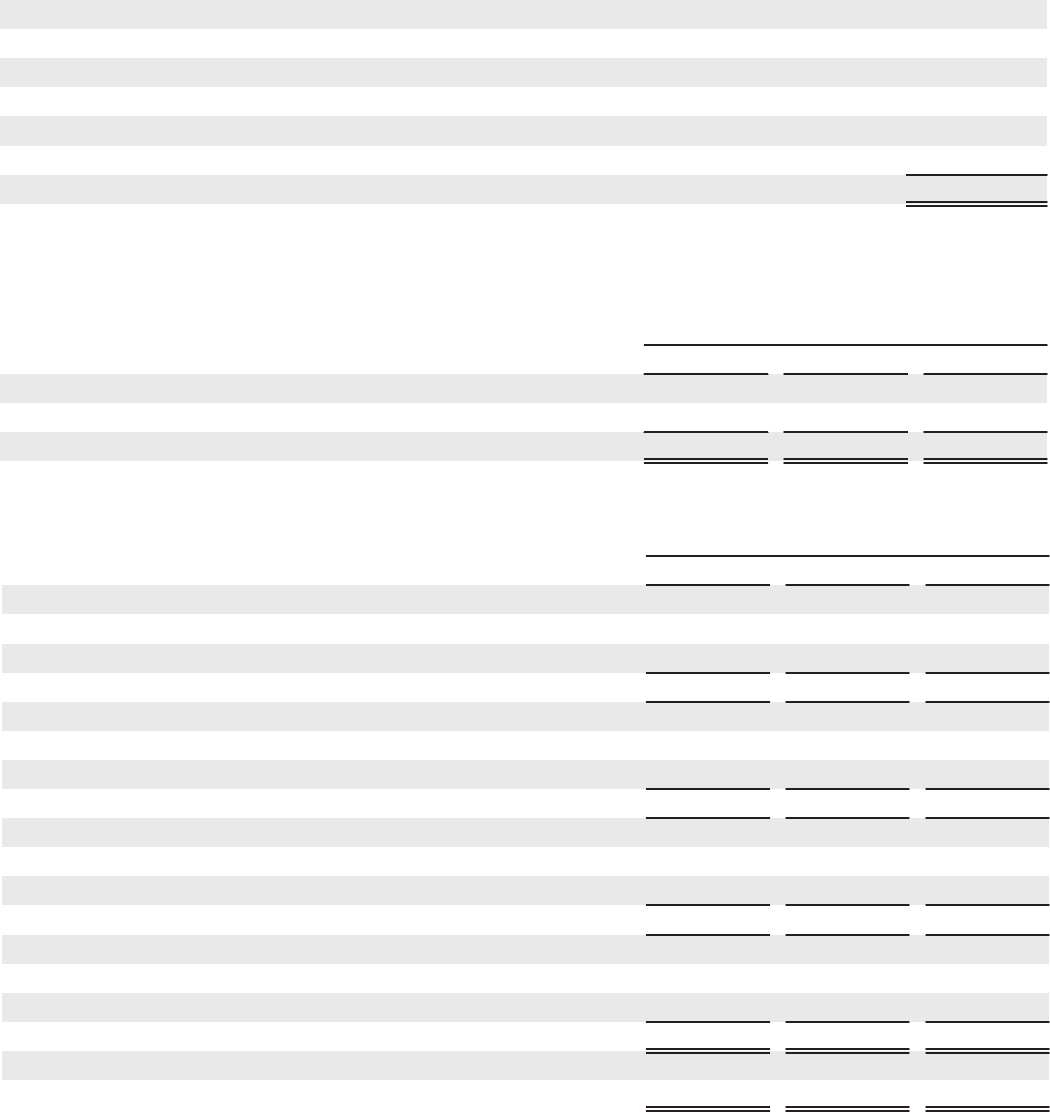

Income from continuing operations before taxes consisted of the following:

Years Ended December 31,

2012 2011 2010

U.S. $ 458,456 $ 463,814 $ 407,060

International 146,157 22,727 149,129

Total $ 604,613 $ 486,541 $ 556,189

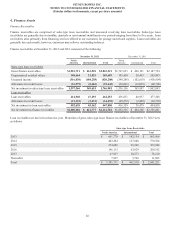

The provision for income taxes from continuing operations consisted of the following:

Years Ended December 31,

2012 2011 2010

U.S. Federal:

Current $ 174,705 $(68,505) $ 175,827

Deferred 16,136 135,305 (24,632)

190,841 66,800 151,195

U.S. State and Local:

Current 3,187 33,922 27,169

Deferred (26,273) (15,546) (17,518)

(23,086) 18,376 9,651

International:

Current 65,412 67,835 44,989

Deferred (82,862) (85,401) 7,763

(17,450) (17,566) 52,752

Total current 243,304 33,252 247,985

Total deferred (92,999) 34,358 (34,387)

Total provision for income taxes $ 150,305 $ 67,610 $ 213,598

Effective tax rate 24.9% 13.9% 38.4%

The effective tax rate for 2012 includes tax benefits of $32 million from the sale of non-U.S. leveraged lease assets, $47 million of tax

benefits from the resolution of U.S. tax examinations and tax accruals of $43 million for the repatriation of additional non-U.S. earnings

that arose as a result of one-time events including the sale of leveraged lease assets and Canadian tax law changes.