Pitney Bowes 2012 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2012 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

66

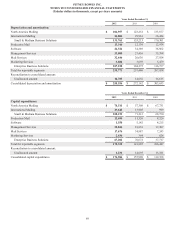

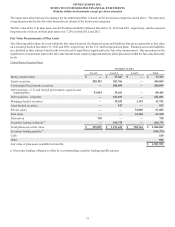

13. Restructuring Charges and Asset Impairments

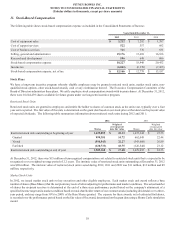

Activity in our restructuring reserves for the years ended December 31, 2012, 2011 and 2010 was as follows:

Severance and

benefits costs

Pension and

Retiree

Medical

Asset

impairments

Other exit

costs Total

Balance at December 31, 2009 $ 73,792 $ — $ — $ 14,834 $ 88,626

Expenses, net 114,873 23,620 9,799 38,163 186,455

Gain on sale of facility — — (8,897) — (8,897)

Cash payments (87,026) — 8,897 (41,436) (119,565)

Non-cash charges — (23,620)(9,799) — (33,419)

Balance at December 31, 2010 101,639 — — 11,561 113,200

Expenses, net 101,043 8,178 13,528 12,471 135,220

Gain on sale of facility — — (601) — (601)

Cash payments (97,646) — 601 (9,957) (107,002)

Non-cash charges — (8,178)(13,528) — (21,706)

Balance at December 31, 2011 105,036 — — 14,075 119,111

Expenses, net 24,992 — — (1,627) 23,365

Cash payments (67,488) — — (7,230) (74,718)

Non-cash charges —————

Balance at December 31, 2012 $ 62,540 $ — $ — $ 5,218 $ 67,758

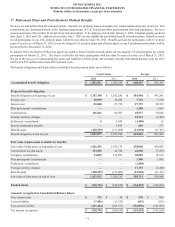

During 2012, we took actions to further streamline our business operations and reduce our cost structure. These actions consisted primarily

of workforce reductions and resulted in a pre-tax restructuring charge of $38 million. We anticipate that these actions will result in

annualized benefits of $45 million to $55 million. Restructuring charges are net of reversals of $15 million for changes in estimated

reserves for prior period programs. Total restructuring reserves at December 31, 2012 are expected to be paid over the next 12-24 months.

We expect to fund these payments from cash flows from operations.

Restructuring charges in 2011 and 2010 represent charges taken in connection with a series of strategic transformation initiatives announced

in 2009. These initiatives were designed to transform and enhance the way we operate as a global company, enhance our responsiveness

to changing market conditions and create improved processes and systems and were implemented over a three year period through 2011.

Restructuring charges and asset impairments on the Consolidated Statements of Income also includes asset impairment charges unrelated

to restructuring programs, which are not included in the table above and excludes restructuring charges related to discontinued operations,

which are included in the table above. Asset impairment charges unrelated to restructuring programs were $5 million in both 2011 and

2010.

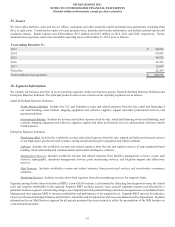

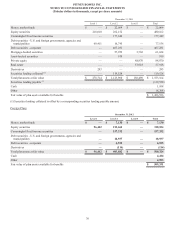

14. Commitments and Contingencies

In the ordinary course of business, we are routinely defendants in, or party to, a number of pending and threatened legal actions. These

may involve litigation by or against us relating to, among other things, contractual rights under vendor, insurance or other contracts;

intellectual property or patent rights; equipment, service, payment or other disputes with clients; or disputes with employees. Some of

these actions may be brought as a purported class action on behalf of a purported class of employees, clients or others.

In October 2009, the company and certain of its current and former officers were named as defendants in NECA-IBEW Health & Welfare

Fund v. Pitney Bowes Inc. et al., a class action lawsuit filed in the U.S. District Court for the District of Connecticut. The complaint

asserts claims under the Securities Exchange Act of 1934 on behalf of those who purchased the common stock of the company during

the period between July 30, 2007 and October 29, 2007 alleging that the company, in essence, missed two financial projections. Plaintiffs

filed an amended complaint in September 2010. After briefing on the motion to dismiss was completed, the plaintiffs filed a new amended

complaint on February 17, 2012. We have moved to dismiss this new amended complaint. We expect to prevail in this legal action;

however, as litigation is inherently unpredictable, there can be no assurance in this regard. If the plaintiffs do prevail, the results may

have a material effect on our financial position, results of operations or cash flows. Based upon our current understanding of the facts

and applicable laws, we do not believe there is a reasonable possibility that any loss has been incurred.