Pitney Bowes 2012 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2012 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

commercial paper borrowings averaged $138 million at a weighted-average interest rate of 0.22% and the maximum amount of commercial

paper outstanding at any point in time was $450 million.

In October 2012, we borrowed $230 million under term loan agreements. The loans bear interest at the applicable London Interbank

Offered Rate (LIBOR) plus 2.25% or Prime Rate plus 1.25%, at our option. Interest is payable quarterly and the loans mature in 2015

and 2016. The proceeds from the loans are for general corporate purposes, including the repayment of 2013 debt maturities.

In November 2012, we issued $110 million of 10-year notes with a coupon rate of 5.25%. Interest is paid quarterly beginning February

2013. The notes mature in November 2022; however, we may redeem some or all of the notes at anytime on or after November 2015 at

a redemption price equal to 100% of the principal amount, plus accrued and unpaid interest. The proceeds from the notes are for general

corporate purposes, including the repayment of 2013 debt maturities.

Cash and cash equivalents held by our foreign subsidiaries were $219 million at December 31, 2012 and $538 million at December 31,

2011. Cash and cash equivalents held by our foreign subsidiaries are generally used to support the liquidity needs of these subsidiaries.

Most of these amounts could be repatriated to the U.S. but would be subject to additional taxes. Repatriation of some foreign balances

is restricted by local laws.

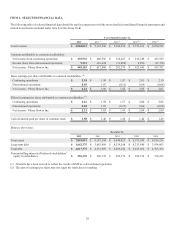

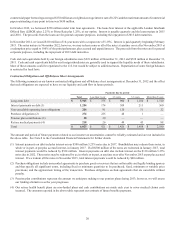

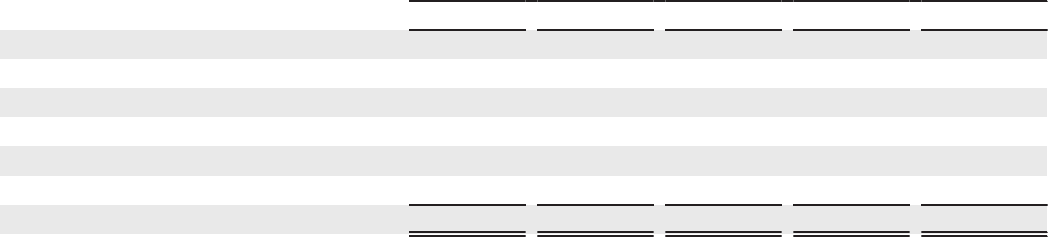

Contractual Obligations and Off-Balance Sheet Arrangements

The following summarizes our known contractual obligations and off-balance sheet arrangements at December 31, 2012 and the effect

that such obligations are expected to have on our liquidity and cash flow in future periods:

Payments due by period

Total Less than 1 year 1-3 years 3-5 years More than 5 years

Long-term debt $ 3,965 $ 375 $ 900 $ 1,180 $ 1,510

Interest payments on debt (1) 1,254 174 309 211 560

Non-cancelable operating lease obligations 284 91 120 51 22

Purchase obligations (2) 274 225 48 1 —

Pension plan contributions (3) 30 30—— —

Retiree medical payments (4) 218 26 49 45 98

Total $ 6,025 $ 921 $ 1,426 $ 1,488 $ 2,190

The amount and period of future payments related to our income tax uncertainties cannot be reliably estimated and are not included in

the above table. See Note 8 to the Consolidated Financial Statements for further details.

(1) Interest payments on debt includes interest on our $500 million 5.25% notes due in 2037. Bondholders may redeem these notes, in

whole or in part, at par plus accrued interest, in January 2017. If all $500 million of the notes are redeemed in January 2017, total

interest payments would be reduced by $524 million. Interest payments on debt also include interest on the $110 million 5.25%

notes due in 2022. These notes may be redeemed by us, in whole or in part, at anytime on or after November 2015 at par plus accrued

interest. If we redeem all the notes in November 2015, total interest payments would be reduced by $40 million.

(2) Purchase obligations include unrecorded agreements to purchase goods or services that are enforceable and legally binding upon us

and that specify all significant terms, including fixed or minimum quantities to be purchased; fixed, minimum or variable price

provisions; and the approximate timing of the transaction. Purchase obligations exclude agreements that are cancelable without

penalty.

(3) Pension plan contributions represent the amount we anticipate making to our pension plans during 2013; however, we will assess

our funding alternatives as the year progresses.

(4) Our retiree health benefit plans are non-funded plans and cash contributions are made each year to cover medical claims costs

incurred. The amounts reported in the above table represent our estimate of future benefits payments.