Pitney Bowes 2012 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2012 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

78

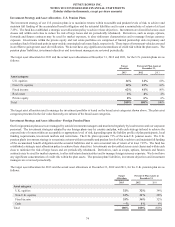

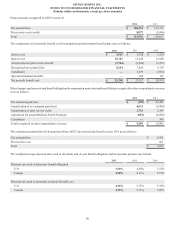

• Derivatives: Instruments are comprised of futures, forwards, options and warrants and are used to gain exposure to a desired investment

as well as for defensive hedging purposes against currency and interest rate fluctuations. Derivative instruments classified as Level

1 are valued through a readily available exchange listed price. Derivative instruments classified as Level 2 are valued using observable

inputs but are not listed or traded on an exchange.

• Securities Lending Fund: Investment represents a commingled fund through our custodian's securities lending program. The U.S.

pension plan lends securities that are held within the plan to other banks and/or brokers, and receives collateral, typically cash. This

collateral is invested in a short-term fixed income securities commingled fund. The commingled fund is not listed or traded on an

exchange and is classified as Level 2. This amount invested in the fund is offset by a corresponding liability reflected in the U.S.

pension plan's net assets available for benefits.

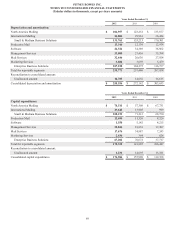

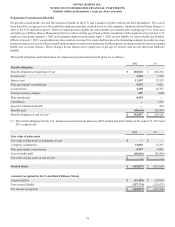

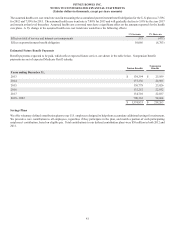

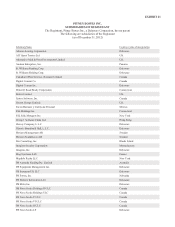

Level 3 Gains and Losses

The following table summarizes the changes in the fair value of Level 3 assets for the year ended December 31, 2012:

Mortgage-backed

securities Private equity Real estate Total

Balance at beginning of year $ 3,702 $ 88,870 $ 57,918 $ 150,490

Realized (losses) gains (3)(13) 1,780 1,764

Unrealized (losses) gains (20) 742 5,711 6,433

Net purchases, sales and settlements (488) 2,206 (2,241) (523)

Balance at end of year $ 3,191 $ 91,805 $ 63,168 $ 158,164

There are no shares of our common stock included in the plan assets of our pension plans.

During 2013, we anticipate making contributions of $10 million to our U.S. pension plans and $20 million to our foreign pension plans.

We will reassess our funding alternatives as the year progresses.