Pitney Bowes 2012 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2012 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

82

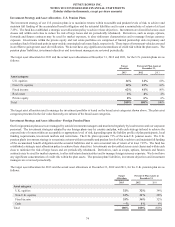

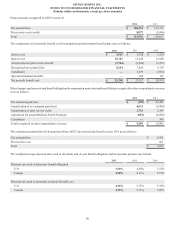

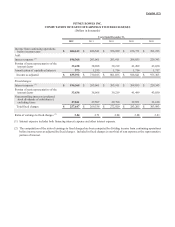

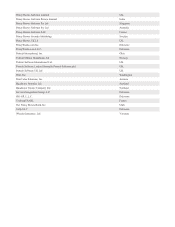

18. Discontinued Operations and Assets Held for Sale

Discontinued operations include our IMS operations (see Note 1) and our Capital Services business, which was sold in 2006. The details

of discontinued operations are shown in the following table:

Years Ended December 31,

2012 2011 2010

International Mail Services

Revenue $ 135,222 $ 155,378 $ 164,898

Cost of revenue 120,251 142,165 163,818

SG&A 19,565 28,220 22,379

Restructuring charges and asset impairments 10,234 11,603 313

Goodwill impairment 18,315 45,650 —

Impairment on assets held for sale 6,941 ——

Loss before taxes (40,084)(72,260) (21,612)

Tax benefit (15,003)(23,025) (7,828)

Net loss (25,081)(49,235) (13,784)

Capital Services, net of tax 34,312 266,159 (18,104)

Income (loss) from discontinued operations $ 9,231 $ 216,924 $ (31,888)

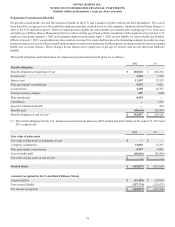

In connection with our decision to exit our IMS operations, during the third quarter of 2012, we conducted a goodwill impairment review.

We determined the fair value of the IMS operations based on third-party written offers to purchase the business as well applying an

income approach with revised cash flow projections. The inputs used to determine the fair value of IMS were classified as Level 3 in

the fair value hierarchy. Based on the results of our impairment test, in the third quarter of 2012, we recorded a goodwill impairment

charge of $18 million and asset impairment charges of $10 million to write-down the carrying value of goodwill, intangible assets and

fixed assets to their respective implied fair values. Based on the terms of the proposed agreement, we recorded an additional pre-tax loss

of $7 million in the fourth quarter to write down the carrying value of the net assets of IMS to their estimated fair value less costs to sell.

In 2011, due to the under-performance of our IMS operations and based on information developed during the early stages of our annual

budgeting and long-term planning process started in the third quarter, we concluded that it was appropriate to perform a goodwill

impairment review for IMS. We determined the fair value of IMS using a combination of techniques including the present value of future

cash flows, multiples of competitors and multiples from sales of like businesses, and determined that the IMS reporting unit was impaired.

The inputs used to determine the fair value of IMS were classified as Level 3 in the fair value hierarchy. Based on the results of our

impairment test, we recorded a goodwill impairment charge of $46 million and an intangible asset impairment charge of $12 million to

write-down the carrying value of goodwill and intangible assets to their respective implied fair values.

The assets and liabilities of IMS consists primarily of accounts receivable and accounts payable and other current accruals. At December

31, 2012, assets of IMS were $25 million and liabilities were $25 million.

The amount recognized for Capital Services in 2012 relates to tax benefits from the resolution of tax examinations. In 2011, we entered

into a series of settlements with the IRS in connection with their examinations of our tax years 2001-2008. We agreed upon both the tax

treatment of a number of disputed issues, including issues related to the Capital Services business, and revised tax calculations. As a

result of these settlements, an aggregate $264 million benefit was recognized in discontinued operations. The amount in 2010 includes

the accrual of interest on uncertain tax positions.