Pitney Bowes 2012 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2012 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

50

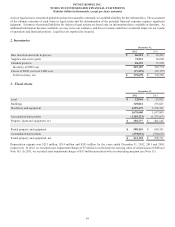

2011, the Bank had assets of $738 million and liabilities of $680 million. The Bank is regulated by the Federal Deposit Insurance

Corporation (FDIC) and the Utah Department of Financial Institutions.

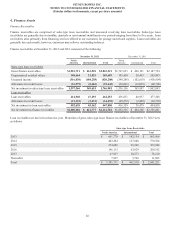

5. Intangible Assets and Goodwill

Intangible assets

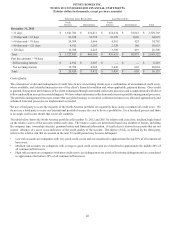

Intangible assets at December 31, 2012 and 2011 consisted of the following:

December 31, 2012 December 31, 2011

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Customer relationships $ 407,901 $ (269,100) $ 138,801 $ 409,489 $ (237,536) $ 171,953

Supplier relationships 29,000 (22,113) 6,887 29,000 (19,213) 9,787

Software & technology 169,632 (151,628) 18,004 170,286 (143,456) 26,830

Trademarks & trade names 35,078 (32,615) 2,463 33,908 (30,076) 3,832

Non-compete agreements 7,471 (7,412)59

7,564 (7,363) 201

Total intangible assets $ 649,082 $ (482,868) $ 166,214 $ 650,247 $ (437,644) $ 212,603

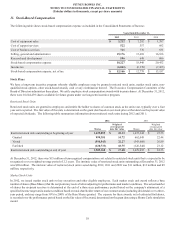

Amortization expense for intangible assets was $45 million, $58 million and $61 million for the years ended December 31, 2012, 2011

and 2010, respectively. The future amortization expense for intangible assets as of December 31, 2012 was as follows:

Year ended December 31,

2013 $ 37,634

2014 36,944

2015 33,763

2016 25,412

2017 11,491

Thereafter 20,970

Total $ 166,214

Actual amortization expense may differ from the amounts above due to, among other things, fluctuations in foreign currency exchange

rates, impairments, future acquisitions and accelerated amortization.

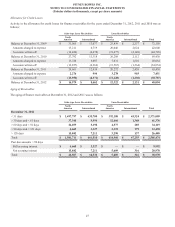

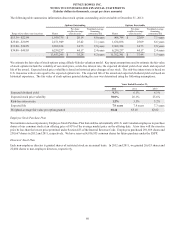

Goodwill

In 2011, based on the results of our annual goodwill impairment review, management determined that the international operations of our

Management Services segment (PBMSi) were impaired. The fair value of PBMSi was determined using a combination of techniques

including the present value of future cash flows, derived from our long-term plans and historical experience, multiples of competitors

and multiples from sales of like businesses. The inputs used to determine the fair value were classified as Level 3 in the fair value

hierarchy. Based on the results of our impairment test, we recorded a goodwill impairment charge of $84 million and an intangible asset

impairment charge of $5 million to write-down the carrying value of goodwill and intangible assets to their respective implied fair values.

The intangible asset impairment charge is included in restructuring changes and asset impairments in the Consolidated Statements of

Income.