Pitney Bowes 2012 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2012 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

45

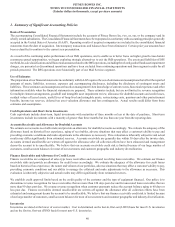

claim or legal action is considered probable and can be reasonably estimated, we establish a liability for the estimated loss. The assessment

of the ultimate outcome of each claim or legal action and the determination of the potential financial exposure requires significant

judgment. Estimates of potential liabilities for claims or legal actions are based only on information that is available at that time. As

additional information becomes available, we may revise our estimates, and these revisions could have a material impact on our results

of operations and financial position. Legal fees are expensed as incurred.

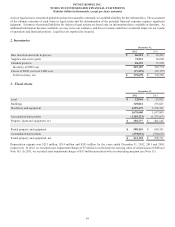

2. Inventories

December 31,

2012 2011

Raw materials and work in process $ 66,221 $ 63,216

Supplies and service parts 72,551 68,600

Finished products 68,335 71,958

Inventory at FIFO cost 207,107 203,774

Excess of FIFO cost over LIFO cost (27,429)(25,175)

Total inventory, net $ 179,678 $ 178,599

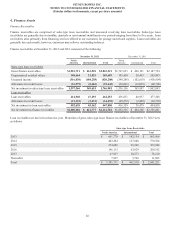

3. Fixed Assets

December 31,

2012 2011

Land $ 22,064 $ 23,852

Buildings 349,061 335,625

Machinery and equipment 1,299,475 1,278,332

1,670,600 1,637,809

Accumulated depreciation (1,285,223)(1,233,663)

Property, plant and equipment, net $ 385,377 $ 404,146

Rental property and equipment $ 580,243 $ 649,343

Accumulated depreciation (339,051)(390,632)

Rental property and equipment, net $ 241,192 $ 258,711

Depreciation expense was $211 million, $214 million and $243 million for the years ended December 31, 2012, 2011 and 2010,

respectively. In 2012, we recorded asset impairment charges of $7 million to write down the carrying value of certain assets of IMS (see

Note 18). In 2011, we recorded asset impairment charges of $13 million associated with a restructuring program (see Note 13).