Pep Boys 2005 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2005 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

historically the Company has been able to return excess items to vendors for credit. Future changes in vendors, in their

policies or in their willingness to accept returns of excess inventory could require a revision in the estimates. If our estimates

regarding excess or obsolete inventory are inaccurate, we may be exposed to losses or gains that could be material. A 10%

difference in these estimates at January 28, 2006 would have affected net earnings by approximately $814,000 for the fiscal

year ended January 28, 2006.

• The Company has risk participation arrangements with respect to casualty and health care insurance. The amounts

included in the Company’s costs related to these arrangements are estimated and can vary based on changes in assumptions,

claims experience or the providers included in the associated insurance programs. A 10% change in our self-insurance

liabilities at January 28, 2006 would have affected net earnings by approximately $4,763,000 for the fiscal year ended January

28, 2006.

• The Company records reserves for future product returns and warranty claims. The reserves are based on current

sales of products and historical claims experience. If claims experience differs from historical levels, revisions in the

Company’s estimates may be required. A 10% change in our reserve for future product returns and warranty claims at January

28, 2006 would have affected net earnings by approximately $521,000 for the fiscal year ended January 28, 2006.

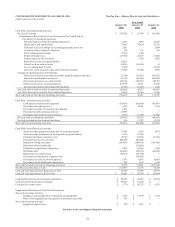

• The Company has significant pension costs and liabilities that are developed from actuarial valuations. Inherent in

these valuations are key assumptions including discount rates, expected return on plan assets, mortality rates and merit and

promotion increases. The Company is required to consider current market conditions, including changes in interest rates, in

selecting these assumptions. Changes in the related pension costs or liabilities may occur in the future due to changes in the

assumptions. The following table highlights the sensitivity of our pension obligations and expense to changes in these

assumptions, assuming all other assumptions remain constant:

Change in Assumption Impact on Annual Pension Expense Impact on ABO

0.50 percentage point decrease in discount rate Increase $530,000 Increase $2,990,000

0.50 percentage point increase in discount rate Decrease $530,000 Decrease $2,990,000

5.0% decrease in expected rate of return on assets Increase $120,000 —

5.0% increase in expected rate of return on assets Decrease $115,000 —

• The Company periodically evaluates its long-lived assets for indicators of impairment. Management’s judgments are

based on market and operational conditions at the time of evaluation. Future events could cause management’s conclusion on

impairment to change, requiring an adjustment of these assets to their then current fair market value.

• The Company provides estimates of fair value for real estate assets and lease liabilities related to store closures when

appropriate to do so based on accounting principles generally accepted in the United States of America. Future circumstances

may result in the Company’s actual future costs or the amounts recognized upon the sale of the property to differ substantially

from original estimates. A 10% change in our location closing liability at January 28, 2006 would not have affected net

earnings materially for the fiscal year ended January 28, 2006.

• The Company is required to estimate its income taxes in each of the jurisdictions in which it operates. This requires

the Company to estimate its actual current tax exposure together with assessing temporary differences resulting from differing

treatment of items, such as depreciation of property and equipment and valuation of inventories, for tax and accounting

purposes. The Company determines its provision for income taxes based on federal and state tax laws and regulations currently

in effect, some of which have been recently revised. Legislation changes currently proposed by certain states in which we

operate, if enacted, could increase our transactions or activities subject to tax. Any such legislation that becomes law could

result in an increase in our state income tax expense and our state income taxes paid, which could have a material effect on

our net income.

The temporary differences between the book and tax treatment of income and expenses result in deferred tax assets and

liabilities, which are included within our consolidated balance sheets. We must then assess the likelihood that our deferred tax

assets will be recovered from future taxable income. To the extent we believe that recovery is not more likely than not, we

must establish a valuation allowance. To the extent we establish a valuation allowance or change the allowance in a future

period, income tax expense will be impacted. Actual results could differ from this assessment if adequate taxable income is

not generated in future periods. Net deferred tax liabilities as of January 28, 2006 and January 29, 2005 totaled $18,354,000

and $45,374,000, respectively, representing approximately 1.5% and 3.7% of liabilities, respectively.