Pitney Bowes 2012 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2012 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.23

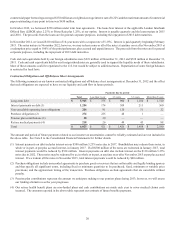

reserve is appropriate. Future changes in tax reserve requirements could have a material impact on our financial condition or results of

operations.

Significant judgment is also required in determining the amount of valuation allowance to be recorded against deferred tax assets. In

assessing whether a valuation allowance is necessary, and the amount of such allowance, we consider all available evidence for each

jurisdiction including past operating results, estimates of future taxable income and the feasibility of ongoing tax planning strategies. As

new information becomes available that would alter our determination as to the amount of deferred tax assets that will ultimately be

realized, we adjust the valuation allowance with a corresponding impact to income tax expense in the period in which such determination

is made.

Useful lives of long-lived assets

We depreciate property, plant and equipment and rental property and equipment principally using the straight-line method over the

estimated useful lives of up to 50 years for buildings, three to 15 years for machinery and equipment, four to six years for rental equipment

and three to five years for computer equipment. Leasehold improvements are amortized over the shorter of the estimated useful life or

the remaining lease term. We amortize capitalized costs related to internally developed software using the straight-line method over the

estimated useful life, which is principally three to 10 years. Intangible assets with finite lives are amortized using the straight-line method

or an accelerated attrition method over their estimated useful lives, which are principally three to 15 years. Our estimates of useful lives

could be affected by changes in regulatory provisions, technology or business plans and changes to the assets' estimated useful lives could

have a material impact on our results of operations.

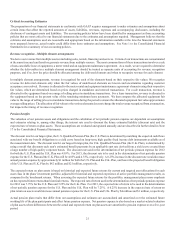

Impairment review

Long-lived and intangible assets are reviewed for impairment on an annual basis or whenever events or changes in circumstances indicate

that the carrying amount may not be fully recoverable. The related estimated future undiscounted cash flows expected to result from the

use and eventual disposition of the asset is compared to the asset's carrying amount. We derive the cash flow estimates from our future

long-term business plans and historical experience. If the sum of the expected cash flows is less than the carrying amount, an impairment

charge is recorded for an amount by which the carrying amount exceeds the fair value of the asset. The fair value of the asset is determined

using probability weighted expected discounted cash flow estimates, quoted market prices when available and appraisals, as appropriate.

Changes in the estimates and assumptions incorporated in our impairment assessment could materially affect the determination of fair

value and the associated impairment charge.

Goodwill is tested annually for impairment, during the fourth quarter, or sooner when circumstances indicate an impairment may exist

at the reporting unit level. The impairment test for goodwill is a two-step approach. In the first step, the fair value of each reporting unit

is compared to the reporting unit's carrying value, including goodwill. If the fair value of a reporting unit is less than its carrying value,

the second step of the goodwill impairment test is performed to measure the amount of impairment, if any. In the second step, the fair

value of the reporting unit is allocated to the assets and liabilities of the reporting unit as if it had been acquired in a business combination

and the purchase price was equivalent to the fair value of the reporting unit. The excess of the fair value of the reporting unit over the

amounts assigned to its assets and liabilities is referred to as the implied fair value of goodwill. The implied fair value of the reporting

unit's goodwill is then compared to the actual carrying value of goodwill. If the implied fair value of goodwill is less than the carrying

value of goodwill, an impairment loss is recognized for the difference.

Significant estimates and assumptions are used in our goodwill impairment review and include the identification of reporting units,

assigning assets and liabilities to reporting units, assigning goodwill to reporting units and determining the fair value of each reporting

unit. The fair value of each reporting unit is determined based on a combination of techniques, including the present value of future cash

flows, applicable multiples of competitors and multiples from sales of like businesses, and requires us to make estimates and assumptions

regarding discount rates, growth rates and our future long-term business plans. Changes in any of these estimates or assumptions could

materially affect the determination of fair value and the associated goodwill impairment charge for each reporting unit.

During the third quarter of 2012, as a result of the continuing under-performance of our IMS operations, and to enable us to better focus

on higher growth cross-border ecommerce parcel opportunities, we began exploring strategic alternatives to exit the IMS operations

related to the international delivery of mail and catalogs and concluded it was appropriate to conduct a goodwill impairment review. We

determined the fair value of IMS based on negotiations with potential buyers and preliminary indications of interests and written offers

received for the IMS business, as well applying an income approach with revised cash flow projections. The inputs used to determine

the fair value of the IMS operations were classified as Level 3 in the fair value hierarchy. Based on our review, we recorded a goodwill

impairment charge of $18 million and additional impairment charges of $10 million to write-down the carrying values of certain intangible

and fixed assets associated with the IMS business to their respective fair values. At December 31, 2012, the assets and liabilities of IMS

were classified as held-for-sale and all historical amounts related to the IMS operations, including the above mentioned goodwill, intangible

asset and fixed asset impairment charges, were included in discontinued operations.