Pep Boys 2005 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2005 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 28, 2006, January 29, 2005 and January 31, 2004

(dollar amounts in thousands, except share data)

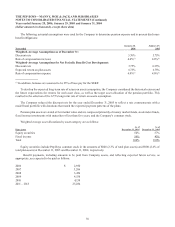

On June 2, 1999 the stockholders approved the 1999 Stock Incentive Plan (the 1999 Plan), which authorized the issuance

of RSU’s and/or options to purchase up to 2,000,000 shares of the Company’s common stock. Additional shares in the amount

of 2,500,000 were authorized by stockholders on May 29, 2002. Under this plan, both incentive and non-qualified stock

options may be granted to eligible participants. The incentive stock options and non-qualified stock options are fully exercisable

on the third anniversary of the grant date or become exercisable over a four-year period with one-fifth exercisable on the grant

date and one-fifth on each anniversary date for the four years following the grant date. In fiscal 2005, certain employees were

granted approximately 220,000 RSU’s to reflect their individual performances in fiscal 2004. All of the RSU’s vest in 20%

increments over four years beginning on the date of grant. Options cannot be exercised more than ten years after the grant

date. As of January 28, 2006, there are 1,335,524 shares remaining available for grant as options or RSU’s.

On April 28, 2003, the Company adopted a stand alone inducement stock option plan, which authorized the issuance of

options to purchase up to 174,540 shares of the Company’s common stock to the Chief Executive Officer in connection with

his hire. The non-qualified stock options are exercisable over a four-year period with one-fifth exercisable on the grant date

and one-fifth on each anniversary date for the four years following the grant date. Options cannot be exercised more than ten

years after the grant date. As of January 28, 2006, there are no shares remaining available for grant.

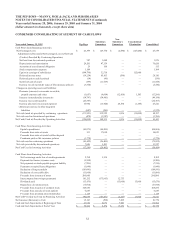

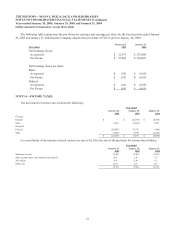

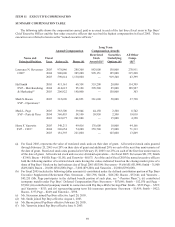

Fiscal 2005 Fiscal 2004 Fiscal 2003

Shares

Weighted

Average

Exercise

Price Shares

Weighted

Average

Exercise

Price Shares

Weighted

Average

Exercise

Price

Outstanding—beginning of year 5,561,085 $ 16.72 6,910,610 $ 16.31 6,898,170 $ 16.57

Granted 296,175 17.34 254,750 13.74 1,624,790 10.38

Exercised (346,600) 16.18 (632,685) 11.05 (1,048,200) 7.52

Canceled (973,505) 22.18 (971,590) 16.23 (564,150) 18.79

Outstanding—end of year 4,537,155 15.87 5,561,085 16.72 6,910,610 16.31

Options exercisable at year end 3,564,889 16.43 3,964,261 18.56 4,210,678 19.55

Weighted average estimated fair

value of options granted 7.66 13.60 4.17

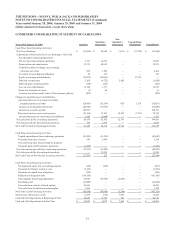

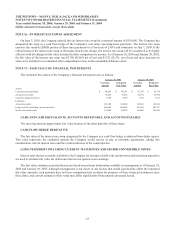

The following table summarizes information about stock options outstanding at January 28, 2006:

Options Outstanding Options Exercisable

Range of Exercise Prices

Number

Outstanding

at Jan. 28, 2006

Weighted

Average

Remaining

Contractual Life

Weighted

Average

Exercise

Price

Number

Exercisable

at Jan. 28, 2006

Weighted

Average

Exercise

Price

$6.16 to $9.00 1,362,455 7 Years $ 8.00 957,039 $ 7.77

$9.01 to $18.00 1,886,275 5 Years 15.63 1,438,950 15.50

$18.01 to $27.00 1,063,475 3 Years 22.74 943,950 22.65

$27.01 to $37.38 224,950 1 Year 32.36 224,950 33.26

$6.16 to $37.38 4,537,155 3,564,889

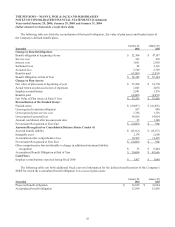

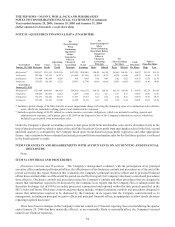

NOTE 13—ASSET RETIREMENT OBLIGATIONS

The Company adopted the provisions of SFAS No. 143, “Accounting for Asset Retirement Obligations”, in the first

quarter of fiscal 2003. SFAS No. 143 requires that the fair value of a liability for an asset retirement obligation be recognized

in the period in which it is incurred if a reasonable estimate of fair value can be made. SFAS No. 143 also requires the

capitalization of any retirement obligation costs as part of the carrying amount of the long-lived asset and the subsequent

allocation of the total expense to future periods using a systematic and rational method. Upon adoption, the Company recorded

a non-cash charge to earnings of $3,943 ($2,484 net of tax) for the cumulative effect of this accounting change. This charge

was related to retirement obligations associated with estimated environmental clean up costs associated with the future

removal of the Company’s remaining underground hydraulic lifts. Such estimates were based upon the average of the

Company’s historical cleanup costs for underground hydraulic lifts previously removed. In addition, the Company initially