Pep Boys 2005 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2005 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71

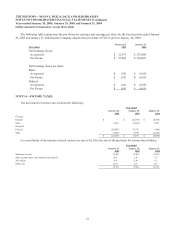

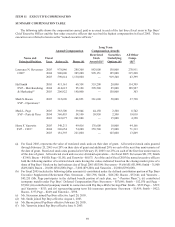

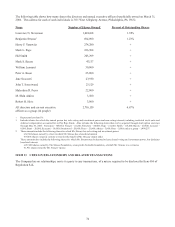

AGGREGATED STOCK OPTION EXERCISES IN LAST FISCAL YEAR AND

FISCAL YEAR-END STOCK OPTION VALUES

The following table shows information about stock options exercised during fiscal 2005 by the named executive

officers and the number and value of stock options held by them on January 28, 2006.

Shares

Acquired Value

Number of

Securities Underlying

Unexercised Options at

Fiscal Year-End (#)

Value of Unexercised

In-the-Money Options at

Fiscal Year-End ($)(a)

Name on Exercise (#) Realized ($) Exercisable Unexercisable Exercisable Unexercisable

Lawrence N. Stevenson 22,000 85,580 605,724 546,816 3,782,229 2,626,206

Hal Smith — — 104,000 91,000 17,100 11,400

Mark S. Bacon — — 10,000 40,000 — —

Mark L. Page — — 221,100 14,500 272,944 49,440

Harry F. Yanowitz — — 83,000 67,000 406,125 270,750

(a) Based on the New York Stock Exchange composite closing price as published by Yahoo, Inc. for the last business day of

fiscal 2005 ($15.84).

PENSION PLANS

Qualified Defined Benefit Pension Plan. We have a qualified defined benefit pension plan for all employees hired prior

to February 2, 1992. Future benefit accruals on behalf of all participants were frozen under this plan as of December 31, 1996.

Benefits payable under this plan are calculated based on the participant’s compensation (base salary plus accrued bonus) over

the last five years of the participant’s employment by Pep Boys and the number of years of participation in the plan. Benefits

payable under this plan are not subject to deduction for Social Security or other offset amounts. The maximum annual benefit

for any employee under this plan is $20,000.

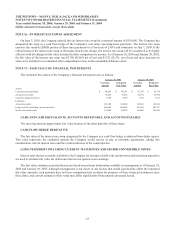

The following table shows the benefits available, at normal retirement age, accrued to the named executive officers

eligible to participate under the qualified defined benefit pension plan.

Name Annualized Benefit

Mark L. Page $19,162

Executive Supplemental Retirement Plan. Our SERP includes a defined benefit portion for certain participants. Mr.

Page is the only named executive officer participating in the defined benefit portion of the SERP. Benefits paid to a participant

under the qualified defined pension plan will be deducted from the benefits otherwise payable under the SERP. Except as

described in the immediately preceding sentence, benefits under the SERP are not subject to deduction for Social Security or

other offset amounts. Benefits under the SERP generally vest after four years of participation.

Normal retirement defined benefits are based upon the average compensation (base salary plus accrued bonus) of an

executive during the five years that yield the highest benefit. The annual death benefit is equal to 50% of the participant’s

base salary on the date of his death, payable until the later of 15 years immediately following the date of death or the

participant’s normal retirement date. This plan also provides for a lump sum distribution of the present value of a participant’s

accrued defined benefits following termination of employment in connection with a change in control of Pep Boys. A trust

agreement has been established to better assure the executive officers of the satisfaction of Pep Boys’ obligations under this

plan following a change in control.

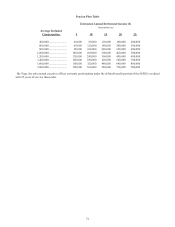

Aggregate Benefit Under Both Plans. The following chart shows, based on the highest average compensation for the

appropriate time period, the approximate aggregate annual benefit under both plans, commencing at the employee’s normal

retirement date (age 65 under the SERP) and generally payable:

• for unmarried participants, at 100% (of the amounts specified below) for the longer of ten years or life

• for married participants, at 100% during the participant’s life and at 50% during the participant’s surviving spouse’s life

The maximum years of service for which a participant will receive credit under the pension plans is 25.