Pitney Bowes 2012 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2012 Pitney Bowes annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22

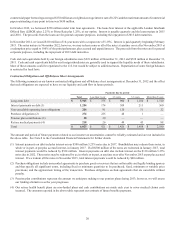

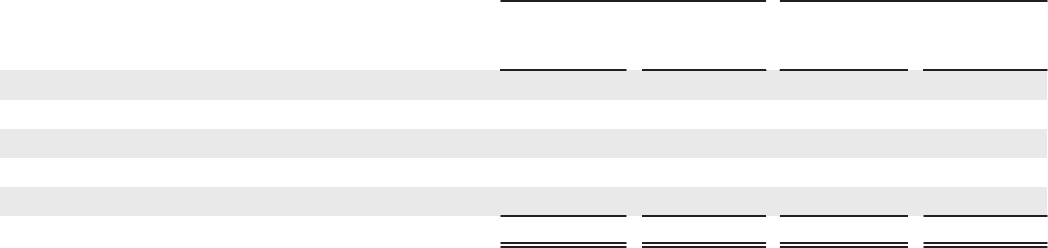

We invest our pension plan assets in a variety of investment securities in accordance with our strategic asset allocation policy. The

allocations of our U.S. and U.K. pension plan assets at December 31, 2012 and target allocations for 2013 are as follows:

U.S. Pension Plan U.K. Pension Plan

Allocation of plan

assets at

December 31,

2012

2013 Target

allocation

Allocation of plan

assets at

December 31,

2012

2013 Target

allocation

Equity securities 29% 28% 63% 65%

Fixed income 61% 62% 36% 35%

Real estate 4% 2% —% —%

Private equity 6% 8% —% —%

Cash —% —% 1% —%

Total 100% 100% 100% 100%

Investment securities are exposed to various risks such as interest rate, market and credit risks, which could cause a change in the value

of such investment securities. Such a change could have a material impact on our future results.

Residual value of leased assets

We provide lease financing for our products primarily through sales-type leases. Equipment residual values are determined at inception

of the lease using estimates of equipment fair value at the end of the lease term. Residual value estimates impact the determination of

whether a lease is classified as an operating lease or sales-type lease. Estimates of future equipment fair value are based primarily on

our historical experience. We also consider forecasted supply and demand for our various products, product retirement and future product

launch plans, end of lease customer behavior, regulatory changes, remanufacturing strategies, used equipment markets, if any, competition

and technological changes.

We evaluate residual values on an annual basis or as changes to the above considerations occur and declines in estimated residual values

considered "other-than-temporary" are recognized immediately. Estimated increases in future residual values are not recognized until

the equipment is remarketed. If the actual residual value of lease assets were 10% lower than management's current estimates, pre-tax

income would be lower by $17 million.

Allowances for doubtful accounts and credit losses

We estimate our credit risk for accounts and finance receivables and provide allowances for estimated losses. We believe that our credit

risk is limited because of our large number of customers, small account balances for most of our customers and customer geographic and

industry diversification. We continuously monitor collections and payments from our customers and evaluate the adequacy of the

applicable allowance based on historical loss experience, past due status, adverse situations that may affect a customer's ability to pay

and prevailing economic conditions. We make adjustments to the reserves as deemed necessary. This evaluation is inherently subjective

and actual results may differ significantly from estimated reserves.

Total allowance for credit losses as a percentage of finance receivables was 1.8% and 2.6% at December 31, 2012 and 2011, respectively.

Holding all other assumptions constant, a 0.25% increase or decrease in the allowance rate at December 31, 2012 would have changed

the 2012 provision by approximately $6 million.

The allowance for doubtful accounts as a percentage of trade receivables was 2.7% and 3.4% at December 31, 2012 and 2011, respectively.

Holding all other assumptions constant, a 0.25% increase or decrease in the allowance rate at December 31, 2012 would have changed

the 2012 provision by approximately $2 million.

Accounting for income taxes

We are subject to income taxes in the U.S. and numerous foreign jurisdictions. Our annual tax rate is based on our income, statutory tax

rates, tax reserve changes and tax planning opportunities available to us in the various jurisdictions in which we operate. Significant

judgment is required in determining our annual tax rate and in evaluating our tax positions.

We regularly assess the likelihood of tax adjustments in each of the tax jurisdictions in which we have operations and account for the

related financial statement implications. Tax reserves have been established which we believe to be appropriate given the possibility of

tax adjustments. Determining the appropriate level of tax reserves requires us to exercise judgment regarding the uncertain application

of tax laws. The amount of reserves is adjusted when information becomes available or when an event occurs indicating a change in the