Pep Boys 2005 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2005 Pep Boys annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

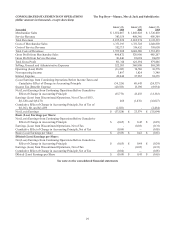

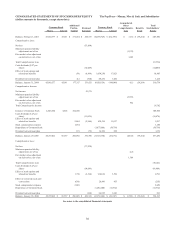

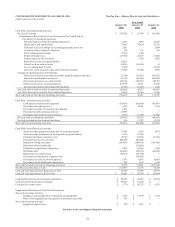

THE PEP BOYS—MANNY, MOE & JACK AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Years ended January 28, 2006, January 29, 2005 and January 31, 2004

(dollar amounts in thousands, except share data)

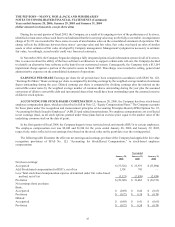

SFAS 123(R) requires the fair value of stock based compensation to be calculated using a valuation model (such as the

Black-Scholes or binomial-lattice models). Consistent with the Company’s historical practice of measuring the fair value of

stock-based compensation for its pro forma disclosures, the Company will utilize the Black-Scholes model to determine the

fair value of its stock-based compensation awards in the future. The statement allows companies the option of adopting its

provisions using a modified-prospective approach or a modified-retrospective approach. The Company will utilize the

modified-prospective approach. Under this approach, the Company must recognize compensation cost for all awards

subsequent to adopting the standard and for the unvested portion of previously granted awards outstanding upon adoption.

The statement also permits the use of either the straight-line or an accelerated method to amortize the cost as an expense for

awards with graded vesting. The Company will use the straight-line method for amortization.

The Company was initially required to apply SFAS 123(R) to all awards granted, modified or settled as of the beginning

of the first interim or annual reporting period that begins after June 15, 2005. However, on April 14, 2005, the United States

Securities and Exchange Commission (the “SEC”) issued a press release that postponed the application of SFAS 123(R) to no

later than the beginning of the first fiscal year beginning after June 15, 2005. For the Company, this is the fiscal year

beginning January 29, 2006. While the impact of adoption of SFAS 123(R) will depend on levels of share-based compensation

granted in the future and the fair value assigned thereto, the future impact is likely to approximate the pro forma compensation

expense reported under SFAS 123 as described in the Company’s disclosure of pro forma net earnings and earnings per share

in the Accounting For Stock Based Compensation section of this note.

In November 2004, the FASB issued SFAS No. 151, “ Inventory Costs, an Amendment of ARB No. 43, Chapter 4

‘inventory Pricing’.” The standard requires that abnormal amounts of idle facility expense, freight, handling costs and wasted

materials (spoilage) should be excluded from the cost of inventory and expensed when incurred. The provision is effective for

fiscal periods beginning after June 15, 2005. The Company does not expect the adoption of this standard to have a material

impact on its financial position, results of operations or cash flows.

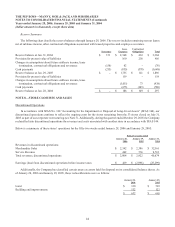

RECLASSIFICATIONS Certain reclassifications have been made to the prior years’ consolidated financial statements to

provide comparability with the current year’s presentation- see note 8. In 2005, the Company has separately disclosed the

investing portion of the cash flows attributable to its discontinued operations, which in prior periods was combined with the

investing portion of the cash flows attributable to its continuing operations.

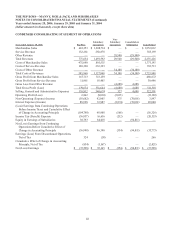

NOTE 2—DEBT AND FINANCING ARRANGEMENTS

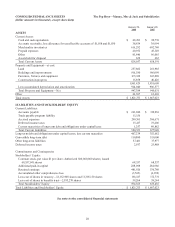

LONG-TERM DEBT

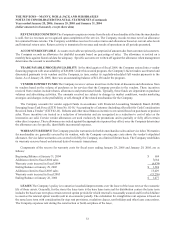

January 28,

2006

January 29,

2005

Medium-Term Notes, 6.7% to 6.9%, due March 2004 through March 2006 $ — $ 43,000

7.0% Senior Notes, due June 2005 — 40,444

6.92% Term Enhanced ReMarketable Securities, due July 2006 — 100,000

7.50% Senior Subordinated Notes, due December 2014 200,000 200,000

Senior Secured Term Loan, due January 2011 200,000 —

Medium-Term Notes, 6.4% to 6.52%, due July 2007 through September 2007 215 215

Other notes payable, 4.9% to 8.0% 1,315 1,331

Capital lease obligations, payable through July 2005 829 422

Line of credit agreement, through December 2009 66,137 8,152

468,496 393,564

Less current maturities 1,257 40,882

Total Long-Term Debt $ 467,239 $ 352,682

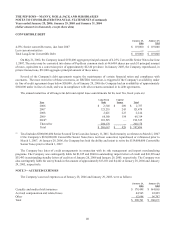

On January 27, 2006 the Company entered into a $200,000 Senior Secured Term Loan facility due January 27, 2011

(March 1, 2007 if the Company’s $119,000 Convertible Senior Notes have not been converted, repurchased or refinanced prior

to March 1, 2007- the Company anticipates refinancing the 4.25% Convertible Senior Notes prior to March 1, 2007). This