Pitney Bowes 2012 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2012 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PITNEY BOWES INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Tabular dollars in thousands, except per share amounts)

62

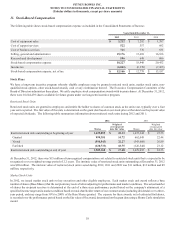

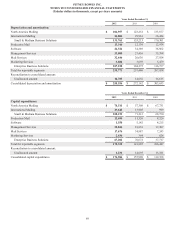

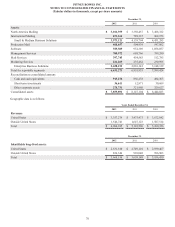

December 31, 2011

Level 1 Level 2 Level 3 Total

Assets:

Investment securities

Money market funds / commercial paper $ 239,157 $ 300,702 $ — $ 539,859

Equity securities — 22,097 — 22,097

Commingled fixed income securities — 27,747 — 27,747

Debt securities - U.S. and foreign governments, agencies

and municipalities 93,175 19,042 — 112,217

Debt securities - corporate — 31,467 — 31,467

Mortgage-backed / asset-backed securities — 134,262 — 134,262

Derivatives

Interest rate swaps — 15,465 — 15,465

Foreign exchange contracts — 4,230 — 4,230

Total assets $ 332,332 $ 555,012 $ — $ 887,344

Liabilities:

Derivatives

Foreign exchange contracts $ — $ (1,439) $ — $ (1,439)

Total liabilities $ — $ (1,439) $ — $ (1,439)

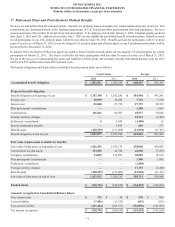

Investment Securities

The valuation of investment securities is based on the market approach using inputs that are observable, or can be corroborated by

observable data, in an active marketplace. The following information relates to our classification into the fair value hierarchy:

• Money Market Funds / Commercial Paper: Money market funds typically invest in government securities, certificates of deposit,

commercial paper and other highly liquid, low-risk securities. Money market funds are principally used for overnight deposits and

are classified as Level 1 when unadjusted quoted prices in active markets are available and as Level 2 when they are not actively

traded on an exchange. Direct investments in commercial paper are not listed on an exchange in an active market and are classified

as Level 2.

• Equity Securities: Equity securities are comprised of mutual funds investing in U.S. and foreign common stock. These mutual funds

are classified as Level 2 as they are not separately listed on an exchange.

• Commingled Fixed Income Securities: Mutual funds that invest in a variety of fixed income securities including securities of the

U.S. government and its agencies, corporate debt, mortgage-backed securities and asset-backed securities. The value of the funds

is based on the market value of the underlying investments owned by each fund, minus its liabilities, divided by the number of shares

outstanding, as reported by the fund manager. These commingled funds are not listed on an exchange in an active market and are

classified as Level 2.

• Debt Securities – U.S. and Foreign Governments, Agencies and Municipalities: Debt securities are classified as Level 1 where active,

high volume trades for identical securities exist. Valuation adjustments are not applied to these securities. Debt securities valued

using quoted market prices for similar securities or benchmarking model derived prices to quoted market prices and trade data for

identical or comparable securities are classified as Level 2.

• Debt Securities – Corporate: Corporate debt securities are valued using recently executed transactions, market price quotations

where observable, or bond spreads. The spread data used are for the same maturity as the security. These securities are classified as

Level 2.

• Mortgage-Backed Securities (MBS) / Asset-Backed Securities (ABS): These securities are valued based on external pricing indices.

When external index pricing is not observable, MBS and ABS are valued based on external price/spread data. These securities are

classified as Level 2.

Investment securities include investments held by the Bank. The Bank's investment securities are classified as available-for-sale and

recorded at fair value on the Consolidated Balance Sheets as cash and cash equivalents, short-term investments and other assets depending

on the type of investment and maturity. Unrealized holding gains and losses are recorded, net of tax, in accumulated other comprehensive

income.