Pitney Bowes 2012 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2012 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

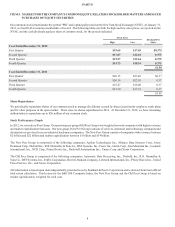

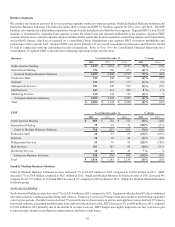

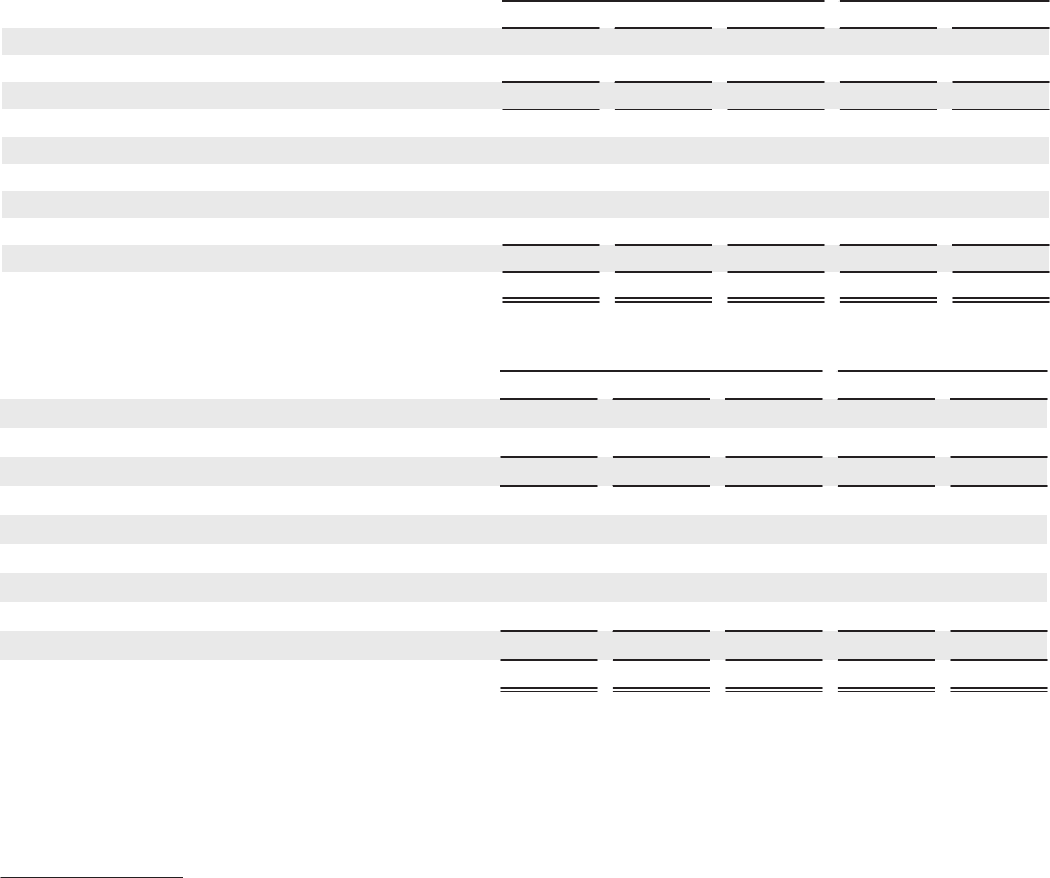

Business Segments

We conduct our business activities in seven reporting segments within two business groups, Small & Medium Business Solutions and

Enterprise Business Solutions. The following tables show revenue and EBIT by business segment for 2012, 2011 and 2010. The IMS

business, now reported as a discontinued operation, was previously included in our Mail Services segment. Segment EBIT, a non-GAAP

measure, is determined by deducting from segment revenue the related costs and expenses attributable to the segment. Segment EBIT

excludes interest, taxes, general corporate expenses not allocated to a particular business segment, restructuring charges, asset impairments

and goodwill charges, which are recognized on a consolidated basis. Management uses segment EBIT to measure profitability and

performance at the segment level. Segment EBIT may not be indicative of our overall consolidated performance and therefore, should

be read in conjunction with our consolidated results of operations. Refer to Note 16 to the Consolidated Financial Statements for a

reconciliation of segment EBIT to income from continuing operations before income taxes.

Revenue Year Ended December 31, % change

2012 2011 2010 2012 2011

North America Mailing $ 1,819 $ 1,961 $ 2,101 (7)% (7)%

International Mailing 676 707 675 (4)% 5%

Small & Medium Business Solutions 2,495 2,669 2,775 (7)% (4)%

Production Mail 512 544 561 (6)% (3)%

Software 393 407 375 (3)% 9%

Management Services 921 949 999 (3)% (5)%

Mail Services 445 412 408 8% 1%

Marketing Services 138 142 142 (3)% —%

Enterprise Business Solutions 2,409 2,454 2,485 (2)% (1)%

Total $ 4,904 $ 5,123 $ 5,260 (4)% (3)%

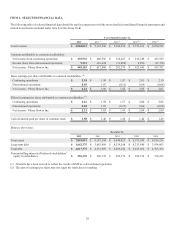

EBIT Year Ended December 31, % change

2012 2011 2010 2012 2011

North America Mailing $ 689 $ 728 $ 755 (5)% (4)%

International Mailing 79 99 79 (20)% 25 %

Small & Medium Business Solutions 768 827 834 (7)% (1)%

Production Mail 26 33 61 (21)% (47)%

Software 38 38 40 (1)% (5)%

Management Services 55 76 93 (28)% (18)%

Mail Services 101 103 85 (2)% 22 %

Marketing Services 28 26 26 7% —%

Enterprise Business Solutions 248 276 304 (10)% (9)%

Total $ 1,016 $ 1,103 $ 1,139 (8)% (3)%

Small & Medium Business Solutions

Small & Medium Business Solutions revenue decreased 7% to $2,495 million in 2012 compared to $2,669 million in 2011. EBIT

decreased 7% to $768 million compared to $827 million in 2011. Small and Medium Business Solutions revenue in 2011 decreased 4%

compared to $2,775 million in 2010 and EBIT decreased 1% compared to $834 million in 2010. Within the Small & Medium Business

Solutions group:

North America Mailing

North America Mailing revenue decreased 7% to $1,819 million in 2012 compared to 2011. Equipment sales declined 6% due to continued

uncertain economic conditions and declining mail volumes. Financing revenue was 9% lower than last year due to the declining equipment

sales in prior periods. Rentals revenue declined 7% primarily due to fewer meters in service and supplies revenue declined 11% due to

lower mail volumes, a declining installed meter base and lower ink and toner sales. EBIT decreased 5% to $689 million in 2012 compared

to $728 million in 2011 primarily due to the decline in revenue; however, EBIT margin was slightly improved over last year due in part

to prior strategic initiatives, productivity improvements and lower credit losses.