Pitney Bowes 2012 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2012 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.15

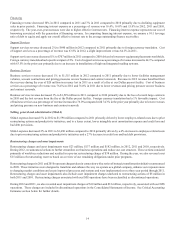

Goodwill impairment

During 2012 and 2011, we recorded goodwill impairment charges of $18 million and $46 million, respectively, associated with our IMS

operations. These charges are included in discontinued operations in the Consolidated Statements of Income. In 2011, we also recorded

a goodwill impairment charge of $84 million associated with the international operations of our Management Services segment (PBMSi).

This charge was included as Goodwill impairment in the Consolidated Statements of Income. See Critical Accounting Estimates section

below for further details of these charges.

Other expense (income), net

Other expense, net in 2012 includes income of $11 million from insurance proceeds received in connection with the February 2011 fire

at our Dallas presort facility offset by a loss of $6 million on a forward rate swap agreement, a loss of $2 million on the early redemption

of debt and a pre-tax loss of $4 million on the sale of leveraged lease assets. We do not anticipate receiving any further insurance proceeds

relating to the Dallas fire.

Other income, net in 2011 includes income of $27 million from insurance proceeds received in connection with the fire at our Dallas

presort facility and a pre-tax loss of $7 million on the sale of leveraged lease assets.

Income taxes

See Note 8 to the Consolidated Financial Statements.

Discontinued operations

See Note 18 to the Consolidated Financial Statements.

Preferred stock dividends of subsidiaries attributable to noncontrolling interests

See Note 9 to the Consolidated Financial Statements.