Pep Boys 2005 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2005 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 28, 2006, January 29, 2005 and January 31, 2004

(dollar amounts in thousands, except share data)

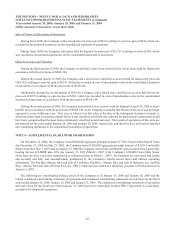

Sales of Stores in Discontinued Operations

During fiscal 2005, the Company sold a closed store for proceeds of $931 resulting in a pre-tax gain of $341, which was

recorded in discontinued operations on the consolidated statement of operations.

During fiscal 2004, the Company sold assets held for disposal for proceeds of $13,327 resulting in a loss of $91, which

was recorded in discontinued operations on the consolidated statement of operations.

Other Store Sales and Transfers

During the third quarter of 2005, the Company reclassified a store from assets held for use to assets held for disposal in

accordance with the provisions of SFAS 144.

During the second quarter of 2005, the Company sold a closed store classified as an asset held for disposal for proceeds

of $6,912 resulting in a pre-tax gain of $5,176, which was recorded in costs of merchandise sales on the consolidated statement

of operations in accordance with the provisions of SFAS 144.

Additionally, during the second quarter of 2005 the Company sold a closed store classified as an asset held for use for

proceeds of $659 resulting in a pre-tax loss of $502, which was recorded in costs of merchandise sales on the consolidated

statement of operations in accordance with the provisions of SFAS 144.

During the second quarter of 2005, the Company reclassified a store in assets held for disposal at April 29, 2005 to assets

held for use in accordance with the provisions of SFAS 144, as the Company concluded that the sale of the store was no longer

expected to occur within one year. This store is valued at its fair value at the date of the subsequent decision to transfer it,

which was lower than its carrying amount before it was classified as held for sale, adjusted for depreciation expense that would

have been recognized had the asset been continuously classified as held and used. The results of operations of this store are

not material for the years ended January 28, 2006 and January 29, 2005, respectively, and therefore have not been reclassified

into continuing operations in the consolidated statements of operations.

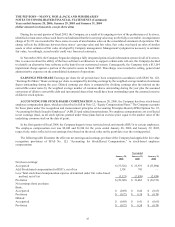

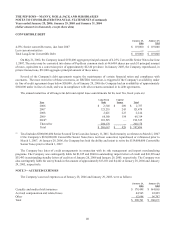

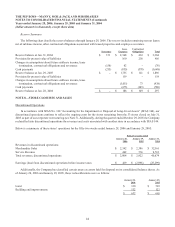

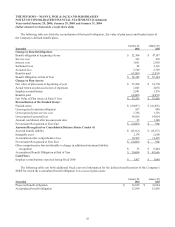

NOTE 9—SUPPLEMENTAL GUARANTOR INFORMATION

On December 14, 2004, the Company issued $200,000 aggregate principal amount of 7.50% Senior Subordinated Notes

due December 15, 2014; on May 21, 2002, the Company issued $150,000 aggregate principal amount of 4.25% Convertible

Senior Notes due June 1, 2007; and on January 27, 2006 the Company entered into a $200,000 senior secured term loan facility

bearing interest of LIBOR plus 3.0% due January 27, 2011 (March 1, 2007 if the Company’s $119,000 Convertible Senior

Notes have not been converted, repurchased or refinanced prior to March 1, 2007). All issuances are unsecured and jointly

and severally and fully and unconditionally guaranteed by the Company’s wholly-owned direct and indirect operating

subsidiaries, The Pep Boys Manny, Moe and Jack of California, Pep Boys - Manny, Moe and Jack of Delaware, Inc. and Pep

Boys - Manny, Moe and Jack of Puerto Rico, Inc. PBY Corporation was added as a subsidiary guarantor of both issuances on

January 6, 2005.

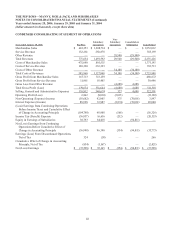

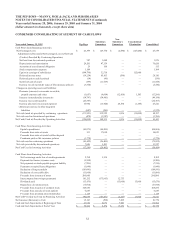

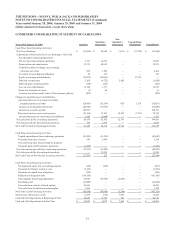

The following are consolidating balance sheets of the Company as of January 28, 2006 and January 29, 2005 and the

related condensed consolidating statements of operations and condensed consolidating statements of cash flows for the fiscal

years ended January 28, 2006, January 29, 2005 and January 31, 2004. The condensed consolidating statements of operations

and cash flows for the fiscal year ended January 31, 2004 have been reclassified to show PBY Corporation as a subsidiary

guarantor for comparative purposes.