Pitney Bowes 2012 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2012 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

52

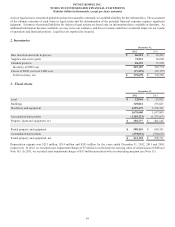

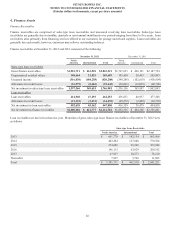

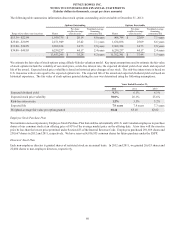

7. Debt

December 31,

2012 2011

Term loans $ 230,000 $ 150,000

4.625% notes due 2012 —400,000

3.875% notes due 2013 375,000 375,000

4.875% notes due 2014 (1) 450,000 450,000

5.00% notes due 2015 400,000 400,000

4.75% notes due 2016 500,000 500,000

5.75% notes due 2017 500,000 500,000

4.75% notes due 2018 350,000 350,000

5.60% notes due 2018 250,000 250,000

6.25% notes due 2019 300,000 300,000

5.25% notes due 2022 (2) 110,000 —

5.25% notes due 2037 (3) 500,000 500,000

Other (4) 52,375 58,909

Total debt 4,017,375 4,233,909

Current portion long-term debt 375,000 550,000

Long-term debt $ 3,642,375 $ 3,683,909

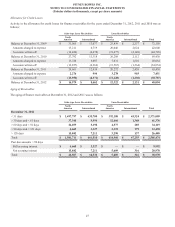

Term loans at December 31, 2012 bear interest at the applicable London Interbank Offered Rate (LIBOR) plus 2.25% or Prime Rate plus

1.25%, at our option. Interest is payable and resets quarterly and the loans mature in 2015 and 2016. Term loans at December 31, 2011

were repaid during 2012.

(1) We have interest rate swap agreements with an aggregate notional value of $450 million that effectively convert the fixed rate interest

payments on this debt issue into variable interest rates. We pay a weighted-average variable rate based on three-month LIBOR plus

305 basis points and receive a fixed rate of 4.875%. The weighted-average rate paid during 2012 and 2011 was 3.5%.

(2) In November 2012, we issued $110 million of 10-year notes with a coupon rate of 5.25%. Interest is paid quarterly beginning

February 2013. The notes mature on November 27, 2022; however, we may redeem some or all of the notes at anytime on or after

November 27, 2015 at a redemption price equal to 100% of the principal amount, plus accrued and unpaid interest. The proceeds

from the notes will be used for general corporate purposes, including the repayment of 2013 debt maturities.

(3) Under the terms of these notes, in January 2017, bondholders may redeem the notes, in whole or in part, at par plus accrued interest.

(4) Other consists of the unamortized net proceeds received from unwinding of interest rate swaps, the mark-to-market adjustment of

interest rate swaps and debt discounts and premiums.

We have a commercial paper program that is an important source of liquidity for us and a committed credit facility of $1.0 billion to

support commercial paper issuances. There were no outstanding commercial paper borrowings at December 31, 2012 or 2011. As of

December 31, 2012, we had not drawn upon the credit facility. The credit facility expires in April 2016.