Pitney Bowes 2012 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2012 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

49

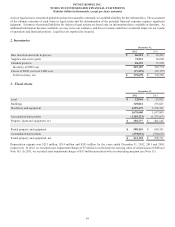

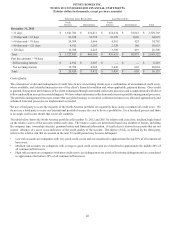

December 31,

2012 2011

Sales-type lease receivables

Risk Level

Low $ 1,016,413 $ 1,096,676

Medium 450,432 473,394

High 43,658 58,177

Not Scored 71,208 99,406

Total $ 1,581,711 $ 1,727,653

Loan receivables

Risk Level

Low $ 254,567 $ 269,547

Medium 136,069 115,490

High 14,624 21,081

Not Scored 9,700 30,513

Total $ 414,960 $ 436,631

Troubled Debt

We maintain a program for U.S. clients in our North America loan portfolio who are experiencing financial difficulties, but are able

to make reduced payments over an extended period of time. Upon acceptance into the program, the client’s credit line is closed and

interest accrual is suspended. There is generally no forgiveness of debt or reduction of balances owed. The balance of loans in this

program, related loan loss allowance and write-offs are insignificant to the overall portfolio.

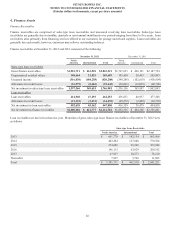

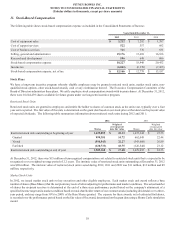

Leveraged Leases

Our investment in leveraged lease assets consisted of the following:

December 31,

2012 2011

Rental receivables $ 83,254 $ 810,306

Unguaranteed residual values 14,177 13,784

Principal and interest on non-recourse loans (55,092)(606,708)

Unearned income (7,793)(79,111)

Investment in leveraged leases 34,546 138,271

Less: deferred taxes related to leveraged leases (19,372)(101,255)

Net investment in leveraged leases $ 15,174 $ 37,016

During 2012 and 2011, we sold certain non-U.S. leveraged lease assets for cash. The investment in each of the leveraged leases at

the time of sale was $109 million. The leveraged lease assets sold in 2012 resulted in after-tax gain of $13 million and the leveraged

lease assets sold in 2011 resulted in an after-tax gain of $27 million.

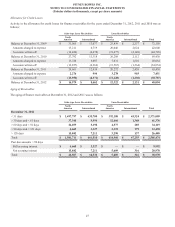

Pitney Bowes Bank

The Pitney Bowes Bank (the Bank) is an indirect wholly owned subsidiary whose primary business is to provide financing solutions

to clients that rent or lease postage meters. The Bank's key product offering, Purchase Power, is a revolving credit solution, which

enables clients to finance their postage costs when they refill their meter. The Bank also provides a deposit solution to those clients

that prefer to prepay postage and earn interest on their deposits. When a client refills their postage meter, the funds are withdrawn

from the savings account to pay for the postage.

The Bank's assets consist primarily of finance receivables, short and long-term investments and cash and liabilities consist primarily

of deposit accounts. At December 31, 2012, the Bank had assets of $796 million and liabilities of $733 million. At December 31,