Pitney Bowes 2012 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2012 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

57

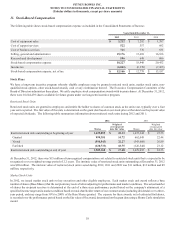

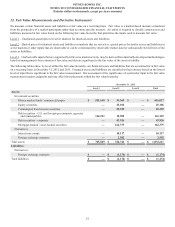

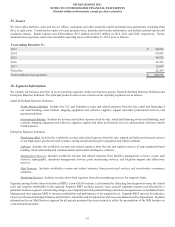

10. Stockholders' Equity

Preferred Stock

We have two classes of Preferred Stock issued and outstanding: the 4% Preferred Stock and the $2.12 Preference Stock. The 4% Preferred

Stock is entitled to cumulative dividends of $2 per year and can be converted into 24.24 shares of common stock, subject to adjustment

in certain events. The preferred stock is redeemable at our option at a price of $50 per share, plus dividends accrued through the redemption

date. We are authorized to issue 600,000 shares of 4% Preferred Stock. At December 31, 2012 and 2011, there were 85 shares outstanding.

There are no unpaid dividends in arrears.

The $2.12 Preference Stock is entitled to cumulative dividends of $2.12 per year and can be converted into 16.53 shares of common

stock, subject to adjustment in certain events. The preference stock is redeemable at our option at a price of $28 per share. We are

authorized to issue 5,000,000 shares of $2.12 Preference Stock. At December 31, 2012 and 2011, there were 23,928 shares and 24,336

shares outstanding, respectively. There are no unpaid dividends in arrears.

Common Stock

We have 480,000,000 shares of common stock authorized and 323,337,912 shares were issued at December 31, 2012 and 2011. At

December 31, 2012, 38,428,301 shares were reserved for issuance under our stock plans and dividend reinvestment program, 2,060 shares

were reserved for issuance upon conversion of the 4% Preferred Stock and 395,530 shares were reserved for issuance upon conversion

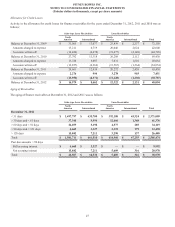

of the $2.12 Preference Stock. The following table summarizes the changes in Common Stock and Treasury Stock:

Treasury Outstanding

Balance at December 31, 2009 116,140,084 207,197,828

Repurchases of common stock 4,687,304 (4,687,304)

Issuance of common stock (876,794) 876,794

Conversions to common stock (43,684) 43,684

Balance at December 31, 2010 119,906,910 203,431,002

Repurchases of common stock 4,692,200 (4,692,200)

Issuance of common stock (963,448) 963,448

Conversions to common stock (48,820) 48,820

Balance at December 31, 2011 123,586,842 199,751,070

Issuance of common stock (1,118,089) 1,118,089

Conversions to common stock (14,888) 14,888

Balance at December 31, 2012 122,453,865 200,884,047

Accumulated Other Comprehensive Loss

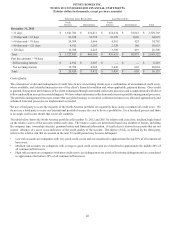

Accumulated other comprehensive loss consisted of the following:

2012 2011 2010

Foreign currency translation adjustments $ 81,250 $ 83,952 $ 137,521

Net unrealized loss on derivatives (7,777)(8,438) (10,445)

Net unrealized gain on investment securities 4,513 4,387 1,439

Net unamortized loss on pension and postretirement plans (759,199)(741,546) (602,321)

Accumulated other comprehensive loss $(681,213)$(661,645) $ (473,806)